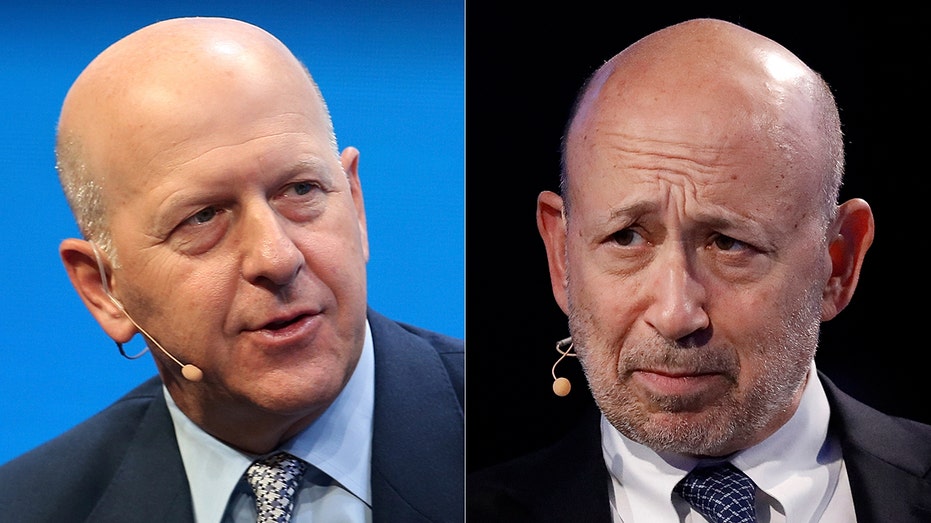

Goldman's lavish spending on Blankfein’s post-CEO office sparks populist debate at white-shoe firm

Goldman Sachs wants to send Lloyd Blankfein off in style: The prestigious white-shoe investment firm is spending top dollar to build its soon-to-be retiring chief executive a new office as he transitions to an advisor for the firm.

The move is not sitting well with many of the rank-and-file employees, several of whom are complaining to FOX Business about the spending on Blankfein’s new digs.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GS | THE GOLDMAN SACHS GROUP INC. | 943.62 | +14.87 | +1.60% |

In an official statement, a Goldman spokesperson tells FOX Business the cost of the office would be well under $100,000 but would not provide an exact number. Sources familiar with the matter tell FOX Business the cost could exceed $500,000. The official construction began on Friday at 5 p.m., with several employees being forced to move to make room for Blankfein’s new digs. He was originally slated to occupy an already available office, but the firm decided to erect a more spacious office with a coveted view of the Hudson River, and to use high-priced union workers to construct it on the weekends, people with knowledge of the matter tell FOX Business.

The controversy over Blankfein’s post-CEO arrangement is emblematic of the growing disparities inside the firm where a program of severe cost cutting has focused almost exclusively on the backs of the average Goldman worker – analysts and associates.

It has also touched off a quiet, populist revolt among such workers. They point to the firm’s rarefied class of partners and managing directors—the upper echelon of the bank, which accounts for less than 8 percent of the firm’s 37,000-member workforce—who maintain both their lofty salaries and perks, these people tell FOX Business.

Analysts and associates, who spoke to FOX Business on the condition of anonymity for fear of losing their jobs, say Goldman has cut back on benefits for the average worker more than any other bank on Wall Street. They base their assessment on both personal experience, as well as anecdotal evidence gleaned from employees at other big banks.

Despite the deteriorating work environment, they remain at the firm largely as a resume builder, based on Goldman’s long-time reputation as Wall Street’s premier investment bank catering to the super rich and the world’s biggest corporations.

By most accounts, the cost-cutting effort after the 2008 financial crisis made it more difficult for the rescued banks to ramp up profits, mainly due to a raft of stringent regulations that followed. Now, on the 10-year anniversary of the financial crisis, banking profits have recovered overall and Goldman earned $2.57 billion in just the second quarter of the year. But its business model remains under pressure. The new financial regulations have made it difficult for Goldman to make big bets trading stocks and bonds, which have typically propelled earnings. Goldman has also not grown through acquisitions, and it is now dwarfed by more profitable megabanks like JPMorgan.

“There is no easy money out there; the only way to survive is to cut costs,” independent analyst Chris Whalen told FOX Business. “And it’s even worse for Goldman these days because they’re one of the smallest guys on the Street.”

With that, Goldman has instilled some of the most severe cost cutting measures on Wall Street, and these cuts have not been distributed evenly.

Despite lackluster stock performance in recent years, Blankfein earned $24 million in 2017, a $2 million jump from the previous year. His No. 2 and successor, David Solomon, got a $1 million raise to $21 million in 2017 in total compensation.

But employees on the lower rung of the corporate ladder—associates and analysts—say they have seen their compensation largely stagnate. And they describe a work atmosphere where strict budgeting pervades almost every aspect of their workday.

Employees who work past 8 p.m. at Goldman’s West Street Manhattan headquarters say the bank will technically pay for their dinner, but only if the meal doesn’t exceed $25 – less than half the average cost of a meal in New York City, according to Zagat’s. Additionally, not all food groups can be expensed. One Goldman employee says the company rejected a reimbursement expense for a piece of fruit because the food group didn’t meet Goldman’s stringent criteria. Employees who surpassed the $25 limit are forced to reimburse the company with a check, these people say. Goldman declined to provide details on its reimbursement rules to FOX Business.

Goldman’s cost cutting also forces most employees to spring for their own computers and iPhones, even though analysts and associates are expected to be monitoring emails 24/7. Also, attending industry conferences was once considered an educational experience for lower-level Wall Street employees, but at Goldman managers routinely reject these requests amid the draconian budgeting, these people say.

A spokesperson for Goldman declined to refute these descriptions of its work environment, but contested the cost described by some employees of Blankfein’s office as too high. The spokesman confirmed the firm will spend tens of thousands constructing the office despite much higher estimates provide by Goldman employees who say they are familiar with the matter.

Another senior Goldman executive authorized to speak to FOX Business says the firm offers many benefits “that our employees value.” These benefits, as described by the executive in an email include an on-sight fitness club, health centers that “provide various preventive services and screenings, including blood pressure, breast, and skin cancer screenings, flu vaccinations.” She says“specialist doctors are available on site” and that Goldman also has an on-site dietitian, provides childbirth classes and what the executive called “on-site back-up child care,” as well as “mindfulness training.” Other programs offered to all employees include “one-on-one financial coaching,” the executive says, that’s administered “over the phone at no cost.”

The firm recently started a “MilkShip” program that “offers a free full-service program for moms in the U.S. to safely ship their breast milk home when traveling overnight for business."

But employees tell FOX Business that these benefits barely make up for their long hours -- 18 hour days are common for associates and analysts -- and comparatively lower pay to other financial firms including private equity or hedge funds. They also say that many of these programs offered by the company are designed to keep people at the office as long as possible. “We call our offices ‘the jail,’” one employee tells FOX Business.

Work space at Goldman is a particularly touchy issue among average employees, which has heightened the internal debate over the company’s spending plans for Blankfein’s new office. Most employees at Goldman work with very little privacy, herded together in what’s described as an “open-office floor plan,” comprised of dozens of desks and no separation between people, according to first-hand accounts. On Friday, several people on the 29th floor in Goldman’s Manhattan headquarters were forced to relocate in preparation for the construction. Blankfein will resign as CEO on Oct. 1 and as chairman at the end of 2018.

Under the terms of his exit agreement, he will remain as an “advisor” to Goldman, but it is unclear how long Blankfein will remain in that role, how much he will be paid or how much work he will do.

What is clear is that the office drama has stoked a degree of outrage among the masses inside the parochial investment bank with some employees complaining that it is just another example of the disparity between the firm’s “haves” and “have nots.”

“This is one reason why no one smiles at work,” said one Goldman employee. “Everyone looks miserable all day long.”