Student loan refinancing can potentially save borrowers $5K while fixed rates are low

You can estimate your savings using a student loan refinancing calculator

Refinancing through a private lender can grant you better terms, including a new interest rate. (iStock)

Student loan debt is a financial burden that weighs heavily on millions of American borrowers. For some, it may be possible to alleviate that strain by refinancing while interest rates are still near all-time lows.

Student loan refinancing is when you take out a new loan with better terms to repay your current loan. It may be possible to pay off your student loans faster, reduce your monthly payments and save money over time by refinancing to a lower interest rate.

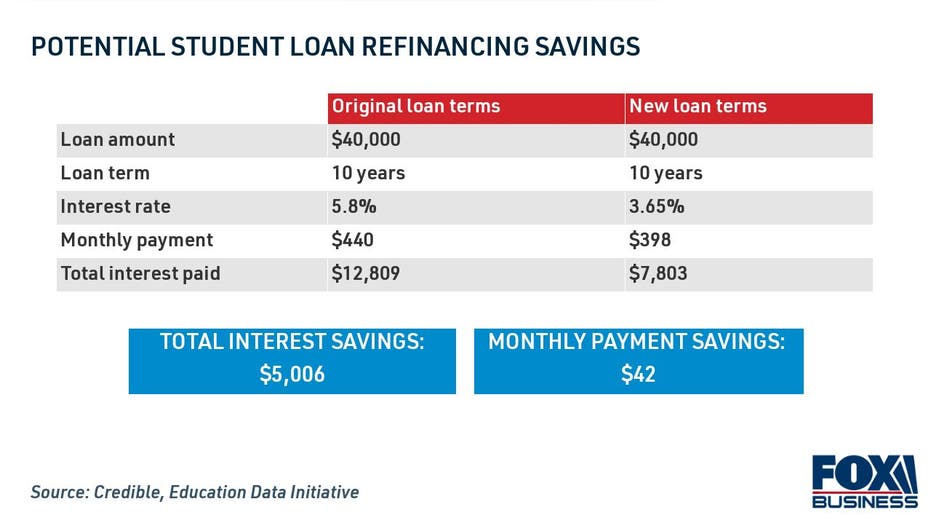

The average student loan interest rate among all existing borrowers is 5.8%, according to the Education Data Initiative. By comparison, the average rate on a 10-year, fixed-rate student loan was 3.65% for well-qualified borrowers who refinanced during the week of Jan. 24, 2022, Credible data shows.

With current student loan rates, some borrowers may be able to save more than $5,000 in total interest charges by refinancing. Keep reading to learn more about how to calculate your potential savings, and visit Credible to compare student loan refinancing rates for free.

HERE'S WHY VARIABLE-RATE STUDENT LOAN REFINANCING MAY BE A SMART MOVE

Student loan refinancing can save some borrowers $5K

Student loan refinance rates are currently much more favorable than what most borrowers are currently paying. Since private student loan lenders are prohibited from charging refinancing fees and prepayment penalties, your interest rate is the total borrowing cost you can expect to pay.

Assuming a student loan balance of $40,000, borrowers stand to save more than $5,000 in total interest payments by refinancing to a private student loan at the interest rates above. They can also reduce their monthly student loan payments by $42.

That being said, student loan refinancing isn't right for everyone. Refinancing your federal loans into a private loan makes you ineligible for select protections, such as unemployment deferment, COVID-19 emergency forbearance, income-driven repayment plans (IDR) and federal student loan forgiveness programs like Public Service Loan Forgiveness (PSLF).

If you have private student loan debt that doesn't qualify for the benefits above — or if you don't plan on utilizing these federal protections — then it may be worthwhile to consolidate your student loans while interest rates are near record lows. You can use Credible's student loan refinance calculator to determine your potential savings and determine if this debt repayment option is right for your circumstances.

12 LENDERS TO CONSIDER FOR STUDENT LOAN CONSOLIDATION

Borrowers with good credit can save even more

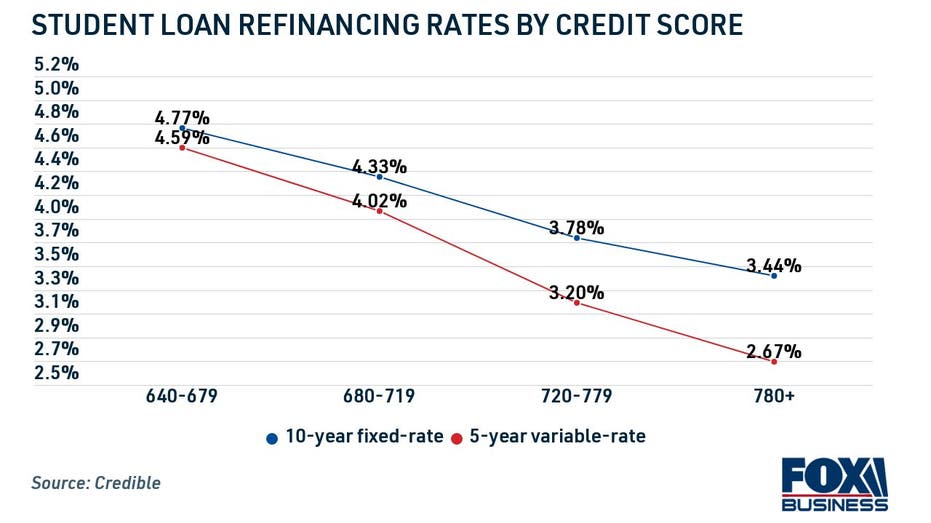

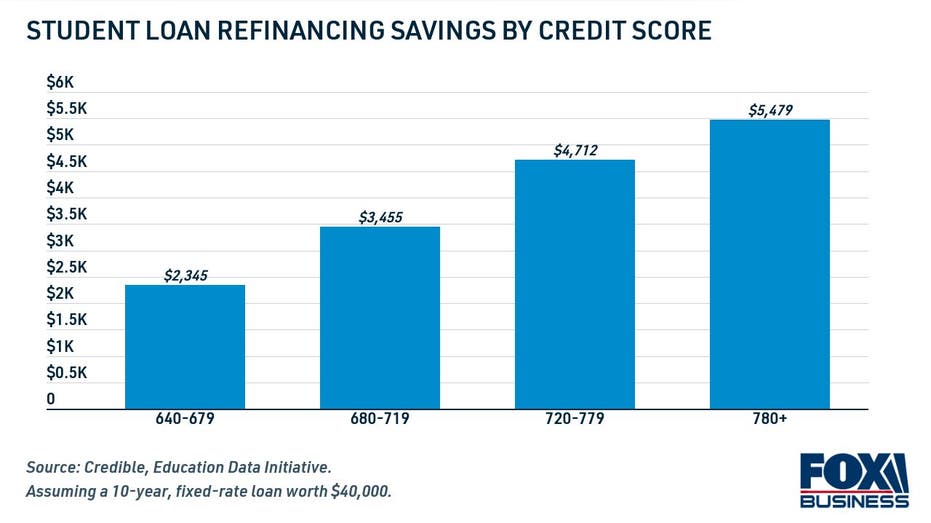

Since student loan refinancing rates vary depending on a borrower's credit score, those with excellent credit stand to save the most money by refinancing. On the other hand, borrowers with fair credit will see higher interest rates, which translates to less opportunity for savings over time.

Well-qualified borrowers with credit scores of 780 or above qualified for an average rate of 3.44%, which translates to nearly $5,500 in total savings over the life of the loan. Even borrowers with fair credit scores between 640 and 679, who saw average fixed rates of 4.77%, still have the potential to save nearly $2,500 in total interest charges.

To qualify for the lowest rates possible and maximize your potential savings, you might consider refinancing your student loans with a cosigner who has excellent credit. A creditworthy cosigner can be a trusted friend or relative who agrees to take on equal responsibility for repaying the loan in order to help you meet a lender's eligibility requirements.

However, refinancing student loans with a cosigner does come with its risks. If you fail to repay your student loan debt, then your cosigner's credit score will also take a hit. Plus, a lender may sue both parties to recuperate the costs of the loan if you go into default.

You can learn more about student loan refinancing by getting in touch with a knowledgeable loan officer at Credible. That way, you can decide if refinancing is the student loan repayment plan for your financial situation.

HERE'S WHO HAS QUALIFIED FOR STUDENT LOAN FORGIVENESS UNDER BIDEN

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.