Experts: E.U. Tax Hike Designed to Hurt U.S. Denim Manufacturers

American jeans have been flying off the shelves in Europe – but they might not be available much longer.

U.S. denim manufacturers last week woke up to a sharp slap in the face from a European Union tax hike, which makes it much more expensive for European stores to stock made-in-America jeans.

With only a few days’ warning, the E.U. announced it was raising the import tax on women’s denim made in the U.S. from 12% to 38% -- which would more than double the fee for any European distributors still willing to stock the American-made product.

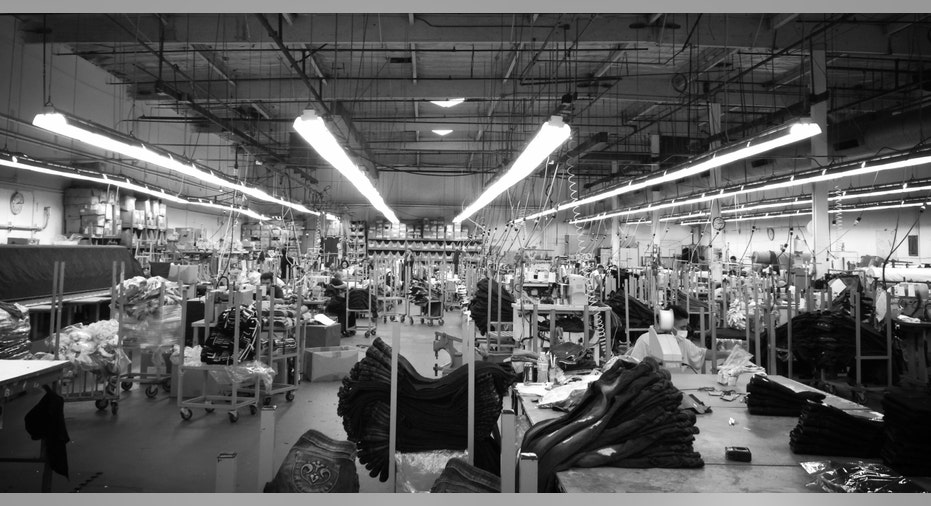

The tax hike deals a heavy blow to the denim industry in Los Angeles, one of the key places where U.S. manufacturing has been going strong.

With Europe currently a solid and growing market for American denim, Los Angeles-based brands say they are faced with a tough decision. They can either move operations to Mexico or another country abroad to avoid the tariff, or they can pass the cost on to customers with price increases--and risk losing European sales.

The steep tariff hike stems from a longstanding battle over U.S. trade practices, according to American Apparel and Footwear Association executive vice-president Steve Lamar.

Specifically, he says, it’s a retaliation against the 2000 Byrd Amendment, which gave the U.S. the rights to distribute money from duties on unfairly traded imports to the American industries affected by these trade practices. The World Trade Organization found this payout illegal in 2002, and the Byrd Amendment was officially repealed in 2005, says Lamar.

“But we left in place a transitional piece, and residual duties could still be disbursed,” says Lamar. And for as long as this goes on –and Lamar says industry insiders expect it will happen for the foreseeable future, the E.U. can retaliate by imposing duties on products, up to a certain level each year.

Women’s denim had never made the cut, but Lamar suggests the category’s growing market share made it a target. The latest data from the American Apparel and Footwear Association shows U.S. jean exports shot up 45.7% in the first two months of 2013.

Jeans Companies Tightening Their Belts “Denim was the only category that was increasing local jobs and local manufacturing. So it won’t only affect the product, it will affect jobs as well,” says California Fashion Association executive director Ilse Metchek.

Metchek says the U.S. exported nearly $36 million in premium denim to Europe last year – and the overwhelming majority was made in the Los Angeles area.

International trade attorney Tom Travis, who specializes in the textile and apparel industries, says the export number was even higher before the recession, and the denim industry was viewing the E.U. “as a good growth market.”

Siwy Denim COO Alain Lafourcade says European sales make up 15-20% of the company’s revenue. Siwy owns a factory in Los Angeles, and the company sells only women’s denim.

“Since we only sell for women, it hurts us the most,” says Lafourcade.

The increased tariff puts Siwy in a tough place.

“We’re not going to stop manufacturing in LA, because we support made in the USA, and there are so many jobs that people will be out of,” says Lafourcade.

At the same time, he says the company has been targeting Europe in its efforts to grow, recently securing a new distributor in Germany. Lafourcade says the company is considering a solution in which they would give their European distributors more of a discount, decreasing Siwy’s margins but continuing to increase the company’s presence abroad.

HUDSON Jeans CEO Peter Kim says the denim brand has been doing all of its manufacturing in Los Angeles since launch more than 10 years ago, with over 100 employees in the area. Last year, the company sold over 1.3 million pairs of jeans worldwide.

“Europe is a pretty big market for us, and it’s a continuously growing market,” says Kim. What’s more, he says France and Italy’s status as fashion capitals make it critical for the company, image-wise, to be well-represented in European stores.

HUDSON says it had recently established relationships with distributors in Spain and Portugal, and was growing in Scandinavian and Benelux countries. “This is huge for us in terms of long-term projections,” says Kim, noting that international business makes up 20% of HUDSON’s sales.

Kim says made-in-America is a “huge part of HUDSON’s DNA,” and there are no plans to shift manufacturing to Mexico or Turkey – locations he says are being tossed around by other denim brands.

“We’re going to sacrifice margins on our side, so the European market won’t feel it,” says Kim, as a 26% increase on the consumer side would price HUDSON well above its competitors abroad.

In addition to his employees, Kim says HUDSON has an extra-large economic footprint in Los Angeles, in terms of the contractors it uses for washing and dyeing denim.

Some Brands Already Shifting South Joe’s Jeans CEO Marc Crossman says the company’s manufacturing is already split at 60/40 between Mexico and the United States – but the tariff hike pushes the brand to move more of its production south of the border.

While European sales only make up 5% of Joe’s Jeans’ $118.6 million business, Crossman says he sees potential for capturing more of the European market. Though the company is headquartered in L.A., manufacturing and shipping from Mexico means no 36% duty for European importers – and a leg up on its competitors for Joe’s Jeans.

“As we show the line to European distributors, we’re making them aware which goods are coming over from Mexico and which are from the U.S.” says Crossman. “Europe is not a huge market for us and doesn’t have a major impact on our existing business, but from a revenue growth perspective, if everyone is shut out and I can ship out of Mexico, it gives me a price advantage over other U.S. competitors.”

Industry Experts Confused by E.U. Decision Earlier this year, the White House notified Congress that it was going to begin talks with the E.U. on a free-trade agreement between the United States and the European Union – and those talks were likely to begin in only a few weeks, says Lamar.

“Before engaging in a trade agreement, you usually don’t start imposing new penalties,” he says.“You usually have a standstill.”

Lamar calls the tariff hike a “colossal measure of bad faith” that could hamper negotiations.

And even the manner in which the increased duty was announced seemed like it was designed to cause the most pain possible, says HUDSON’s Kim.

The announcement came just days before the increase went into effect – and it hit shipments as they cleared customs, not as they were shipped out, meaning that denim that had been sent to Europe earlier in April was subject to the tax increase.

“There was nothing we could have done at that point when we found out,” says Kim. “It’s not a nice thing to do.”

Lamar, however, says he is hopeful that spreading the word will force the E.U.’s hand in this situation.

“People in Europe are now hurt, too, because they’re being denied access to a product that was popular,” he says. “Clearly the solution is not to allow this to continue.”