SBA Initiative to Speed Up Loan-Application Process

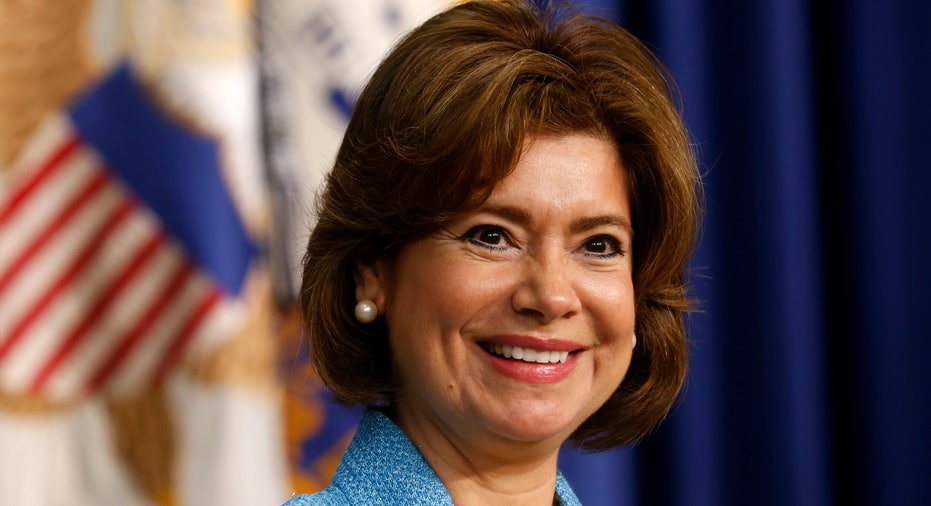

The SBA loan-approval process is getting a technological makeover. On Tuesday, SBA Administrator Maria Contreras-Sweet discussed a new lending initiative while speaking at the Center for American Progress. The in-development platform, called SBA One, is intended to streamline the loan-application process for small-business owners. Many of the changes will be technological in nature. Contreras-Sweet said SBA One will bring documents and forms online, and business owners will be able to provide electronic signatures. “Say goodbye to fax machines and mountains of paperwork,” said Contreras-Sweet. Contreras-Sweet said the makeover will help save banks hours of time and thousands of dollars processing 7A loan applications. 7A loans, which Contreras-Sweet referred to as the SBA’s core product, can be used to pay operational expenses or accounts payable, or purchase inventory, equipment and real estate. In combination with SBA credit scoring, Contreras-Sweet said that SBA One will hopefully lead more banks to partner with the administration. “By making the process quicker, cheaper and more intuitive, these reforms will help existing lenders do more small-dollar lending,” she said. While National Small Business Association spokesperson Molly Day applauded the intent to streamline the loan-application process, she raised concerns regarding the use of credit scoring. “On the one hand, [SBA One] is a positive move, but the area where it raises questions for us is that moving everything to a credit-scoring model … it [could] create a more homogenized population and cut out some of the small-business owners from getting loans, who would have been able to if there were more qualifiers in the underwriting process,” said Day. Day said this might particularly affect newer business owners or startup entrepreneurs who haven’t established a longer credit history.