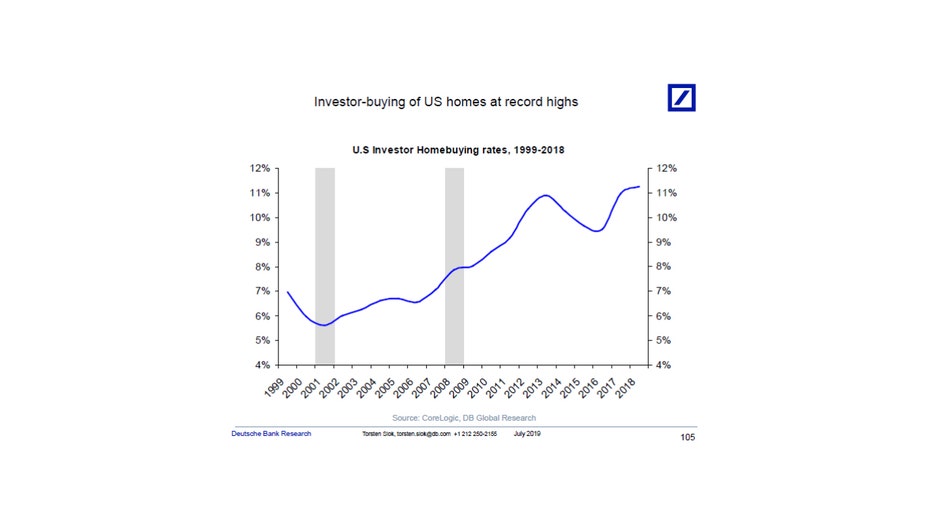

Investors snapping up US homes at record levels: What it says about the housing market

As economic uncertainty permeates throughout the market, investors are flocking to some sectors over others, including real estate.

According to data from Deutsche Bank Research, U.S. investors’ home purchase rates are at a record high – which could be a positive sign for the housing market.

“With declining mortgage rates … they’re searching for a better return for their money,” Lawrence Yun, chief economist and senior vice president at the National Association of Realtors, told FOX Business.

On Thursday, Freddie Mac said the 30-year fixed-rate mortgage fell to its lowest level since November 2016 – 3.6 percent. Lower mortgage rates indicate that more people can qualify for a loan – and qualify for a larger loan.

Yun added that real estate is providing a “more secure return” than other investments – including bonds and stocks – thanks to steady price gain. He said, however, that he has yet to see a noticeable uptick in investor activity.

In June, the median price of an existing home rose, reaching an all-time high of $285,700. The median sales price of a newly-built home during the same month was $310,400.

Investors’ purchases come amid concerns of an economic slowdown – brought on in part by an escalation of trade tensions between the U.S. and China. The U.S. stock market has also been volatile in response to new developments in economic relations between the world’s two largest economies – which have recently included the U.S. announcement of another round of tariffs and China.

Confidence in the housing market during times of uncertainty might provide another clue about the economy. A housing collapse precipitated the last financial crisis, but amid concerns about a potential economic slowdown, investors are choosing the sector as a safer play.

Yun said housing will in fact be a “buffer to an economic downturn,” because there is a current housing shortage – as opposed to the surplus leading up to the recession.

CLICK HERE TO GET THE FOX BUSINESS APP

JPMorgan Chase CEO Jamie Dimon has made similar comments, saying a possible near-term recession wouldn’t look anything like the financial crisis, which was precipitated by loose underwriting standards at some banks. Dimon has said the U.S. credit profile this time around is “much stronger.”

The one area Dimon is wary of, however, is student loans.