A recession is ‘absolutely’ on the horizon, expert warns

Easing inflation rates is going to be a 'long slow-down story'

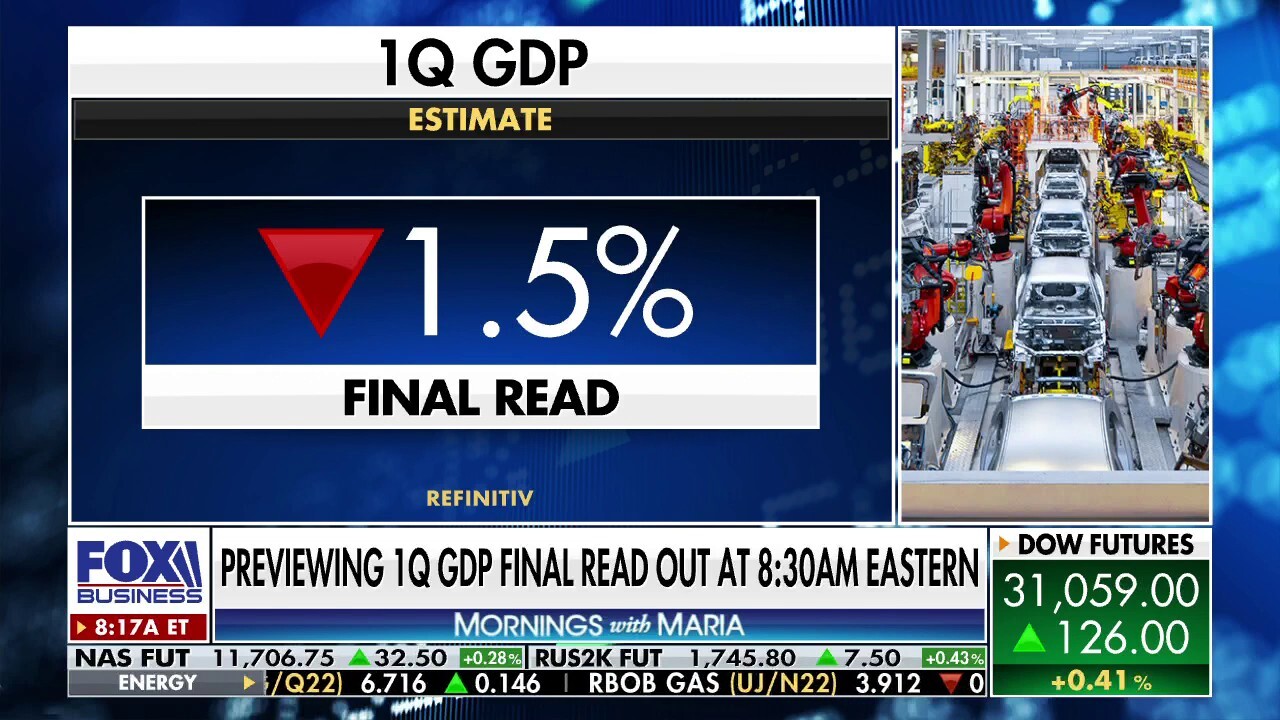

Michael Kantrowitz on first-quarter GDP: We are absolutely heading towards a recession

Piper Sandler chief investment strategist Michael Kantrowitz provides analysis of the first quarter GDP report and market futures on ‘Mornings with Maria.’

During an interview on "Mornings with Maria," Wednesday, Piper Sandler chief investment strategist Michael Kantrowitz provided expert analysis of the U.S. markets and economy, warning investors that economic growth and unemployment rates will soon become our new crisis.

MICHAEL KANTROWITZ: I don't think we're in a recession. I know obviously Q1 was a real ugly GDP report, but the details matter and that was largely a big hit to trade. If you look at private domestic GDP, consumer spending was strong in Q1. But yeah, we're heading in that direction. Absolutely. 100%. You look at leading indicators of the economy, the Empire Fed Index, the Philly Fed Index, the Dallas PMI, the Kansas City PMI, they're all in negative territory now for the first time in this slowdown. And so everything's pointing in that direction when you start to see an unemployment claims sharply rise. And we're just beginning to see layoffs from mostly tech companies, just beginning as that broadens out, then that's really the signposts of recession.

Illustration of American currency (istock / iStock)

I think we're going have a lot of volatility. The debate around inflation's not going to end this year. And so, yes, we'll eventually see a peak in CPI and a decline. It's not going to be fast enough to make the Fed pivot. I think it's actually more likely the Fed ends up pausing because we have a job market problem next year. Then inflation goes away, and the Fed just thinks everything's fine.

GDP CONTRACTION DEEPENS GIVING FRESH RECESSION CLUES AMID SOARING INFLATION

WATCH THE FULL INTERVIEW HERE:

Inflation will trickle ‘well into 2023’: Michael Kantrowitz

Piper Sandler chief investment strategist Michael Kantrowitz weighs in on the economy ahead of the GDP update on ‘Mornings with Maria.’