Student loan borrowers in default will receive 'fresh start' when forbearance ends: Education Department

How you can prepare for student loan repayment and avoid defaulting on your debt

Federal student loan borrowers will be placed in good standing when payments resume in September, the Education Department announced. (iStock)

The Biden administration announced on Wednesday that it's extending the student loan payment pause through Aug. 31, giving borrowers four additional months to financially prepare for the end of forbearance.

This extension also gives Education Department policymakers more time to ensure "student loan borrowers have a smooth transition back to repayment," Education Secretary Miguel Cardona said in a statement. This includes allowing borrowers in delinquency and default to restart payments in good standing.

"During the pause, we will continue our preparations to give borrowers a fresh start and to ensure that all borrowers have access to repayment plans that meet their financial situations and needs," Cardona said.

About 7.1 million federal student loan borrowers were in default in 2018 before the payment pause began, according to Credible, citing the most recent department data. Defaulted borrowers will effectively be given a second chance to build a better credit history, stop wage garnishment and regain eligibility for federal benefits like income-driven repayment and deferment plans.

Keep reading to learn more about how this decision may impact your student loan debt, as well as how you can prepare to restart payments in September. One strategy to consider is refinancing to a private loan at a lower interest rate, which may help you lower your monthly payments and get out of debt faster. You can compare student loan refinancing rates on Credible for free without impacting your credit score.

HOW CAN BORROWERS RECOVER FROM STUDENT LOAN DEFAULT?

What happens to student loan borrowers in delinquency or default

During the student loan payment pause, most federal borrowers have been granted temporary relief from the consequences of delinquency or default. The Education Department suspended collection activities, which means that tax refunds and other federal payments will not be withheld, wages will not be garnished and interest will not accrue on loans.

When student loan payments resume in September, all federal borrowers will be given a "fresh start" by entering repayment in good standing. However, if a borrower misses a loan payment after forbearance ends, their loan will become past due.

Student loan borrowers who are in delinquency for more than 90 days will be reported to the credit bureaus as delinquent. This will result in late fees and a negative credit score impact, which can make it harder to obtain favorable terms when borrowing credit cards, mortgages and auto loans. Having poor credit can also make it difficult to rent an apartment, get homeowners insurance and sign up for utilities.

After a prolonged period of nonpayment, typically 270 days after the due date, borrowers may be moved from delinquency to default. The consequences of defaulting on federal student loan debt are more serious and can include:

- Loan acceleration. This is when the entire unpaid student loan balance and any unpaid interest become immediately due.

- Loss of benefits. Defaulted student loan borrowers can no longer apply for deferment, forbearance or income-driven repayment plans.

- Damaged credit. Being in default comes with a more significant negative credit impact than delinquency. It may take years for defaulted borrowers to establish good credit.

- Treasury offset. The servicer may withhold a borrower's tax refunds and federal benefit payments and use them toward defaulted loan repayment.

- Court proceedings. Loan servicers may take defaulted borrowers to court, which can result in court costs, collection fees, attorney fees and even wage garnishment.

HOW LONG DO NEGATIVE ITEMS STAY ON YOUR CREDIT REPORT?

The Federal Reserve Bank of New York has estimated that many federal student borrowers may be at risk of delinquency or default when payments resume. If you're worried that you won't be able to afford your monthly payments in September, you might consider refinancing to reduce your loan payments.

Keep in mind that refinancing your federal debt into a private loan would make you ineligible for certain protections like COVID-19 administrative forbearance, income-driven repayment, deferment plans and federal student loan forgiveness programs like Public Service Loan Forgiveness (PSLF). You can visit Credible to learn more about student loan refinancing so you can decide if this debt repayment strategy is right for your financial situation.

BIDEN ADMINISTRATION RECONSIDERING STANCE ON FEDERAL STUDENT LOANS IN BANKRUPTCY

How to prepare for student loan repayment in September

While borrowers with federal student loans will be placed back in good standing when forbearance ends, they still risk becoming delinquent if they can't resume monthly payments. Below are a few strategies to financially prepare for federal student loan repayment.

Reach out to your student loan servicer

During the forbearance period, millions of borrowers have had their student loans transferred to a new servicer. The Biden administration has required student loan servicers to reach out to borrowers via email — so if you haven't received any communications, get in touch with your new servicer right away.

Your student loan servicer can give you more information about your payment due date, monthly payment amount, current interest rate and remaining loan balance. You may also need to re-enroll in automatic payments if your loan servicer has changed.

DEBT COLLECTORS CAN NOW CONTACT YOU THROUGH TEXT, EMAIL AND EVEN SOCIAL MEDIA

Enroll in an income-driven repayment plan (IDR)

Federal Student Aid (FSA) offers four types of IDR plans that allow federal borrowers to limit their monthly student loan payment to between 10% and 20% of their discretionary income:

- Revised Pay As You Earn Repayment Plan (REPAYE Plan)

- Pay As You Earn Repayment Plan (PAYE Plan)

- Income-Based Repayment Plan (IBR Plan)

- Income-Contingent Repayment Plan (ICR Plan)

After a repayment period of 20 or 25 years, borrowers enrolled in an IDR plan will have the remaining balance of their student loan debt discharged.

WHAT TO KNOW ABOUT STUDENT LOAN CONSOLIDATION

Refinance to a private student loan with better terms

Student loan refinancing is when you pay off the balance of one or multiple student loans by opening a new private loan with more favorable repayment terms. Borrowers who refinance to a lower rate may be able to reduce their monthly payments, pay off debt faster and save money on interest charges over time.

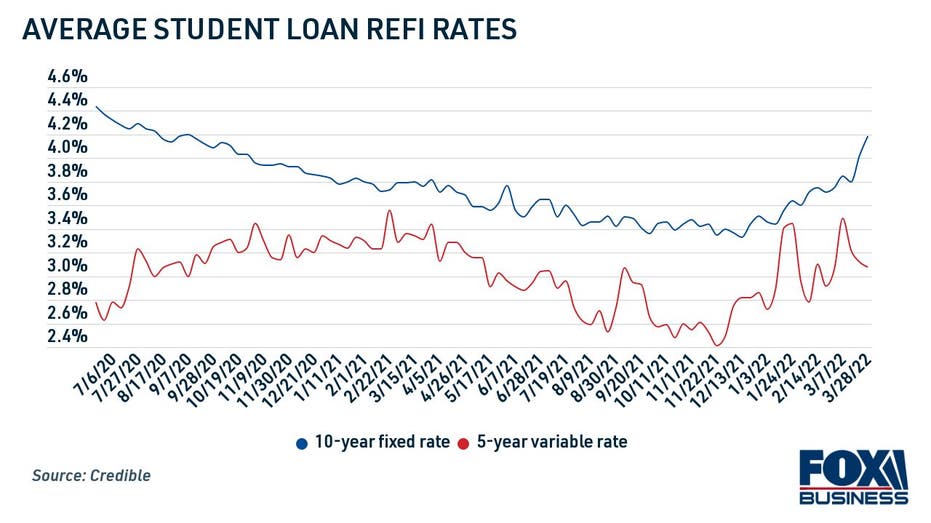

While the Federal Reserve's recent economic policy changes have caused interest rates to rise on fixed-rate refinancing loans, Credible data shows, rates for variable-rate loans have been trending down in recent weeks.

Unlike with federal loans, student loan refinancing lenders determine a borrower's interest rate based on their credit history and debt-to-income ratio (DTI). Applicants with very good credit will be eligible for the most competitive rates available, those with bad credit may need to enlist the help of a creditworthy cosigner in order to qualify.

You can browse current student loan refinance rates in the table below. You can also use Credible's student loan calculator to estimate your new monthly payment, so you can decide if refinancing is the right repayment plan for you.

WHAT ARE THE FEDERAL DIRECT LOAN LIMITS FOR THE 2021-22 SCHOOL YEAR?

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.