Silicon Valley Bank collapse: GOP's Vivek Ramaswamy says more regulation would encourage ‘crony capitalism’

U.S. Treasury Secretary Janet Yellen has ruled out a bailout for Silicon Valley Bank

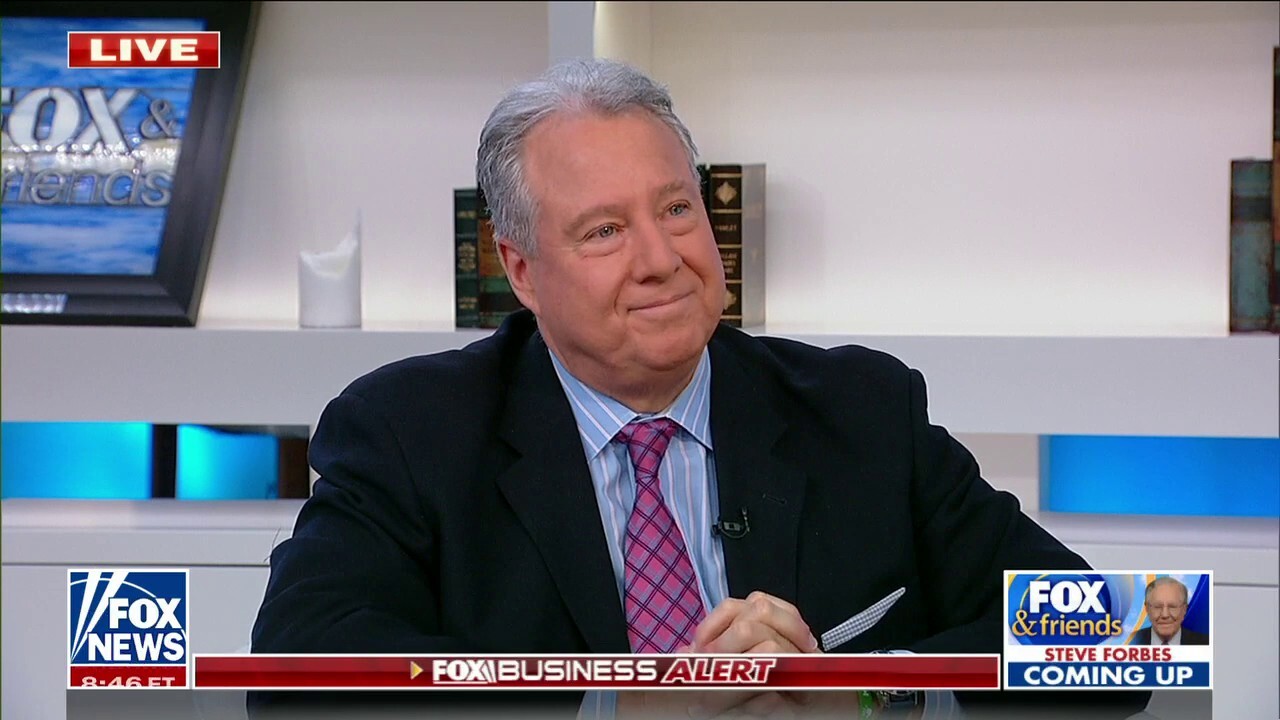

Economic expert Robert Wolf reassures consumers that SVB collapse is ‘nothing like Lehman’

Former Obama economic adviser and former CEO of UBS Robert Wolf breaks down the historic collapse of Silicon Valley Bank and the economic fallout that has followed on ‘Fox & Friends Weekend.’

As the financial industry reels from Friday’s collapse of Silicon Valley Bank – the largest since the 2008 financial crisis – 2024 Republican presidential candidate Vivek Ramaswamy has argued that adding regulation in the industry would only incentivize more bad behavior.

"I think more regulations are not the answer, because that creates more room for crony capitalism," Ramaswamy told FOX Business.

FILE: Vivek Ramaswamy speaks with the Associated Press with supporters nearby, at the Conservative Political Action Conference, CPAC 2023, Friday, March 3, 2023, at National Harbor in Oxon Hill, Md. (AP Photo/Alex Brandon / AP Newsroom)

Ramaswamy, the 37-year-old CEO of a biotech company and author of "Woke Inc: Inside Corporate America’s Social Justice Scam," argued that tech startups – whom SVB largely served – operated under the assumption that they would get bailed out as Washington did for Lehman Brothers following the 2008 financial crisis.

"I think what we really need here is fostering a culture of greater due diligence by market actors to not have to just rely on the government to do their work for them," Ramaswamy said.

SILICON VALLEY BANK GAVE COMPANY-WIDE BONUSES HOURS BEFORE IT COLLAPSED: REPORT

Ramaswamy’s comments came hours after the Treasury Department, Federal Reserve and Federal Deposit Insurance Corporation, in an effort to shore up confidence in the baking system, said Sunday that all Silicon Valley Bank clients would be protected and able to access their money. They also announced steps that are intended to protect the bank’s customers and prevent additional bank runs.

FILE: A worker (C) tells people that the Silicon Valley Bank (SVB) headquarters is closed on March 10, 2023, in Santa Clara, California. (Justin Sullivan/Getty Images / Getty Images)

Under the plan, depositors at Silicon Valley Bank and Signature Bank – including those whose holdings exceed the $250,000 insurance limit – will be able to access their money on Monday. Depositors at U.S. banks are typically insured up to $250,000 of deposits guaranteed by the FDIC.

Ramaswamy called the rule change a triumph for crony capitalism.

"I think it’s disappointing to see crony capitalism win again in America. We have a $250,000 limit. If you want to change the limit and change the rules, then change the rules. But don’t just wing it after the fact, which is exactly what they do here to save their darlings," he said.

SILICON VALLEY BANK FALLOUT, INFLATION DATA, FEDEX EARNINGS TOP WEEK AHEAD

"And in the future, what this does is encourages more risk-taking at banks. It tells them that the government is going to be there for their depositors in the end anyway."

file: U.S. outgoing Federal Reserve Chair Janet Yellen holds a news conference after a two-day Federal Open Market Committee (FOMC) meeting in Washington, U.S. December 13, 2017. (Reuters/Jonathan Ernst / Reuters Photos)

U.S. Treasury Secretary Janet Yellen blamed rising interest rates – which the Federal Reserve has increased to combat inflation – as the core problem for Silicon Valley Bank. Many of its assets, such as bonds or mortgage-backed securities, lost market value as rates climbed.

CLICK HERE TO GET THE FOX BUSINESS APP

In an interview with CBS’ "Face the Nation" on Sunday, Yellen insisted that Washington was not coming to the rescue of Silicon Valley Bank.

Asked whether a bailout was on the table, Yellen said: "We’re not doing that again."

She added: "But we are concerned about depositors, and we’re focused on trying to meet their needs."

The Associated Press contributed to this report.