Patricof: Startup Failure Rate is Going to Be “A Lot Higher”

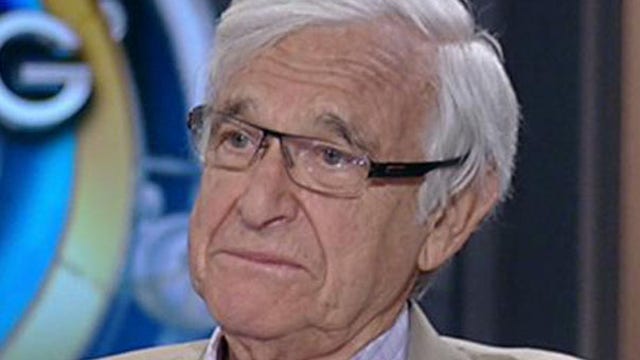

In an interview with FOX Business's Maria Bartiromo, Greycroft Partners founder Alan Patricof gave his outlook for ecommerce and digital video, explaining why he thinks more startups will flop.

Patricof expressed concern that young people are entrepreneurs for the wrong reasons. He sees a lot of people starting businesses because their friends are doing it, instead of building something out of passion.

As a result, “the failure rate is going to be a lot higher as we go forward into 2014 and 2015," he predicts. Patricof views a lot of these startups as “imitations” of things that already exist.

Although he is expecting fewer startups to make it to the finish line, Patricof says it is easier to hit the ground running. “The cost of getting into business is much less,” he explains. Through crowdfunding and venture capital, “almost everybody can raise some money to get started.”

The majority of startups struggle to make the big leagues, but Greycroft has had some success. Investments like Huffington Post, Buddy Media and Klout have all resulted in significant acquisitions.

Greycroft is also enthusiastic about digital video. They were an investor in Maker Studios, which recently sold to Disney for $500 million.

“Video advertising is the hot area,” Patricof says. “We really believe very strongly in the video market and video on mobile is a whole new world.”

Greycroft is also making investments in ecommerce -- Trunk Club and The Real Real are both portfolio companies.

Patricof predicts that online commerce will continue to grow, particularly as smartphone and tablet usage rises. These startups will be “disintermediating the traditional retailers you see on the street because people are using their mobile phone a lot more.”

Although activity has been mixed in recent weeks, IPOs were off to a strong start in 2014, especially in the technology sector. Patricof says this is resulting in increased investment activity, “the whole venture market is excited by the whole IPO market going.”