Americans stress that their US dollars aren't stretching far enough to make up for inflation

Prices for goods remained abnormally high according to October inflation data

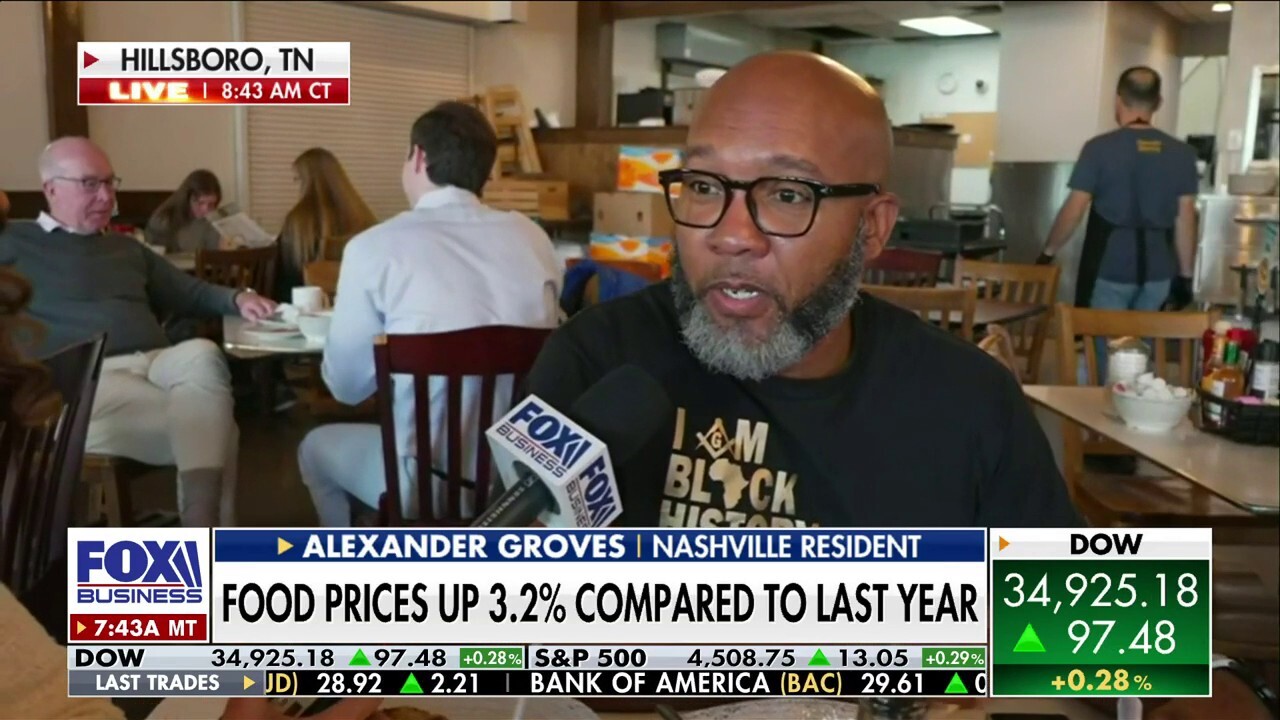

Americans' dollars 'not stretching nearly as far' due to inflation: Nashville resident

Pancake Pantry owner Chip Bradley and restaurant patrons speak to FOX Business' Madison Alworth about still feeling the brunt of decades-high inflation.

If you’re still feeling the crunch of inflation, you’re not alone.

"In the last two years, we haven't really increased our prices. And June of this year, we actually increased our prices 20% to offset the cost of inflation," owner of the Pancake Pantry outside Nashville, Tennessee, Chip Bradley told FOX Business’ Madison Alworth on "Varney & Co." Wednesday.

"It's not that we're trying to make more money," he added. "We're just trying to ensure our cost of goods are where they need to be, to be a profitable business."

One Pancake Pantry patron Alexander Groves also told Alworth: "My dollar does not stretch nearly as far. Just like he was mentioning, they had to adjust for inflation. Well, my adjustment to them is not being met. Wages are not going up."

IMPENDING U.S. POPULATION DECLINE COULD LEAD TO ANOTHER DEPRESSION, MORE INFLATION: EXPERTS

October inflation data showed prices for many goods remained abnormally high for millions of U.S. households. Housing costs were the biggest driver of core inflation last month, with rent rising 0.3% for the month and up 6.7% from the same time last year; and grocery prices climbed 0.3% over the course of the month and 2.1% year-over-year.

Two U.S. workers in the Nashville, Tennessee, area say a necessary inflation adjustment "is not being met," on "Varney & Co." Wednesday. (iStock)

Additionally, millions of Americans have received a pay cut over the past two years thanks to high inflation, with the U.S. Department of Labor reporting Tuesday that average hourly earnings for all employees was $11.05 in October – a 3.32% decline from the $11.43 figure in January 2021, when Biden took office.

By that measure, the typical U.S. worker is actually worse off today than two years ago, even though nominal wages are rising at the fastest pace in years.

For restaurant owner Bradley, he’s seen a 400% price increase in the cost of eggs alone: two years ago an egg cost $0.09, and today it’s $0.47 per egg.

Inflation in wage growth 'only real problem' we have right now, says Lee Munson

Portfolio Wealth Advisors President and CIO Lee Munson discusses his market outlook, Apple shares and the October jobs report expectations.

"One of our values is a very cost-driven value for our guests and our customers, and we don't want to increase the prices and pass it on to the guests. So we waited our absolute latest we could to raise the prices," Bradley explained.

"So if he's going up from $0.09 for an egg to $0.47, that's a difference that I'm not getting in return from a raise or cost of living adjustment," Groves pointed out. "So there's a big difference between what we are feeling and what they're feeling also."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Markets can expect an inflation reacceleration: Michael Lee

Michael Lee Strategy founder Michael Lee explains why hot August CPI data is not affecting markets on 'Varney & Co.'

The consumer price index is still running well above the typical pre-pandemic rate, and the cost of necessities like food, gasoline, rent and child care remain far more expensive than they were just one year ago. Chronically high prices are forcing Americans to spend about $650 more per month than they did two years ago, according to a recent estimate from Moody's Analytics.

"Wages here have been pretty much the same for a number of years, but I've seen the prices of housing, rents, gas steadily goes up. Every year is higher than it was for the year before," Groves continued. "There's a big difference and you feel it every time you go to the gas pump, every time you have to pay your mortgage or rent."

FOX Business’ Megan Henney contributed to this report.