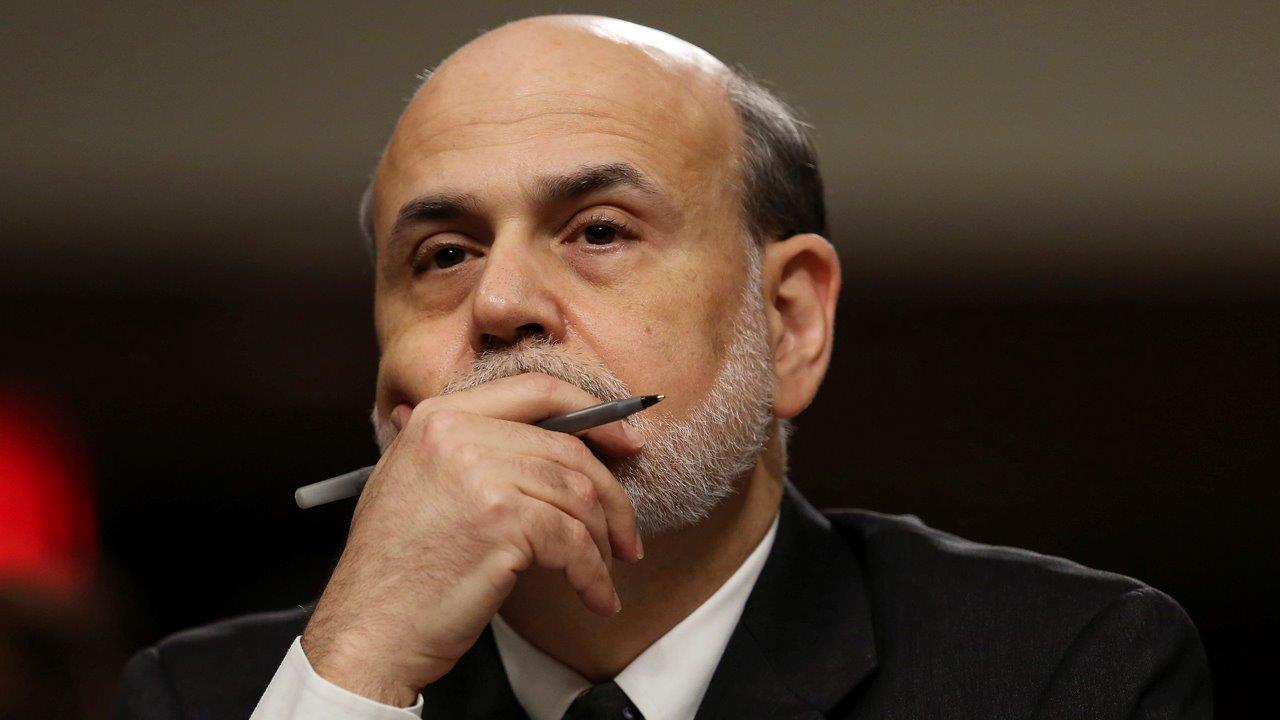

Bernanke: Trump Policy Won’t Be as Effective as the Markets Anticipated

Former Federal Reserve Chairman Ben Bernanke appeared on the FOX Business Network Friday to discuss the state of the U.S. economy, Federal Reserve policy and the impact of President Trump’s policies.

According to Bernanke, the Fed will begin to unwind its balance sheet by the end of this year or early next year, telling Maria Bartiromo, “It’s $4.5 trillion, which of course is a huge amount of money, but it’s about a quarter of U.S. GDP, similar to other large central banks. What they want to do is unwind it, reduce it probably to $3 trillion or so.”

Despite the big numbers, Bernanke predicts the unwinding will have little impact on the economy.

“I think it’s not going to cause a lot of problems, most people in America won’t even be aware of it.”

Bernanke was positive on the progress the U.S. economy has made since the Great Recession.

“Unemployment rate, 4.4%, stock market is up as you mentioned, job creation, confidence – all those things are very positive.”

Despite the improvements, Bernanke applauded President Trump for connecting to voters who are not benefiting from the recovering economy.

“He did identify some real dissatisfaction in the country and it relates to some very long-term trends, a lot of inequality, slow wage growth, lots of things, you know, in the middle part of the country and among people with less education that have held them back and made them pretty dissatisfied.”

Going forward, Bernanke sees the U.S. consumer as the key driver of the economy.

“In the consumer confidence surveys, how do they feel about their own financial situations? They’re more upbeat about that than they’ve been in quite a few years. So I do think that engine of the recovery will continue to be consumers.”

Though Bernanke was positive about the markets, he warned economic policies coming out of Washington, D.C. may not live up to what the markets hoped for.

“Good markets are justified, but as you say, from a policy perspective, U.S. policy, it’s not going to be as big or as effective as some of the markets originally anticipated.”