The Democrats’ 5% Solution

“We Democrats believe that our economy can and must grow at an average rate of 5% annually, almost twice as fast as our average annual rate since 1953....We shall bring in added Federal tax revenues by expanding the economy itself.” -- 1960 Democratic Party Platform

“We will continue to use tax policy to maintain steady economic growth by helping through tax reduction to stimulate the economy when it is sluggish.” – 1968 Democratic Party Platform

“We reject ..the big government theory that says we can..tax and spend our way to prosperity..We honor business as a noble endeavor.” -- 1992 Democratic Party Platform

“Today's Democratic Party knows that the era of big government is over. Big bureaucracies and Washington solutions are not the real answers to today's challenges. We need a smaller government.” – 1996 Democratic Party Platform

“We have ended the era of big government; it’s time to end the era of old government…Democrats believe in supporting the startups, the small businesses, and the entrepreneurs that are making the New Economy go.” -- 2000 Democratic Party Platform

“We promise to cut taxes for 98% of Americans…We believe the private sector, not government, is the engine of economic growth and job creation.” -- 2004 Democratic Party Platform

“The American people do not want government to solve all our problems..We will shine a light on government spending.” -- 2008 Democratic Party Platform

“What is the difference between a Democrat and a socialist? I used to think there was a big difference. What do you think?”--MSNBC’s Chris Matthews to Democratic National Committee Chair Debbie Wasserman-Schultz (D-FL)

“The difference between….the real question is what’s the difference between being a Democrat and being a Republican.” -- Democratic National Committee Chair Debbie Wasserman-Schultz (D-FL), avoiding Matthews’ question

Five years after the immaculate recovery declared by Vice President Joe Biden in the summer of 2010, the U.S. still faces dismal job and wage growth, with more small businesses shuttering than opening, a first for the U.S. economy since the Carter Administration.

What could fix all that?

For the Democrats to stop their identity crisis and return to their economic growth plans built on their small government, low-tax platforms.

Up until 2000, Democrats routinely used buzzwords like “tax cuts,” “smaller government,” and “growth” in their platforms,” beginning in the John F. Kennedy era, even through Al Gore’s “reinventing, downsize the government” campaign. Though Democrats kept the caveat that it would resort to higher taxes, as it did in 1960, if the “unfolding demands of the new decade” necessitated them, President John F. Kennedy still cut taxes and famously declared that “a rising tide lifts all boats.”

The Kennedy and Lyndon B. Johnson Administrations believed strong economic growth could come about with lower taxes, a position now lost in the weeds of the “income inequality” debate. If Kennedy had lived, he would have seen that by 1966 the U.S. economy was growing at 6.6% and the jobless rate had dropped to 3.8%.

By 1968, the Democratic platform still stipulated that tax reductions were necessary “to stimulate the economy.”

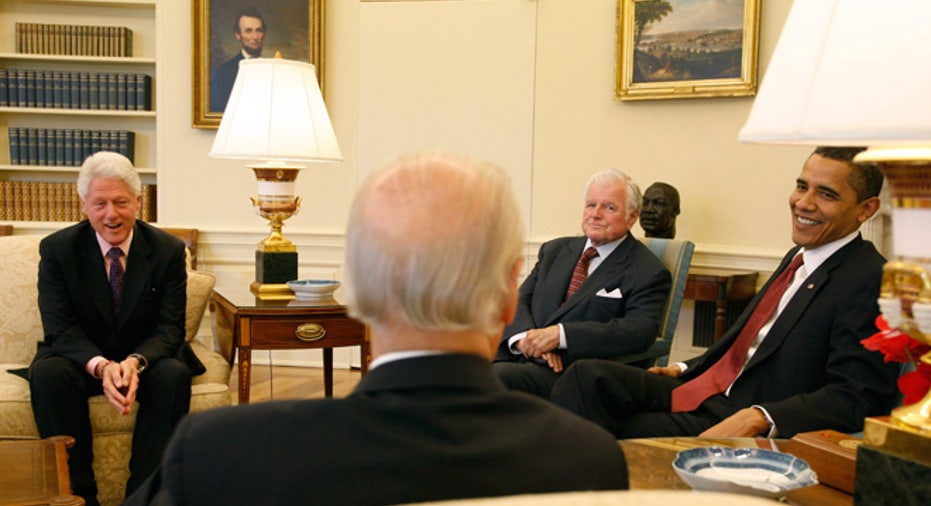

But since 2008, the Democrats have lost their ideological bearings. The Obama Administration and now Democrat presidential contender Hillary Clinton are pursuing a course the polar opposite of the modus operandi of prior Democratic Administrations, when tax cuts were about igniting growth first, redistribution later. But both Hillary Clinton and President Barack Obama continue to put redistribution and big government first at the expense of growth, and end up getting neither.

Both are about raising taxes when the government routinely fails to deliver a budget. For the first time in six years, both houses of Congress last May adopted concurrent budget resolutions, notes FOX News Channel’s information specialist Stephen Scarola, as the federal government continues to mistake emergency stabilization plans to handle the housing crash as growth plans.

And now, Hillary Clinton proposes a mind-boggling capital gains tax plan that involves a half-dozen rates, a plan which nearly doubles the rate for investments held less than six years.

A flip flop from when Mrs. Clinton said of the capital gains tax rate in the 2008 Democrat presidential debates: “I wouldn’t raise it above the 20% if I raised it at all. I would not raise it above what it was during the Clinton Administration.”

We’ve got a U.S. tax code undermining the economy that sits at 77,000 pages, with all the statutes and regulations factored in, at seven times the length of Tolstoy’s “War and Peace.” Americans spend 6.1 billion hours every year attempting to comply with the revenue code, at an all in monetary cost of about $168 billion, estimates the Tax Foundation, about the size of Vietnam's GDP.

It’s a tax code written in an incomprehensible tongue and neurotically fiddled with by politicians doing the paid bidding of rent seekers seeking privileges their competitors don’t get. Entire, multi-billion dollar, unproductive industries are built, and wasted, on either complying with the code, or chasing elected officials who dole out tax privileges.

The tax code has even Congress lost in its own convolutions. It strands taxpayers on a funhouse carnival boat ride, leaving the very same people who pay for the salaries of bureaucrats running the ride with the eerie presentiment that they will meet extraordinary creatures on the way just as despotic as any found in a European Russian town.

“We will protect the rights of all taxpayers against oppressive procedures, harassment and invasions of privacy by the Internal Revenue Service,” reads the 1976 Democratic Party platform. “At present, many federal government tax and expenditure programs have a profound but unintended and undesirable impact on jobs and on where people and business locate. Tax policies and other indirect subsidies have promoted deterioration of cities and regions. These policies should be reversed.”

However, now both President Obama and Hillary Clinton are about bigger government, even though the economy grew at less than 2% since 2008 and just 1.5% in the first half of 2015, a virtual standstill.

That first half performance is less than half the average growth the U.S. economy experienced, at just over 3%, from World War II to 2007.

This isn’t just the worst growth rate since World War II. It’s the worst rate of growth since the modern concept of GDP was first developed in 1934. When about half the time from 1950 to 2000, 4% growth was the norm. Most every recession since World War II saw higher economic growth, including the cataclysmic 1981 recession that saw a severe banking collapse when big money center banks, including Citibank (NYSE:C), faced insolvency due to Latin American debt crisis.

That 3% growth rate would toss off another $600 billion in annual economic growth, estimates show, which would mean more jobs and higher incomes.

But despite minimum wage increases from big employers such as Walmart (NYSE:WMT), Target (NYSE:TGT) and McDonald’s (NYSE:MCD), U.S. workers’ wages grew by the smallest amount since 1982. The minimum wage job was never meant for families to raise their children on, it was meant for 20-somethings just starting out. But due to the poor economic performance under the Obama Administration, the minimum wage is now an odd, awkward plank in the “income inequality” debate.

Today we’ve got a federal government whose spending annually equates to about 24% of GDP, up from the 19% average from 1950 to 2000. That’s a lot of capital sucked out of the private markets away from job-creating entrepreneurs who could develop the next, hot technology or medical cures, capital for the politicians to use instead to pick and choose how it’s deployed.

“The ballooning [George H.W.] Bush deficits hijacked capital from productive investments,” chided the 1992 Democrat platform. However, since 2002 under both Democratic and Republican Administrations, tax receipts have not come close to matching total federal government spending, when the federal deficit was a quaint $6.2 trillion. Today the gross federal debt stands at $18.7 trillion, up from $11.9 trillion in 2009.

Meantime, the Office of Management and Budget estimates there are roughly 77,000 empty federal buildings worth hundreds of billions of dollars that instead cost taxpayers nearly $2 billion a year just to maintain.

Taxpayers continue to pay for federal waste, anywhere from $125 billion to $200 billion, due to duplicative spending, even after the Government Accountability Office, Congress‘ official watchdog, made 440 recommendations since 2009 for cut backs in 180 areas. Less than a third, 29%, of the GAO’s recommendations were fully addressed.

This, as the 2008 Democratic platform said the party would be all about “eliminating waste in existing government programs” and “pay as you go budgeting rules.”