JPMorgan Chase CEO Jamie Dimon says status of banking system is 'nothing like '08'

The JPMorgan Chase CEO said the banking system 'is in pretty good shape'

Jeremy Siegel: Banking crisis is equal to three or four Fed rate hikes

SlateStone Wealth chief market strategist Kenny Polcari and Wharton School professor Jeremy Siegel discuss banks tightening lending standards after Fed rate hikes on 'The Claman Countdown.'

Jamie Dimon on Wednesday said the current status of the U.S. banking system was "nothing like ‘08."

The JPMorgan Chase CEO told Bloomberg Television "there’s nothing like that leverage in the system" that was present during the 2008 financial crisis. He also pointed to how private companies and the banking system are doing, as well as recent earnings reports from regional banks

"The private companies are actually in very good shape. The banking system is in pretty good shape," he said. "You’ve seen regional banks just report very good numbers. The deposits didn’t run out like people are talking about."

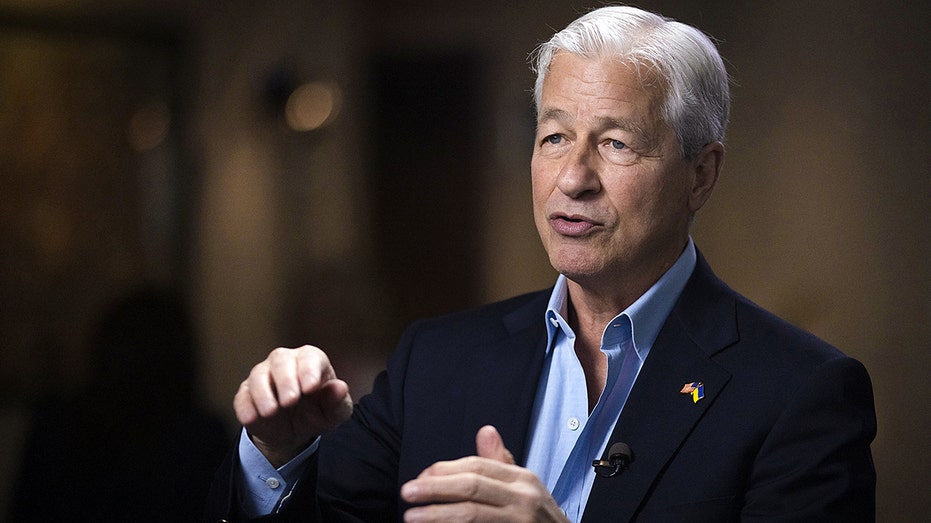

Jamie Dimon, billionaire and chief executive officer of JPMorgan Chase & Co., following a Bloomberg Television interview at the JPMorgan Global Markets Conference in Paris, France, on Thursday, May 11, 2023. (Cyril Marcilhacy/Bloomberg via Getty Images / Getty Images)

He did note a "couple of banks" that are "offsides" on interest rate exposure, one of which he said was First Republic Bank.

JPMORGAN BUYS FIRST REPUBLIC BANK, DIMON DECLARES ‘THIS PART OF THE CRISIS IS OVER’

At the beginning of May, JPMorgan Chase reached a deal to purchase embattled First Republic from the Federal Deposit Insurance Corporation. The Dimon-run bank’s acquisition of First Republic had been preceded by two other banks — Silicon Valley Bank and Signature Bank, also experiencing collapses.

Pedestrians walk past the JP Morgan Chase headquarters in New York on March 17, 2008. JP Morgan Chase bought Bear, Stearns & Co, for 2 USD a share, with help of 30,000 billion in financing of Bear, Stearns assets from the US Federal Reserve. (DON EMMERT/AFP via Getty Images / Getty Images)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 322.26 | +0.06 | +0.02% |

Dimon said in the Bloomberg interview that his company was "asked by our government to step in and we did — we were able to handle it." He also praised Jennifer Piepszak and Marriane Lake, the JPMorgan Chase consumer and community banking co-CEOs that have been tapped to run the First Republic businesses that were purchased.

"Obviously, it’s a lot of work and, you know, hard for people," Dimon went on to say. "We’re trying to show real humanity, using redeployment of anyone who loses their job to try to find other jobs at JPMorgan or elsewhere."

Last week, JPMorgan Chase informed roughly 1,000 of First Republic Bank’s employees they will soon be out of a job, something first reported by Bloomberg. The bank confirmed to FOX Business it was able to offer jobs to nearly 85% of the former institution’s workers.

JPMORGAN LETTING GO 1,000 FIRST REPUBLIC EMPLOYEES

On regulation, he said he would be "careful" about "where regulations have to be done as opposed to supervision" of smaller banks. He noted community banks "do a lot of things we can’t do" and are a "critical part of the system."

He went on to say he believed the U.S. was "over this part" of the banking crisis "for the most part," acknowledging "there may be something else."

Jamie Dimon, chairman and chief executive officer of JPMorgan Chase & Co., during a Bloomberg Television interview at the JPMorgan Global High Yield and Leveraged Finance Conference in Miami, Florida, US, on Monday, March 6, 2023. (Marco Bello/Bloomberg via Getty Images / Getty Images)

"But rising rates, if they get high enough, it could rear its ugly head again," Dimon warned. "It’s not just banks, people should be prepared for slightly higher rates than they’ve been used to in the past 15 years."

The JPMorgan CEO had said earlier in the Bloomberg Television that "stickier" inflation could prompt the Federal Reserve to "raise a little bit more" the benchmark interest rates. That could come in spite of the Fed being "right to pause at this point," according to Dimon.

JAMIE DIMON WEIGHS IN ON JPMORGAN CHASE PURCHASING ADDITIONAL TROUBLED BANKS

The range of the rate has been set to 5% to 5.25% since earlier in the month. The Federal Open Markets Committee has its next meeting slated to take place in mid-June.

"People should be a little prepared for that," Dimon said. "Just as a matter of managing your own business, be a little prepared for that, whether you’re a financial company or a real estate company, et cetera."

Breck Dumas contributed to this report.