5 ways to use your tax refund strategically

You could use your tax return to pay off debt, boost your savings or start investing

Taxpayers received an average tax refund of nearly $3,000 in 2021, according to the IRS, and it's possible to use this cash windfall to improve your financial situation. (iStock)

Tax season is here, which means that millions of U.S. taxpayers could soon receive a substantial cash windfall in the form of a tax refund check. Last year, the average refund was $2,873, according to the Internal Revenue Service (IRS).

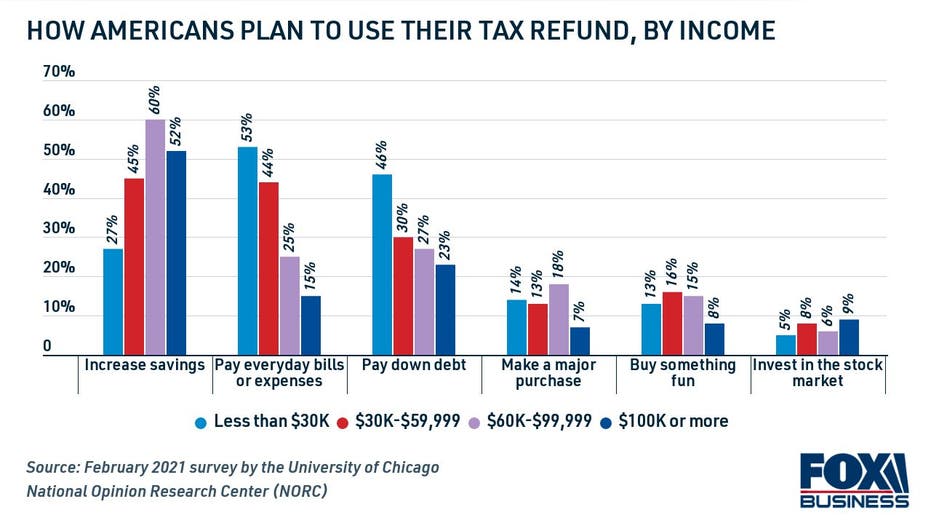

American taxpayers generally use their tax refund to improve their finances, according to a survey from the University of Chicago. In 2021, consumers planned to increase savings (46%), cover everyday expenses (35%) or pay down debt (32%) with their tax return.

While many Americans use the extra money from their tax refund to build long-term wealth, others decide to splurge on something fun or finance a major purchase, the survey said. If you're wondering how to use your tax refund wisely, consider the following strategies:

- Pay off high-interest credit card debt

- Boost your retirement nest egg

- Pay down your student loan balance

- Invest in the stock market

- Create an emergency fund

Keep reading to learn more about these options in the sections below. And visit Credible to compare a wide variety of financial products, such as debt consolidation loans and high-yield savings accounts.

YOU COULD SEE A LOWER TAX REFUND THIS YEAR, AND THIS IS WHY

1. Pay off high-interest credit card debt

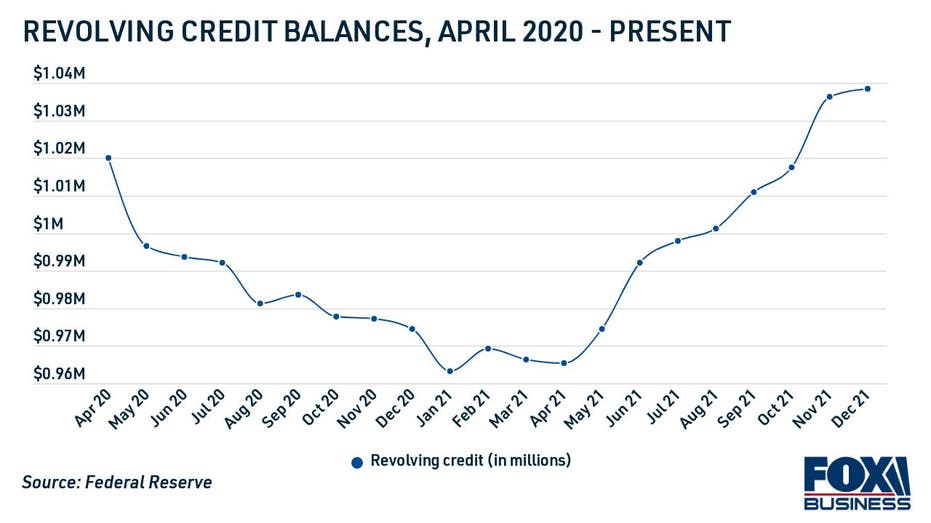

Consumers became increasingly reliant on credit card spending in 2021, as revolving credit balances skyrocketed to pre-pandemic levels, according to the Federal Reserve. This means that many Americans may be entering 2022 with loads of high-interest debt that's difficult to repay every month.

If your revolving credit balance has grown in the last year, you could consider using your tax refund check to pay off your credit cards. Since credit card interest compounds on a daily basis, you can save hundreds or thousands of dollars in interest charges over time by paying off credit card debt with your tax refund.

Another way to get rid of credit card debt is with a debt consolidation loan. This is a lump-sum personal loan with a low interest rate that you repay in fixed monthly installments. You can compare debt consolidation loan rates across multiple lenders at once on Credible and find the lowest rate possible for your financial situation.

SHOULD YOU MAKE EXTRA MORTGAGE PAYMENTS OR INVEST THE MONEY?

2. Boost your retirement nest egg

The median retirement savings balance is $93,000, which is far below the amount that experts say is needed to retire, according to a Transamerica survey. One way to shore up your retirement fund is to add your tax refund check to a Roth or traditional IRA (individual retirement account).

Americans under 50 can contribute up to $6,000 annually to a traditional or Roth IRA, although the maximum annual contribution phases out at certain income levels, according to the IRS. Consumers who are 50 or older can contribute $7,000 per year, depending on income.

5 STRATEGIC WAYS TO SAVE FOR YOUR CHILD'S COLLEGE FUND

3. Pay down your student loan balance

Monthly payments and interest charges on federal student loans are paused until May 1, 2022. This means borrowers who choose to continue making payments on their college debt can lower their principal balance without paying interest.

You can maximize this current federal benefit by using your tax refund check to pay down the principal balance of your student loans. Or you could also save the tax refund money to utilize when student loan payments resume in a few short months.

Student loan borrowers may also consider refinancing while interest rates are still near all-time lows. Keep in mind that refinancing federal student loan debt into a private student loan will disqualify you for income-driven repayment plans (IDR) and select student loan forgiveness programs. You can compare student loan refinancing rates on Credible to decide if this debt repayment method is right for your needs.

HOW TO GET YOUR STUDENT LOAN INTEREST DEDUCTION

4. Invest in the stock market

If you have robust savings and no debt to repay, you might consider investing your tax return in the stock market. While the stock market experiences short-term fluctuations, it can offer a greater long-term return on investment than traditional savings accounts or bonds.

To mitigate your risk, you could consider putting your money in an index fund that tracks the stock market, such as an S&P 500 index fund. This can diversify your investment, which protects your money more than if you just invested in a few individual stocks.

SOCIAL SECURITY PAYCHECKS TO INCREASE AT HIGHEST RATE IN NEARLY 40 YEARS

5. Create an emergency fund

It's recommended that consumers should have about three to six months' worth of expenses saved in an emergency fund. Having a robust emergency savings can help you avoid taking on debt when faced with unexpected expenses like car repairs or surprise medical bills.

This year, you could kickstart your emergency savings by putting your tax refund in a high-yield savings account. These accounts have higher savings rates than traditional bank accounts, although they have a lower return on investment compared with stocks. But unlike stock investments, you can access your money in a high-yield savings account quickly and without penalty if you need it in an emergency.

You can compare high-yield savings account rates across multiple banks at once on Credible to find the best possible offer for your financial needs. Shopping around is free and does not impact your credit score.

5 REASONS TO FILE YOUR TAXES EARLY

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.