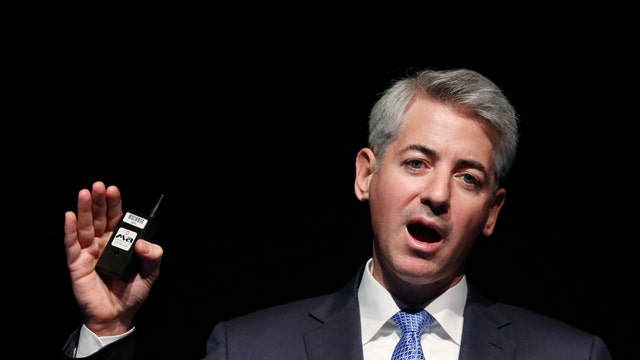

An Inside Scoop on Investing Insight from Pershing's Ackman

Bill Ackman’s Pershing Square Capital Management was up 40% in 2014, making it the best performing hedge fund in the world. Moreover, it outperformed the S&P 500, which was up 13.5% for the year.

I caught up with him at The Harbor Investment Conference for Boys and Girls Harbor, which supports kids’ education in New York City's Harlem. We talked about his investment strategies, where he's looking for his next opportunity, and a few fun, fast-ball questions.

Ackman said about 400 investors go into the conference with a charitable mindset, and a desire to hear new ideas. It is worth noting that in the past six out of the seven years, the information advised at the conference has beaten the S&P. In other words, if the conference were a hedge fund, it would be a top performing one.

Part of the attraction at this year’s event was Ackman’s interview of Ray Dalio, the founder of Bridgewater, the largest hedge fund in the world, with assets under management of $160 Billion. Dalio is quantitative in focus with a strong belief in artificial intelligence. On the opposite end of the spectrum, Ackman is more qualitative and evaluates numerous factors, including strength in a company’s leadership.

In fact, Ackman sees himself as a partner to the CEOs of companies in which Pershing holds significant positions. Those include Canadian Pacific (NYSE:CP), Air Products (NYSE:APD) and Howard Hughes (NYSE:HHC), among many others. Ackman also likes to think of Pershing as more of a holding company than a hedge fund. That thought process comes from the investing style of billion-dollar-investor Warren Buffet, someone Ackman greatly admires.

In it for the Long Haul

By concentrating on a few investments and holding them for a long time, Ackman has answered numerous critics who say all activists are focused only on short-term profits. For example, in our interview, Ackman confirmed that he will probably never sell his 9% stake in Howard Hughes.

In a slightly more controversial move he undertook last year, he shepherded a deal with Valeant Pharmaceuticals (NYSE:VRX) to buy Allergan (NYSE:AGN) in a deal valued at $66 billion. As part of the process, Ackman also bought stock in Allergan, knowing it was a takeover target.

In criticism for the move, former SEC chairman, Harvey Pitt said, "Ackman's conduct seems designed to operate on the edges of legality."

But Ackaman sees it completely differently, and says there's not a move his company makes that even borders on illegal activity.

“What I'll tell you is shareholder activism, by its very nature, any active strategy where you intend to intervene in a business, the activist has a plan. And that plan is not known by the person who he's buying stock from," he said.

He expanded on that idea, explaining how the deal with Canadian Pacific played out.

"We bought a stake in Canadian Pacific, we had a plan to replace the management of the company. We didn't tell the 14% of the stock that we purchased -- those shareholders --what we were doing. We didn't tell the Allergan shareholders we bought 9% of the company from that we had a plan to take over the business," he said. "You are permitted, under the rules, to take advantage of your own inside information and that of your partner, as long as your partner shared that information without violating a -- a duty of trust or competence."

Despite the scrutiny and increased attention on activist-investor activity in the last year or so, Ackman said he doesn't believe the rules of the game will be altered. He said laws typically cahnge when people are harmed, and he contends no one was harmed in the deal with Allergan. He said, it's actually been the opposite.

"90.3% of the stock that we didn't buy, people made a fortune. The 9.7% of the stock we bought, we paid a meaningfully higher price than where it was at the time. So anyone who sold to us got a better price. The, you know, Valiant did very well," Ackman said.

Ackman noted Allergan was one of the best performing stocks of 2014, and said he hasn't heard many complaints about the company, especially from its management team. He contends they're happy they didn't sell the firm to Valiant, a rival company that also made a bid for a buyout before the company teamed up with Pershing.

With another high profile position, that has garnered a lot of media attention, Ackman said that the controversy surrounding his stake in Herbalife (NYSE:HLF) will probably be resolved this year.

“The government doesn't tell us when they're going to do something. But, you know, the FCC has been at it for more than two years. The FTC is approaching their one year anniversary of announcing a formal investigation, which took place after a -- I guess an informal investigation. So I'd be shocked if something doesn't happen in this calendar year," he said.

Whether his positions are high or low profile, Pershing Square has more flexibility than the average fund. Of his capital base, about half is permanent, which is much higher than average. For Ackman, it allows the firm to be a long-term investor and find itself in a forced selling position because an investor needs capital back.

As for what he does next with that capital, he said more of the same.

“… great, high quality businesses, typically in North America and ones where there is opportunity for improvement," Ackman said.

He added he is always looking for good ideas and welcomes input.

“We're not a not-invented-here company. So if someone has got a great idea, a great business that needs improvement, we're all ears," he said.