Yellen ‘Strongly Supports’ Fed’s Monetary Strategy

Janet Yellen said Tuesday in her first testimony before Congress as chair of the Federal Reserve that the central bank’s plan to gradually scale back its easy-money programs is just that – a gradual plan designed to be flexible so it can be adjusted to economic data as it is released.

There is no “preset course” for tapering the Fed’s monthly bond purchases, she said.

Asked what might cause the Fed to delay tapering, Yellen said a “notable” reversal of the long-term economic outlook. But she downplayed recent weak labor reports, telling members of the House Financial Services Committee, “We have to be very careful not to jump to conclusions.”

Fed policy makers will look at all new data at their March meeting and will “take our time to assess just what the significance of this is,” she said.

In defense of the Fed’s long-running easy-money policies, Yellen said quantitative easing helped many underwater homeowners gain equity and provided an overall boost to the housing sector.

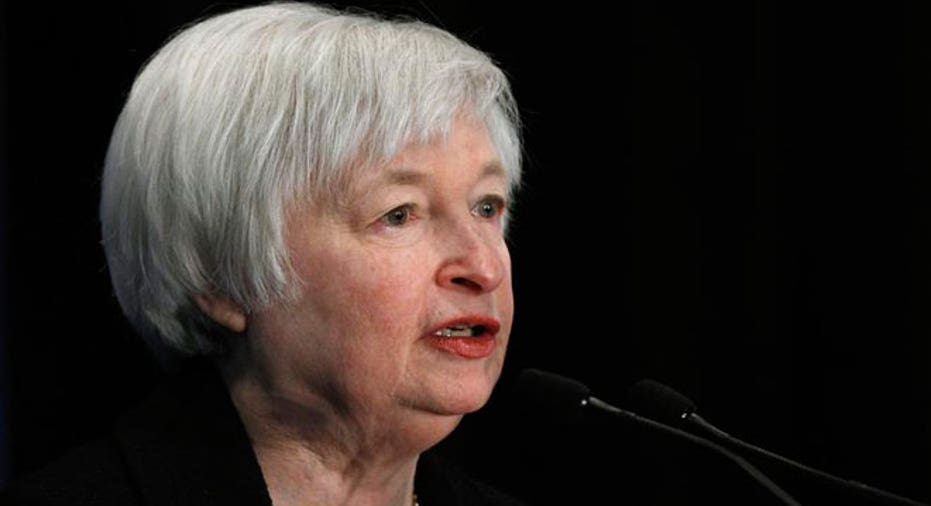

Yellen, the first woman to serve as Fed chair in the central bank’s 100-year history, testified before the Republican-controlled committee, many of whom have expressed deep reservations for the Fed’s long-running easy-money policies.

Those reservations became clear during the question and answer period. Yellen was asked to justify the Fed’s unprecedented interventionist policies in the wake of the 2008 financial crisis.

In addition to QE lifting the housing sector, Yellen said low interest rates have spurred lending. But the Fed can’t fix everything. “Monetary policy is not a panacea,” she said.

In prepared remarks during her first semiannual report on monetary policy, Yellen said she has no intention of forging a new path for monetary policy outside the one established by her predecessor, Ben Bernanke.

“Let me emphasize that I expect a great deal of continuity in the (Federal Open Market Committee’s) approach to monetary strategy,” Yellen said. “I served on the committee as we formulated our current policy strategy and I strongly support that strategy, which was designed to fulfill the Federal Reserve's statutory mandate of maximum employment and price stability.”

Yellen has long been expected to maintain the Fed’s accommodative policies, adjusting specific programs as necessary when and if economic data warrant such a move. Her testimony Tuesday shows she plans to adhere to that expectation.

The Fed set interest rates at near zero in December 2008 and has held them there ever since in an effort to spur lending and economic activity. In addition, three separate bond purchase programs, known as quantitative easing, have more than quadrupled the Fed’s balance sheet to more than $4 trillion.

In December the Fed voted to begin gradually scaling back its easy money policies by reducing the amount of bond purchases it makes each month by $10 billion. Fed policy makers initiated the program in January then approved another $10 billion reduction a few weeks ago despite a slew of mixed economic news and the rough patch in emerging markets.

In her opening statement, Yellen said recent turbulence in emerging markets, a subject on which the Fed had been generally quiet, is being watched closely by the Fed but is not yet a cause of serious concern.

“We have been watching closely the recent volatility in global financial markets,” she said. “Our sense is that at this stage these developments do not pose a substantial risk to the U.S. economic outlook. We will, of course, continue to monitor the situation.”

Similarly, Yellen addressed the two most recent monthly labor reports, both of which were big disappointments. The weak December report, which was blamed on extreme weather, showed the U.S. economy added just 75,000 jobs, and the January report, released last week, showed the addition of just 113,000 jobs.

Comments from Fed policy makers indicate that the central bank is looking well beyond the labor indicators to determine future policy decisions. GDP has been relatively strong and inflation is not yet a concern. Yellen’s statement stuck to that wider view of the economic landscape.

“Participants viewed labor market indicators as showing further improvement on balance -- not withstanding recent mixed readings -- and overall economic activity as consistent with growing underlying strength in the broader economy,” she said.

The unemployment rate – 6.6% in January – remains too high, however, the long-term unemployed, or those out of work for six months or more, represent “an unusually large fraction” of the unemployed, and too many part-time workers who want full-time jobs can’t find them, she added.

The newly-minted Fed chief also doesn’t see a bubble emerging in U.S. equities.

Despite the recent turbulence, many economists believe the Fed will continue to gradually taper and wind down bond purchases by the end of the year. Interest rates, meanwhile, will remain near-zero for the foreseeable future.

Echoing comments made repeatedly by her predecessor, Yellen said Tuesday, “The Committee has emphasized that a highly accommodative policy will remain appropriate for a considerable time after asset purchases end.”

On the regulatory front, Yellen said Fed actions that have led to substantial increases in capital and liquidity in the banking sector “are making our financial system more resilient.”

Since the financial crisis of 2008 the Fed has initiated stress tests for big banks, proposed rules to increase capital and strengthen big banks’ liquidity positions, and most recently issued a final ruling on the Volcker Rule, which prevents big banks from certain proprietary trading for their own gains.

All these regulations are intended to reduce risk-taking that could lead to another crisis and better equip banks to deal with a crisis if one occurs.