New House bill would create payroll tax holiday for American workers

Americans would receive a four-month pay raise under Rep. Brady's bill

A top House Republican introduced legislation that would create a temporary payroll tax holiday from Sept. 1 to Dec. 31, essentially giving all American workers a four-month pay raise.

Rep. Kevin Brady, House Ways and Means ranking member, on Friday proposed the Support for Workers, Families and Social Security Act, which would reduce the 6.2% payroll levy known as FICA taxes to zero in the final months of the year, including for the self-employed.

“The essential workers who keep this country running through the pandemic deserve a pay raise,” Brady, R-Texas, said in a statement. “This bill forgives the payroll taxes deferred by President Trump to help working families, many of whom now rely on a single paycheck.”

HOUSE DEM PUSHES MEASURE TO OVERHAUL TRUMP'S PAYROLL TAX DEFERRAL

To ensure the holiday would not hurt the Social Security trust fund, the bill would make transfers from the general fund to offset the reduced tax revenue.

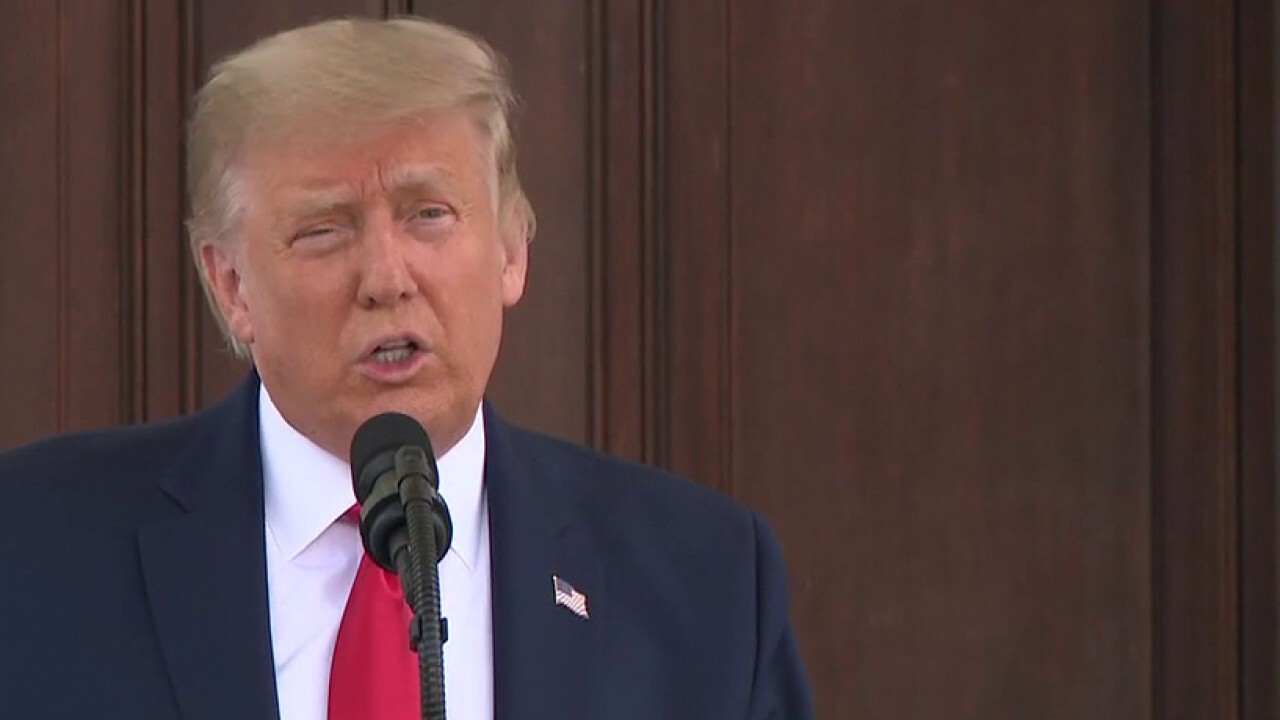

At the beginning of August, President Trump signed an executive action allowing the payroll tax to be deferred for workers earning less than $104,000 annually, or $4,000 biweekly, from Sept. 1 through the end of the year. But come next year, employers are obligated to start recouping what is owed.

The measure, which Trump said could provide some financial salve to workers and households struggling as a result of the coronavirus-ravaged economy, came amid a congressional stalemate over another emergency aid package. He's indicated that he wants to "terminate" the tax so that workers are not required to pay back the money at a later point.

WHAT A TRUMP PAYROLL TAX DEFERRAL WOULD ACTUALLY MEAN FOR YOUR WALLET

Abolishing the debt requires an act of Congress, and absent legislation, the Treasury Department's guidance indicates that after Jan. 1, companies will withhold taxes from paychecks in larger amounts so employees can pay back what they owe, meaning that millions of Americans could see a smaller paycheck in the first few months of 2021.

The payroll tax deferral is optional, and many employers are choosing to not participate over fears they will ultimately be on the hook for the money next year.

It's unclear what would happen if employees pocket the windfall and then stop working at their companies before the end of April, either because they quit their job or were laid off or furloughed. According to the guidance, companies can "make arrangements to otherwise collect the total applicable taxes from the employee."

PERMANENT PAYROLL TAX CUT COULD DEPLETE SOCIAL SECURITY FUNDS BY 2023

The Joint Committee on Taxation said in a memo that under current IRS protocol, employers would file amended returns if they over-withheld payroll taxes. If the employee did not receive a refund from their employer, they would receive that money when they file their 2020 tax return next year.

The committee estimated the proposal would reduce federal revenue by about $137 billion.