Pending home sales fall by most in 2 years as rising mortgage rates sap demand

Housing market is cooling sharply as Fed hikes interest rates

'Unprecedented' move in mortgage rates causing problems for homebuyers: Greg Kuhl

Janus Henderson Investors portfolio manager Greg Kuhl discusses how inflation is affecting the real estate market on 'The Claman Countdown.'

Signed contracts to buy previously owned homes in the U.S. plunged more than expected in September as rising mortgage rates and higher home prices continued to push entry-level homebuyers out of the market.

The National Association of Realtors said Friday that its pending home sales index tumbled 10.2% in September compared with the same month one year ago. On a monthly basis, pending home sales dropped 5% — more than double the 2% decline projected by Refinitiv economists.

The once red-hot housing sector is in the midst of a severe correction as the Federal Reserve raises interest rates at the fastest pace in decades.

The Federal Reserve raised its benchmark interest rate by 75 basis points for the third straight month in September, following similar rate hikes in June and July — the most aggressive series of increases since 1994. One basis point equals one hundredth of one percent.

The move puts the key benchmark federal funds rate at a range of 3% to 3.25%, the highest since before the 2008 financial crisis. It also marks the fifth consecutive rate increase this year.

INFLATION SURGED MORE THAN EXPECTED IN SEPTEMBER AS PRICES REMAIN PAINFULLY HIGH

For sale sign stands in front of a house on Oct. 6, 2020, in Westwood, Mass. (AP Photo/Steven Senne, File / AP Newsroom)

In addition to the large rate hike, Fed officials laid out an aggressive path of rate increases for the remainder of the year. New economic projections released after the two-day meeting show policymakers expect interest rates to hit 4.4% by the end of the year, suggesting that another three-quarter percentage point increase is on the table. The Federal Reserve's policy-setting committees meets twice more — in November and December.

NEW HOME SALES TUMBLE IN SEPTEMBER AS MORTGAGE RATES MARCH HIGHER

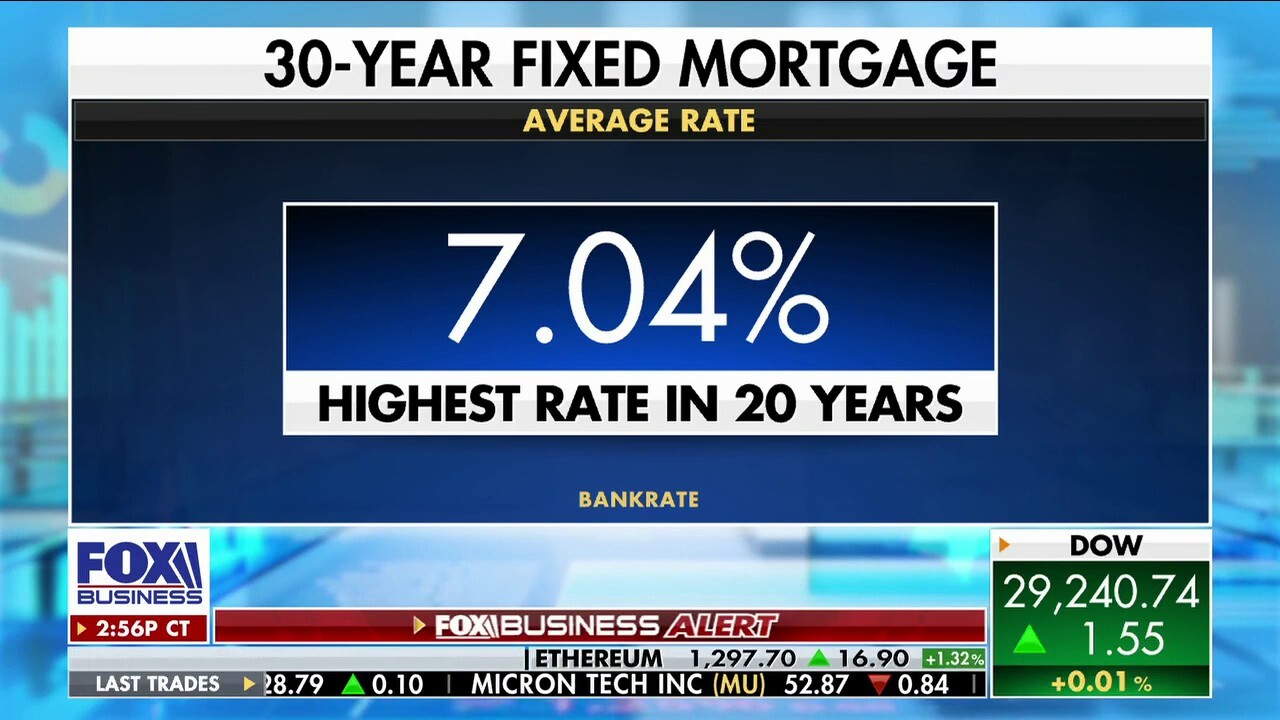

Mortgage rates have more than doubled to 7.08%, the highest level since 2002, according to recent data from mortgage lender Freddie Mac, and could continue to climb higher. And while home price growth has cooled over the past month, prices remain well above where they were just one year ago, putting affordability out of reach for many prospective buyers.

Combined with high home prices, the rapid rise in borrowing costs has pushed many entry-level homebuyers out of the market.

Jerome Powell, chairman of the U.S. Federal Reserve, arrives to speak during a news conference following a Federal Open Market Committee (FOMC) meeting in Washington, D.C., on Wed., Sept 21, 2022. (Sarah Silbiger/Bloomberg via Getty Images / Getty Images)

New home sales also tumbled in September, with new single-family home purchases jumping nearly 11%. Meanwhile the median new house price climbed nearly 14% in September from the year-ago period to $470,600. That is also up about 8% from August.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"The housing market is still normalizing to an economy under pressure from higher borrowing costs, nagging inflation and uncertainty about future Fed activity," said Jeffrey Roach, the chief economist at LPL Financial. "Housing demand will likely fall further in the coming months, putting downward pressure on median prices."