Biden administration suspends collection of 1M student loans in default

New Department of Education policy to halt collection of loans for about 1.1M borrowers

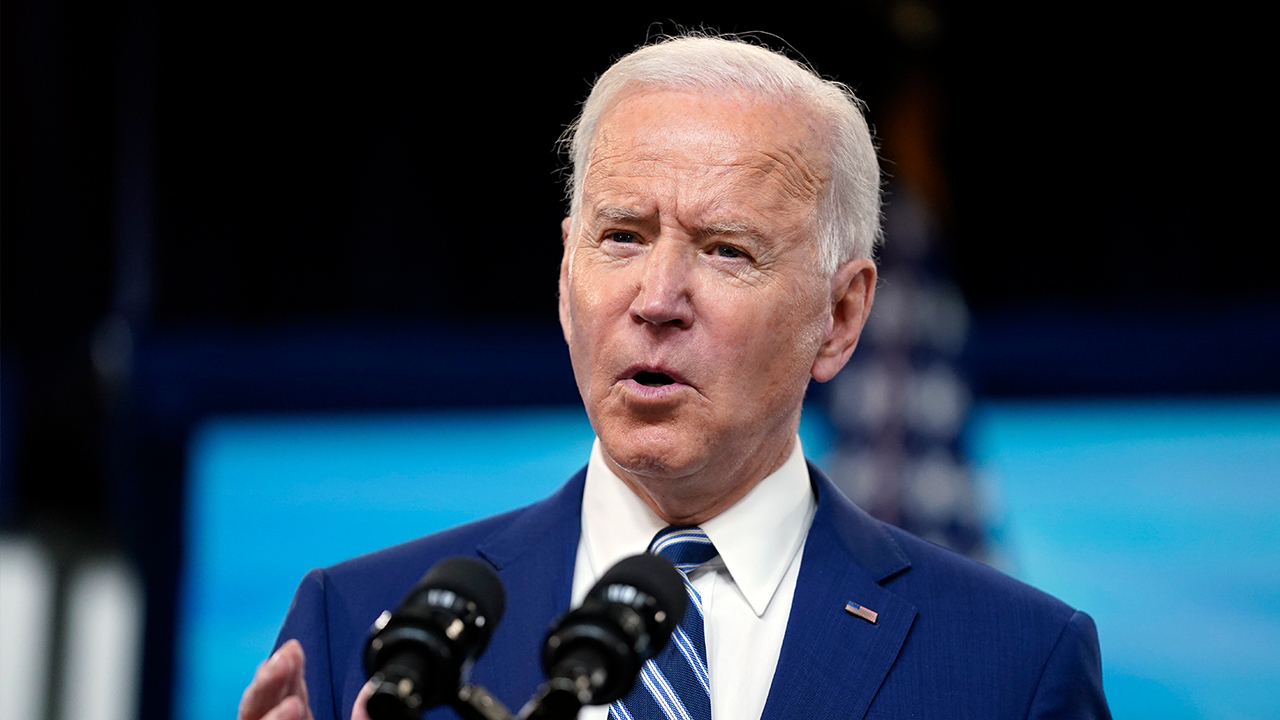

The Biden administration on Tuesday announced that it's suspending the collection of more than 1 million federally guaranteed student loans, expanding a key coronavirus relief program to a group of Americans who were previously excluded from the government's loan freeze.

The new policy will halt the collection of loans for about 1.14 million borrowers who are in default on federal loans held by private companies. These individuals received their loans through the Federal Family Education Loan Program, which offered loans backed by private companies.

SOME AMERICANS STILL NEED TO PAY TAXES BY APRIL 15, DESPITE NEW DEADLINE

“Our goal is to enable these borrowers who are struggling in default to get the same protections previously made available to tens of millions of other borrowers to help weather the uncertainty of the pandemic,” Education Secretary Miguel Cardona said in a statement.

The relief will apply retroactively to March 13, 2020, when former President Donald Trump first declared a national emergency, meaning the government will refund the tax returns and wages that it has since collected from borrowers when they defaulted. More than 100,000 of these borrowers have fallen behind severely on their debt, the department said, and about 800,000 were at risk of having their federal tax refund seized this year to repay a defaulted loan.

Individuals who made voluntary payments on any of their defaulted loans since the start of the pandemic can request a refund. Interest paid on those loans will also be returned.

HERE'S HOW THE $10,200 UNEMPLOYMENT TAX BREAK IN BIDEN'S COVID RELIEF PLAN WORKS

One year ago, the Trump administration told borrowers they wouldn't have to pay their student loan bills or worry about interest for 60 days, an order that's been repeatedly extended. In January, President Biden continued the moratorium through Sept. 30.

FILE - In this Wednesday, March 18, 2020, file photo, people remove belongings on campus at the University of North Carolina in Chapel Hill, N.C., amid the coronavirus pandemic. (AP Photo/Gerry Broome, File) ((AP Photo/Gerry Broome, File))

About 41 million Americans are benefitting from the federal government’s pause of student loan payments.

Consumers advocates praised the move, but have urged the Biden administration to go further in providing relief to all borrowers.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“Borrowers with commercial FFEL loans need Washington to stop drawing arbitrary lines that leave them without any protection or assistance,” Seth Frotman, executive director of the Student Borrower Protection Center, said in a statement. “It is clear that the Department has the legal authority to protect all federal student loan borrowers during the pandemic and provide real relief— it is long past time for them to use it.”

CLICK HERE TO READ MORE ON FOX BUSINESS

Biden has also urged Congres to eliminate $10,000 in student loan debt per borrower – a commitment reiterated by White House press secretary Jen Psaki on Tuesday.

"The President continues to call on Congress to cancel $10,000 in debt for student loan borrowers," she said during the daily White House press briefing. "That's something Congress could take an action on and he'd be happy to sign. We're still taking a closer look at our options on student loans. This includes examining the authorities we have, the existing loan forgiveness programs that are clearly not working as well as they should."