2012: Another Stomach-Churning Year for Retail Investors

Don't let this year’s solid stock-market gains fool you, 2012 was yet another anxiety-filled, confidence-reducing year for retail equity investors.

From the hugely disappointing Facebook (NASDAQ:FB) initial public offering and the alarming fiscal-cliff talks to insider-trading scandals and costly glitches at Knight Capital Group (NYSE:KCG) and Nasdaq OMX Group (NASDAQ:NDAQ), there was no shortage of new shocks to the psyche of average investors this year.

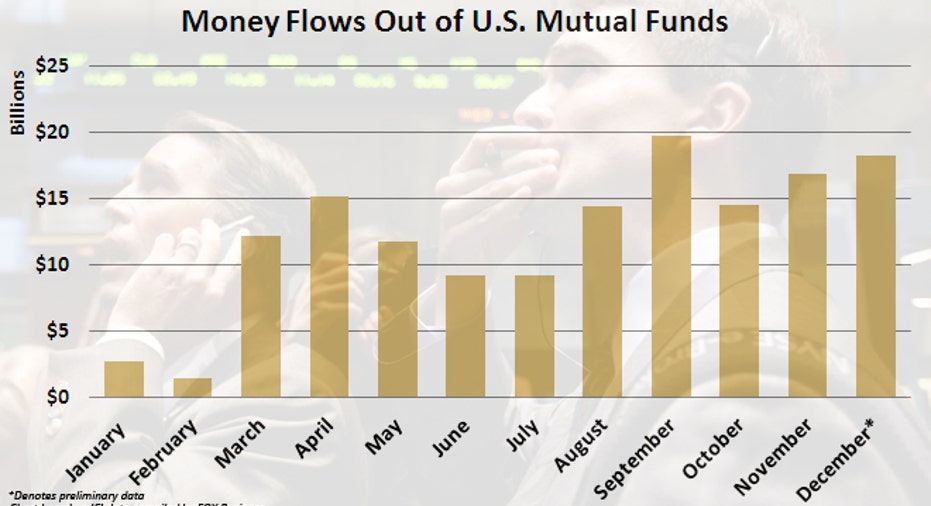

With the 2008 crisis and dotcom bubble still in the rearview mirror, the diminished confidence in the safety and fairness of the equity markets is underscored by almost $150 billion being yanked from domestic equity mutual funds so far this year alone.

“All of those events are confidence-shattering events,” said Joe Saluzzi, co-head of trading at Themis Trading and co-author of Broken Markets.

Cash Flees Equity Funds

With scary incidents coming one after another, many retail investors are still sitting out, missing out on the enormous surge in equity prices since the March 2009 bear-market lows.

“They throw up their hands and say, ‘What kind of market is this? Is this Warren Buffett buying a company and holding it for years?’ No, it’s a game that the big players play,” said Saluzzi.

According to statistics compiled by the Investment Company Institute, domestic equity mutual funds have suffered outflows of $145.63 billion this year through December 19. That comes on top of $132.15 billion that was siphoned out of the market in 2011.

By comparison, world equity mutual funds have enjoyed net inflows of $6.4 billion so far this year.

Investors also continue to pour cash into more stable bond mutual funds, which have enjoyed a whopping $302.59 billion in inflows in 2012, ICI estimates.

Fiscal Cliff, Facebook IPO Spook Investors

This year seems poised to be capped off by yet another confidence-reducing event: the looming fiscal cliff.

Fears that politicians in Washington will fail to reach a deal to avert this $600 billion batch of spending cuts and tax increases triggered a triple-digit tumble for the Dow on Friday morning, following several sessions of weakness.

An extended stalemate on this budget conflict threatens to send stocks tumbling an estimated 15% by the end of January, a risk analysis by SunGard’s APT projects.

Despite the stumbles, 2012 held promise as a year that would recapture the imagination of retail investors thanks in part to the highly-anticipated IPO of Facebook in May.

Yet if anything the Facebook IPO, which gave the social network a stunning valuation of $104 billion, helped reduce faith in the markets. Within months of the overvalued debut, Facebook’s stock tumbled from its IPO price of $38 to as low as $17.55 -- representing a hefty loss of nearly 54%.

Morgan Stanley (NYSE:MS), which led the $18 billion IPO, caught flak for privately providing clients with a dimmed pre-IPO revenue forecast for Facebook while simultaneously trumping up the company’s growth prospects in public.

Structural Jitters Persist

As if that weren’t enough, technical glitches at Nasdaq OMX Group (NASDAQ:NDAQ) marred Facebook’s first day of trading and created confusion for many investors.

The technical glitches underscore serious concerns in some corners about problems with the structure of the capital markets, which increasingly cater to high-frequency traders instead of the mom-and-pop investor.

Just months after the Nasdaq glitch, Knight Capital Group, a crucial cog in the financial system, nearly filed for bankruptcy after a computer problem prompted $400 million of erroneous trades.

While Knight eventually received an industry bailout and more recently a buyout, the incident reminded investors of how things can go wrong, such as in the scary 2010 Flash Crash.

“Most people trading nowadays are micro scalpers,” said Saluzzi. “High-frequency guys are only looking for the next move in the price; all that matters is what’s going to happen in that next millisecond. That’s how they play the game. We’ve been divorced from fundamental valuations.”

In another embarrassing and ironic event, computerized exchange operator BATS Global Markets suffered a technical glitch in March that caused its own IPO to go up in flames.

Insider Trading, Fraud Charges

There have also been ethical issues that have only added to the feeling that the deck may be stacked against the retail investor.

For example, commodities firm Peregrine Financial collapsed in July amid a $200 million shortfall in customer funds. Russell Wasendorf, Sr., the company’s CEO, was arrested and pled guilty to defrauding investors after a suicide attempt.

Earlier this year Raj Rajaratnam was sentenced to an 11-year prison term and slapped with a $92.8 million civil penalty after being found guilty in what the U.S. called the largest hedge fund insider-trading scheme in American history.

In June the U.S. also won an insider-trading case against Rajat Gupta, a former Goldman Sachs (NYSE:GS) accused of passing illegal information to Rajaratnam.

Investors will surely be hoping the stomach-churning events of 2012 won’t be repeated next year, but it seems likely few will be confident enough to bet on it.