With sub-3% mortgage rates a reality, here's what homeowners and buyers should do now

Average 30-year mortgage rates have dipped below 3% again, while 15-year rates dropped near all-time lows, according to Freddie Mac. Here's how you can take advantage of sub-3% mortgage rates. (iStock)

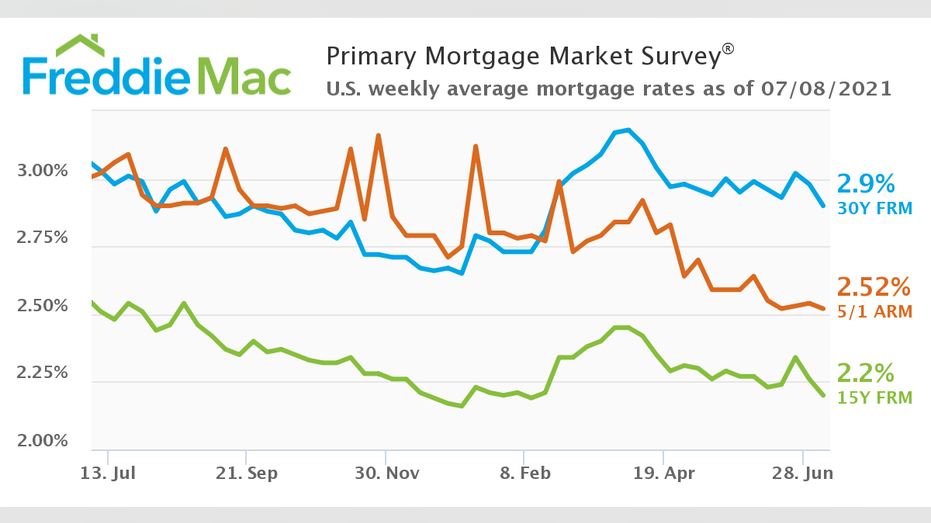

Mortgage interest rates fell below 3% in July across many home loan products, including the popular 30-year fixed-rate mortgage, according to Freddie Mac. Rates also dropped to near-record lows on 15-year fixed-rate mortgages, which are commonly used for refinancing.

While mortgage rates spiked in early 2021, data suggests a downward trend into the summer months. 30-year rates have been hovering around 3% since April, with a more significant drop on July 8 following the dip on U.S. Treasury yields.

But these historically low mortgage rates won't last forever. The Federal Reserve predicts two rate hikes by 2023, which will almost certainly cause interest rates on mortgages to rise. The Mortgage Bankers Association (MBA) predicts that rates on a 30-year mortgage will rise to 4.9% in 2023.

If you've been considering buying a home or refinancing your current mortgage, now is the time to lock in a sub-3% mortgage rate. Make sure you're getting the best rate for your situation by shopping around and comparing quotes from multiple lenders. You can get prequalified and compare rates on Credible's online loan marketplace, all without impacting your credit score.

ADJUSTABLE-RATE MORTGAGES HAVE ADVANTAGES FOR HOMEOWNERS — HOW YOU COULD BENEFIT

Mortgage rate trends: What to know if you're buying or refinancing

Rates on both 15-year and 30-year mortgage options are lower than they were a year ago.

Rates on a 30-year fixed-rate mortgage are 2.90%, which is 0.08% lower than the week prior and 0.13% lower than July 2020, according to Freddie Mac. Rates on a 15-year fixed-rate mortgage are 2.20%, down 0.06% from last week and 0.311% from last year.

30-year mortgage rates hit an all-time low of 2.65% the week of Jan. 7, 2021, but it's not likely that mortgage rates will drop that low again as the economy continues its post-pandemic recovery. 15-year rates also dropped to historic lows in January 2021, dipping as low as 2.16% — not much lower than the current rate of 2.20%.

We expect economic growth to gradually drive interest rates higher, but homebuyers and refinance borrowers still have an opportunity to take advantage of 30-year rates that are expected to continue to hover around three percent.

VETERANS BORROWING VA LOANS AT A RECORD PACE, STUDY SHOWS

Homeowners who are considering refinancing should do so while 15-year rates are near record lows. By refinancing to a shorter mortgage term, you may be able to pay off your total loan amount faster without significantly increasing your mortgage payments.

Don't miss out on historically low mortgage rates again, because it's impossible to know if rates will continue to drop or even how long they'll stay this low. Lock in your mortgage purchase or refinance rate now by shopping around on Credible. You can compare the estimated annual percentage rate (APR) offered by some of Credible's partner lenders in the table below.

WHAT ARE MORTGAGE DISCOUNT POINTS — AND HOW DO THEY WORK?

Prospective homebuyers: Get preapproved to lock in current mortgage rates

Buying a home in today's competitive housing market can be challenging due to low inventory and high demand. But the hot market is showing signs of cooling, with a drop in mortgage applications and more inventory expected to flood the market this autumn.

Rates on a 30-year mortgage may not remain below 3% for very long. The MBA forecasts that 30-year rates will average 3.5% in 2021, with the assumption that mortgage rates will continue to rise in the second half of the year.

There's good news, though: Mortgage preapprovals typically last about three months, so you can still lock in a low mortgage rate if you're just waiting for housing inventory to increase before your home purchase. Doing so can help you lock in a lower monthly mortgage payment, too.

You can get preapproved through multiple mortgage lenders in just three minutes on Credible.

THE BASICS OF CLOSING ON A HOME AND BUYER FEES

Getting multiple mortgage rate quotes can save you thousands

Mortgage lenders set their rates based on a number of factors, which means that one lender may be able to offer you a lower rate than another. That's why it's so important to shop around for the lowest mortgage rate possible if you're purchasing a home or refinancing your current mortgage.

Research from Freddie Mac estimates that buyers can save $1,500 over the life of the loan by comparing just one extra lender, or $3,000 for getting five rate quotes. You can use a mortgage calculator to get an idea of how much a lower interest rate can affect your monthly payment, too.

You don't have to make extra calls to mortgage lenders or conduct online research yourself. Credible lets you compare mortgage loans across multiple lenders by filling out a single form, all without affecting your credit score.

WHAT YOU NEED TO KNOW BEFORE MAKING A DOWN PAYMENT ON YOUR HOME

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.