Housing starts resume downward spiral in March while building permits plummet

New home construction market has 'yet to see new growth' as housing freeze continues

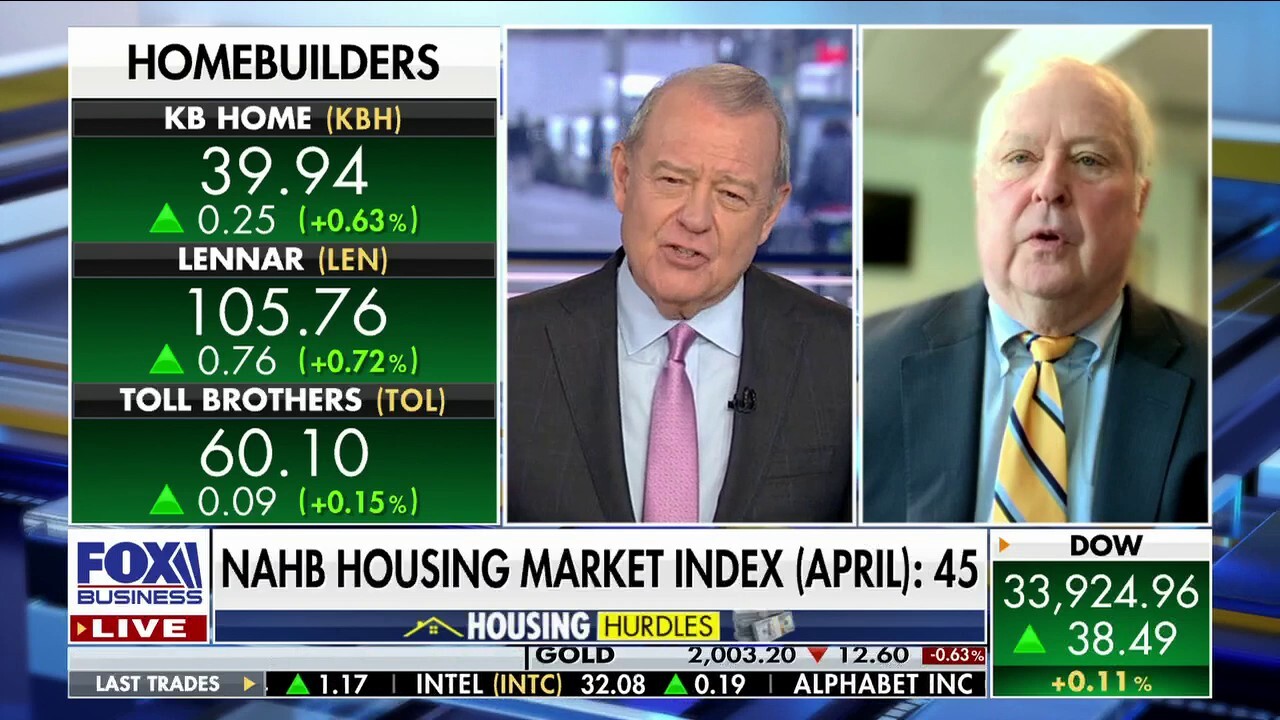

US housing market 'not operating on all cylinders' yet: Jerry Howard

National Association of Home Builders CEO Jerry Howard breaks down April's housing market index, which showed new home starts rose slightly.

New U.S. home construction fell less than expected in March as a retreat in mortgage rates helped to jolt homebuyer demand, but the housing market remains depressed.

Housing starts slid 0.8% last month to an annual rate of 1.42 million units, according to new Commerce Department data released on Tuesday. That is below Refinitiv economists' forecast for a pace of 1.40 million units.

In a sign the deep freeze that has paralyzed the housing market for months is not over yet, applications to build – which measures future construction – tumbled 8.8% to an annualized rate of 1.41 million units.

"While the start of spring typically brings new life to the housing market, the new home construction market has yet to see new growth," said Nicole Bachaud, senior economist at Zillow. "Builder confidence overall has been rising every month in 2023, but confidence that prospective buyers will return is still low, possibly a cause of lower home construction activity."

COMMERCIAL REAL ESTATE MARKET COULD CRASH SOON. HERE’S WHY

Homes in Rocklin, California, on Dec. 6, 2022. ( Photographer: David Paul Morris/Bloomberg via Getty Images / Getty Images)

The data comes one day after the National Association of Home Builders/Wells Fargo Housing Market Index, which measures the pulse of the single-family housing market, rose one point to 45, the highest reading since September. Any reading above 50 is considered positive; prior to 2022, the gauge has not entered negative territory since 2012, excluding a brief – but steep – drop in May 2020.

Despite the increase, the index still points to a slump in the housing sector ahead of the pivotal spring-selling season. Any reading above 50 is considered positive; prior to 2022, the gauge has not entered negative territory since 2012, excluding a brief – but steep – drop in May 2020.

The index has fallen to half of what it was just one year ago, when it stood at 81, although it has increased from a low of 31. It peaked at a 35-year high of 90 in November 2020, buoyed by record-low interest rates at the same time that American homebuyers – flush with cash and eager for more space during the pandemic – started flocking to the suburbs.

ECONOMIST WHO CALLED 2008 HOUSING CRASH PREDICTS ANOTHER 15% DROP IN HOME PRICES

Houses under construction at the Norton Commons subdivision in Louisville, Kentucky, on July 1, 2022. (Photographer: Luke Sharrett/Bloomberg via Getty Images / Getty Images)

The interest rate-sensitive housing market has borne the brunt of the Federal Reserve's aggressive campaign to tighten policy and slow the economy.

Policymakers already lifted the benchmark federal funds rate nine straight times – well into restrictive territory – and have opened the door to a 10th rate hike in May as they try to crush stubborn inflation that is still running about three times higher than the pre-pandemic average.

Still, demand has shown early signs of returning as mortgage rates fall from a record high of 7.08% in November.

The average rate for a 30-year fixed mortgage dropped to 6.27% last week, according to data from mortgage lender Freddie Mac. However, that remains significantly higher than just one year ago, when rates hovered around 5%.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Limited inventory has also bolstered demand this month. A recent report from Realtor.com showed that the number of available homes on the market in March is down more than 50% from the typical amount before the pandemic began.