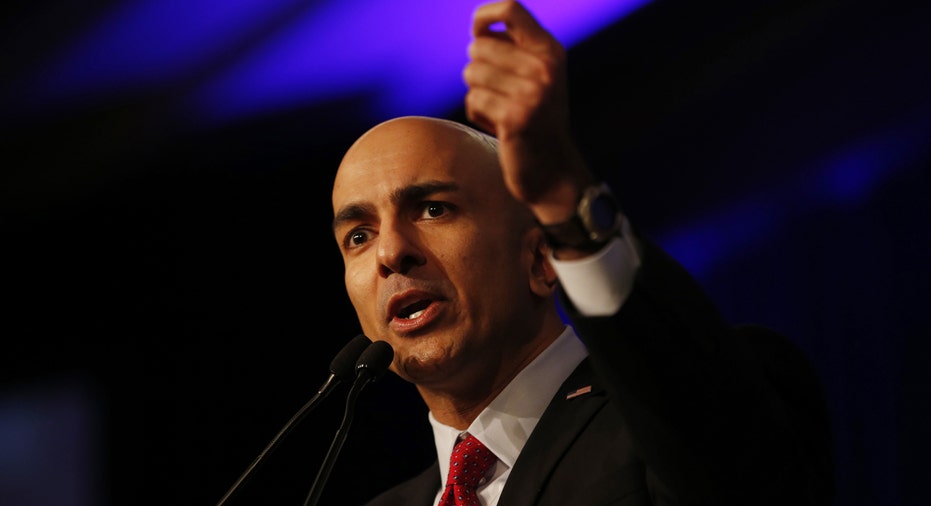

Kashkari to be New Minneapolis Fed President

The Federal Reserve Bank of Minneapolis has named former banker, government official and unsuccessful California gubernatorial candidate Neel Kashkari to become its new president and chief executive officer. He'll succeed Narayana Kocherlakota, who leaves office at the end of the year. Mr. Kashkari, 42, is slated to take office on Jan. 1, 2016, the bank plans to announce Tuesday. Mr. Kashkari's views on central bank interest-rate policy are not publicly known. He's not an economist, beginning his career as an aerospace engineer working on space missions before earning an M.B.A. at the University of Pennsylvania's Wharton School. He's an alumni of investment bank Goldman Sachs and investment fund Pacific Investment Management Co., or Pimco. Mr. Kashkari rose to public prominence as a member of President George W. Bush's administration by running the government's $700 billion Troubled Asset Relief Program--a controversial effort aimed at stabilizing the financial system by pumping capital into banks during the 2008 financial crisis. Critics called the program an improper intrusion by the government into private enterprise and an unfair bailout of big banks. The U.S. Treasury has recovered $442.04 billion from the TARP rescues, after disbursing $430.06 billion--making a profit. The effort injected taxpayer funds into 707 financial institutions; all but 19 of which have paid the money back. Mr. Kashkari--taking a job that paid $339,000 a year, according to the Fed's most recent annual report--said in an interview with the Wall Street Journal that his diverse resume provides a critical foundation for his new role. He also offered broad praise for how the Fed has conducted policy, even as he declined to offer his views about the monetary policy outlook. The Fed's regional banks "can be and should be some of the most important economic policy thought leaders in the country," Mr. Kashkari said in the interview. He sees his new job as "a continuation of a lot of the policy work I've already done" in government and the private sector. He said he also sees the regional Fed banks as an antidote to the "group-think" that can take hold of Washington-based policy makers. In his new job, Mr. Kashkari will participate in meetings of the Federal Reserve's policy committee, though he will not be a voting member next year. The voting seats rotate annually among 11 of the 12 regional banks and Minneapolis's president will next gain one in 2017. The announcement comes at a time when the central bank is considering raising short-term interest rates from near zero, where they have been for seven years. He also will oversee the Minneapolis Fed's 1,100 employees, who conduct economic research and supervise financial institutions, among other things. In the interview, Mr. Kashkari offered broad praise for how the Fed has conducted monetary policy. "I think the Fed is doing the right things with the levers the Fed can control," he said. He added he was not surprised that inflation is currently as low as it is, given that there remain signs of underlying softness in the job market. While he declined to say anything about when the Fed should raise rates, he countered critics of the central bank's policy by saying "the Fed had hasn't caused inflation, hasn't devalued the dollar." "Right now, everyone is laser focused on when is the Fed going to raise interest rates and start the normalization process, for good reason. But there are a whole host of economic challenges we face as a country, and I want to pay attention to all of that," Mr. Kashkari said. Mr. Kashkari worked for the Treasury Department in 2006 as a senior advisor before becoming an assistant secretary between 2008 and 2009. After leaving the administration, Mr. Kashkari worked as a money manager for Pimco between 2009 and 2013. Mr. Kashkari said his experience had led him away from ideological views on complex problems and towards a pragmatic, inclusive and data-driven way of approaching policy issues. Before the financial crisis, Mr. Kashkari described himself as a "free-market guy." But he added "I learned the limits of free markets in the intensity" of the 2008 financial crisis. "I still lean in that direction but I'm also more humble," believing "ideology is great, but data is better" Pimco began a push into stocks in 2009 when it hired Mr. Kashkari to help turn the bond-fund company into a player in stock funds. But the performance of funds Mr. Kashkari launched was spotty. He left in 2013 and the firm has since closed some of its stock funds. Mr. Kashkari left Pimco to run for governor of California in 2014. A political rookie and son of Indian immigrants, he won a Republican primary against an assemblyman, Tim Donnelly, a leader in the movement to stop illegal immigration. During the campaign, he presented himself as a moderate focused on economics with centrist social views. He identified himself as a fiscal conservative, supported abortion rights and gay marriage and said he voted for President Barack Obama in 2008. He touted his ability to work with politicians regardless of party. He lost to incumbent Gov. Jerry Brown , a Democrat, garnering 40% of the vote. "My entire agenda was economic opportunity. It was 100% focused on economic issues," which means there's "great continuity" between what he hoped to do in California and what he'll do at the Minneapolis Fed, Mr. Kashkari said. An Ohio native, Mr. Kashkari moved to California in 1997. He's in the process of relocating to the Minneapolis area. He said he's a big fan of outdoor activities and a lifelong Michael Jackson enthusiast. Mr. Kashkari said he had two Newfoundland dogs named for players on the Cleveland Browns football team. Mr. Kashkari worked at Goldman Sachs in San Francisco from 2002 to 2006 on technology financing issues. The presidents of the New York, Dallas and Philadelphia Fed banks-- William C. Dudley, Robert Steven Kaplan and Patrick T. Harker, respectively--also worked for the firm. Mr. Kashkari's first job at Treasury was working as a senior advisor to then-Treasury Secretary Henry Paulson, the former chairman and CEO of Goldman. Mr. Kashkari's political profile makes him an unusual selection for the central bank, which in recent years has seen only one other aspirant for elected office among its ranks. That was former Dallas Fed President Richard Fisher, who ran unsuccessfully for a U.S. Senate seat from Texas in 1993 as a Democrat. The Fed seeks to maintain independence from the political process so it can set interest rate policies for the economy free from partisan pressures. Mr. Kashkari said, in some ways, his first job could be the most important to his new role as a central banker. "Policy making is problem solving," he said. While he managed the TARP program, "the fact that I had went to Wharton and got my MBA and worked at Goldman are all fine, but I really relied on my engineering skills as a research engineer working on NASA missions," he said, because that experience was all about solving problems with limited tools. He earned bachelor's and master's degrees in mechanical engineering from the University of Illinois at Urbana-Champaign. Mr. Kashkari takes office at a time of transition at the regional Fed banks, after new presidents took office in Dallas and Philadelphia this year. Regional Fed bank presidents are selected by their respective boards of directors, although representatives from the financial industry do not participate in the process. In an unusual move for a process frequently criticized for too much secrecy, the Minneapolis Fed released the criteria it was seeking in a leader, and as part of the planned announcement of Mr. Kashkari's appointment, the bank also will offer a detailed timeline of the search. It will not reveal the names of other candidates. Mr. Kashkari succeeds the Fed's most aggressive supporter of taking strong action to support the economy. Mr. Kocherlakota recently called for the Fed to lower its benchmark short-term interest rate target, which is now between zero and a quarter-percentage point. Mr. Kocherlakota became Minneapolis Fed president in 2009 and announced in December 2014 that he would not seek reappointment.