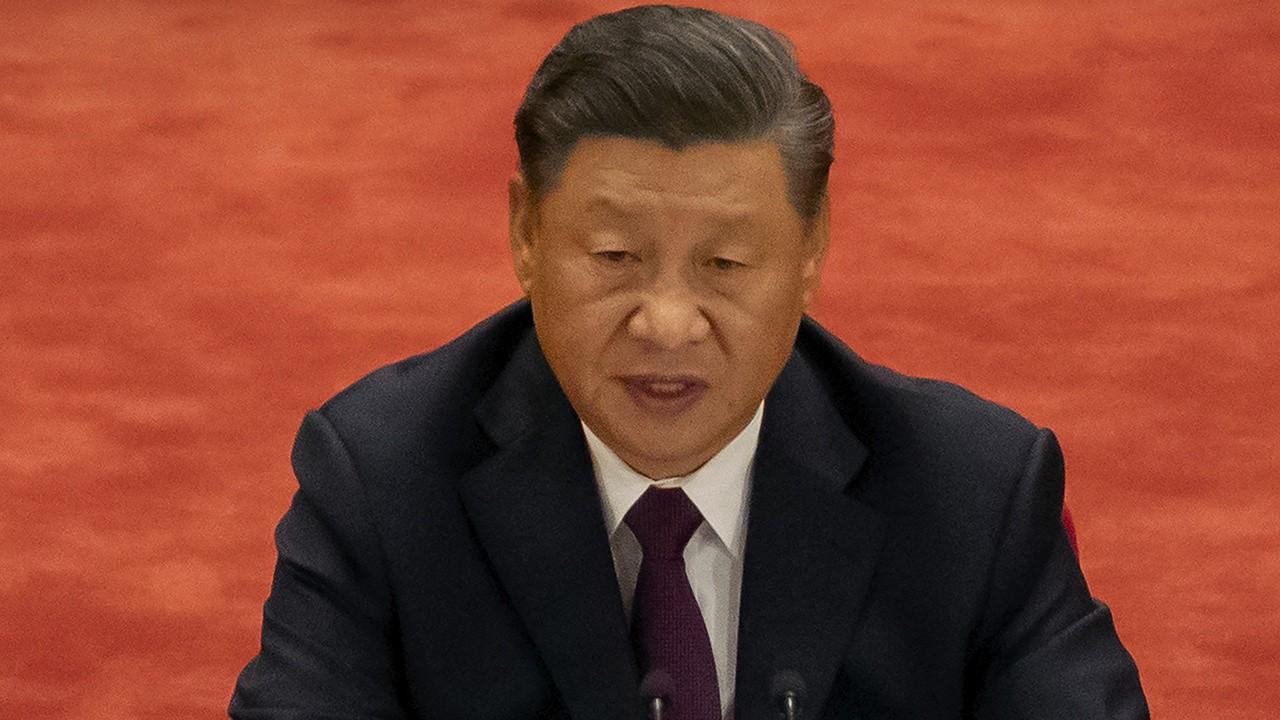

Chinese investment in Australia drops by nearly half, political tension continues to rise

The current level is a fraction of the nearly A$16 billion peak in 2016

Chinese investment in Australia has sharply declined as mistrust continues to rise between the two nations, with China instead turning to emerging markets, according to reports.

Investment declined for the third year in a row, dropping by roughly 47% to 2.5 billion Australian dollars ($1.8 billion) from AU$4.8 billion in 2018, according to Reuters. The figure is a far cry from the peak of AU$15.8 billion in 2016, with losses in mining, real estate and commercial property, manufacturing and agriculture.

China also limited citizens traveling and studying in Australia and targeted commodity imports in an effort to curtail general economic exchanges between the two countries, Bloomberg reported.

TRUMP'S WECHAT BAN ENDANGERS US BUSINESSES IN CHINA

“The 2019 decline in investment coincides with lower flows of Chinese investment abroad, but the fall in flows to Australia was sharper,” a report by the Australian National University’s Chinese Investment in Australia database stated.

The report also noted small increases in construction, education and finance.

The leader of the database, ANU professor Peter Drysdale, said there was no single explanation for such a drastic fall, ABC News Australia reported.

CHINA BECOMING BATTLEGROUND FOR PLANT-BASED MEAT MAKERS

One factor may be that a mining boom – which brought heavy investment flow from China – has dropped off, as well. Drysdale says, however, that Chinese investors are also deterred by new regulatory barriers established by the Australian government.

Additionally, the political relationship between the two nations has deteriorated as they continue to clash over foreign interference, intimidation of Australian journalists in China, cyber espionage, trade, Hong Kong, and the COVID-19 outbreak.

"Chinese investors now view Australia as a more difficult place to invest in now, there's no question about that," Drysdale said.

Earlier this year, Australian Treasurer Josh Frydenberg introduced new restrictions designed to stop overseas companies from targeting distressed Australian assets hit by the economic impact of the coronavirus pandemic. Last month, Frydenberg effectively blocked Mengniu Dairy from buying Australian company Lion Dairy and Drinks, saying the deal would be “contrary to the national interest.”

CLICK HERE TO GET THE FOX NEWS APP

The government also barred mobile technology maker Huawei Technologies Co. from joining the rollout of the nation’s 5G network, according to Bloomberg.