Economist explains how inflation problem becomes a 'growth problem'

Increased likelihood of another 75 basis-point rate hike following new inflation data: Tyler Goodspeed

How inflation problem becomes a 'growth problem'

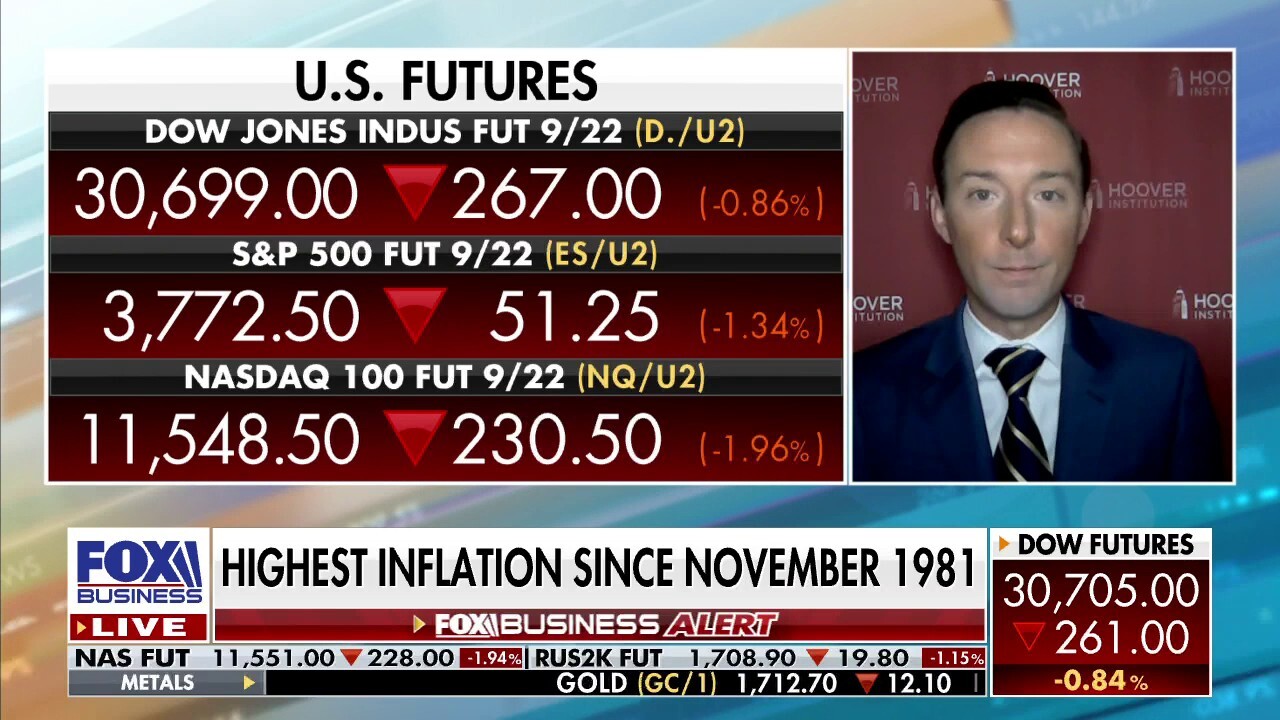

Kleinheinz Fellow at the Hoover Institution at Stanford University, Tyler Goodspeed, weighs in on the latest inflation data, arguing that the probability of getting another 75-basis point rate hike shot up another 50%.

Tyler Goodspeed, a Kleinheinz Fellow at the Hoover Institution at Stanford University, explained on Wednesday how the inflation problem becomes a "growth problem."

He argued on "Mornings with Maria" that, so far, "the only thing really keeping the show on the road is the American consumer."

The economist, who served as Acting Chairman and Vice Chairman of the Council of Economic Advisers from 2020 to 2021, noted that business investment, residential investment as well as inventories, and exports, are all "heading down" and said, once the consumer also starts to limit spending, "I think we’re in series trouble."

Goodspeed also argued that the probability of another 75-basis point rate hike has shot up another 50% following the release of the latest inflation data.

INFLATION SURGES 9.1% IN JUNE, ACCELERATING MORE THAN EXPECTED TO NEW 40-YEAR HIGH

Last month, central bank policymakers approved a 75 basis-point rate hike for the first time since 1994 as they race to catch up with runaway inflation, which, according to data released on Wednesday, now sits at new 40-year highs.

Another hike of that magnitude could be on the table this month amid signs of stubbornly high inflation, Chairman Jerome Powell told reporters after the meeting, prompting investors to reassess the economic outlook.

June's Consumer Price Index released Wednesday revealed inflation now sits at a new 40-year high. (istock / iStock)

Goodspeed weighed in shortly after it was revealed that inflation accelerated more than expected in June as the price of everyday necessities remains painfully high, exacerbating a financial strain for millions of Americans.

AVERAGE AMERICAN WORKER HAS LOST $3,400 IN ANNUAL WAGES UNDER BIDEN THANKS TO INFLATION

The Labor Department said Wednesday that the consumer price index, a broad measure of the price for everyday goods, including gasoline, groceries and rents, rose 9.1% in June from a year ago. Prices jumped 1.3% in the one-month period from May. Those figures were both far higher than the 8.8% headline figure and 1% monthly gain forecast by Refinitiv economists.

The data marks the fastest pace of Inflation since December 1981.

Price increases were extensive, suggesting that inflation may not be near its peak: Energy prices rose 7.5% in June from the previous month, and are up 41.6% from last year. Gasoline, on average, costs 59.9% more than it did one year ago and 11.2% more than it did in May. The food index, meanwhile, climbed 1% in June, as consumers paid more for items like cereal, chicken, milk and fresh vegetables.

Inflation numbers hotter than expected

FOX Business' Cheryl Casone reports on June's Consumer Price Index released Wednesday, which revealed inflation now sits at a fresh 40-year high.

Although American workers have seen strong wage gains in recent months, inflation has largely eroded those increases: Real average hourly earnings decreased 1% in June from the previous month when accounting for higher consumer prices, according to the Labor Department. On an annual basis, real earnings actually dropped 3.6% in June.

"In recent months, when you and I talk about CPI we keep saying, ‘There go real wages for last month,’" Goodspeed told host Maria Bartiromo.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"Typically that has been average real wages, but last month the total wage bill was up .6 month-over-month on a nominal basis. Now we have a CPI at 1.3% month-over-month. That means that the aggregate wage bill for the total economy went down in the month of June, and this is where an inflation problem becomes a growth problem," he said.

FOX Business’ Megan Henney contributed to this report.