What is mortgage recasting and why should you do it?

If you want to lower your monthly mortgage payment without refinancing, a mortgage recast might be a good option.

A mortgage recast can help you lower your monthly payment without changing your loan term or interest rate. Find out how it works. (Shutterstock)

Receiving a financial windfall might inspire thoughts of all the fun things you could do with the additional cash. However, a wise use of the money might include an extra payment toward the principal on your home loan. This is referred to as a mortgage recast. Once you make the extra payment, your lender will reamortize (recalculate) your mortgage based on the new, lower principal balance.

While the lump-sum payment won’t affect the term or interest rate of your existing mortgage, it could help you pay off the loan balance sooner. Or, if your loan servicer offers mortgage recasting, it could allow you to decrease your monthly loan payment.

Credible lets you compare mortgage refinance rates from various lenders in minutes.

- What is a mortgage recast?

- How mortgage recasting works

- Should you recast or refinance?

- Qualifying for a mortgage recast

- Benefits of recasting your mortgage

- Drawbacks of recasting your mortgage

- Is a mortgage recast right for you?

What is a mortgage recast?

Mortgage recasting is when your loan servicer recalculates your monthly mortgage payment after you make a large payment toward the principal of your existing home loan. Before making your payment, you have to specifically request and get permission to recast. Otherwise, your monthly payments won’t go down — although your large payment will still reduce your principal.

Recasting should result in a lower monthly payment and reduce how much interest you pay in the long run. The process is simpler and less expensive than refinancing, and your loan servicer won’t need to look at your income, credit score, or debt-to-income ratio.

Not all loan servicers offer mortgage recasting, however. Those that do will create a new amortization schedule after applying your large payment to the balance of your outstanding home loan. Your new monthly payment will be based on the lower loan balance. Your interest rate and payoff date won’t change.

Before recasting your mortgage:

- Check with your mortgage servicer to see if it offers recasting. Not all servicers do, and few advertise it.

- Ask if your loan type is eligible to be recast. Not all loan types qualify. For example, government loans, like FHA loans or VA loans, can’t be recast.

- Decide how much money to put toward your principal. Minimums can apply and are typically $5,000 or more.

- Find out if your servicer charges a mortgage recasting fee. Some servicers don’t charge for a mortgage recast, while others do.

- Keep making your loan payments. If you don’t, you might incur a late payment fee and a negative mark on your credit report. You might also become ineligible for a recast.

Your loan servicer should do the following in response:

- Let you know whether it offers mortgage recasting.

- Check your loan type for eligibility.

- Let you know the minimum lump sum it will accept.

- Inform you of any mortgage recasting fees.

- Let you know when the recasting process is complete.

WHAT IS CASH-OUT REFINANCING AND HOW DOES IT WORK?

How mortgage recasting works

Mortgage recasting is a relatively simple concept to understand. Here’s an example of how it works:

Let’s say, 15 years ago, you borrowed $200,000 on a 30-year mortgage with a fixed interest rate of 4%. Now, you have a remaining principal balance of about $129,000 and 15 years left on your loan term. Your monthly payment is about $955.

With a lump-sum payment of $10,000, your principal drops to $110,000. Recasting that amount over 15 years would drop your monthly payments to approximately $880.

The payment difference of about $75 per month for 15 years (180 months) totals $13,500. Subtracting the original $10,000 lump-sum payment, you'll save $3,500 in interest over the life of the loan by recasting.

How long does mortgage recasting take?

If you’re considering a mortgage recast, be aware that it may take several weeks to complete the process. It’s important to keep making your regular payment each month during that time. If you aren’t current on your loan payments, you could become ineligible for the mortgage recast.

How many times can you recast a mortgage?

Some loan servicers allow you to recast a mortgage as many times as you’d like, but others limit the frequency. You may also have to pay a recast fee each time.

HOW OFTEN CAN YOU REFINANCE YOUR HOME?

Should you recast or refinance?

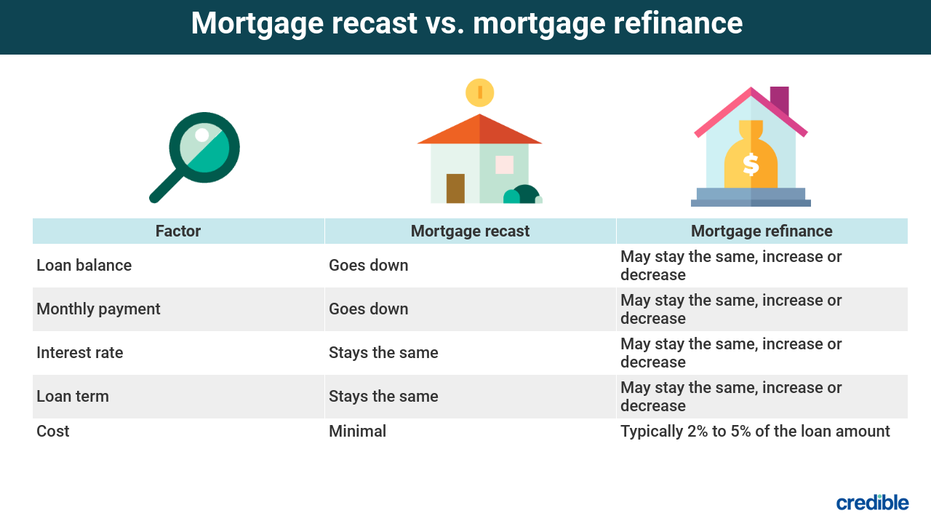

Consider these differences when deciding whether refinancing or recasting might be right for you:

- Mortgage recasting might be a better choice if you’d like to keep the same interest rate and loan term of your existing mortgage, and you have additional money to invest in your home in exchange for a lower monthly payment. It also costs much less than a mortgage refinance.

- Mortgage refinancing may be the right option when you’d like to replace your existing loan with a new one. It could allow you to secure a lower interest rate and change your loan term. You could even do a cash-in refinance to reduce your loan principal. But you’ll need to pay closing costs, which can equal 2% to 5% of the loan amount.

Compare mortgage refinance rates on Credible and see if you qualify for a mortgage refinance right now.

Recasting vs. loan modification

A loan modification is another alternative to mortgage recasting and can be advantageous in certain circumstances:

- Mortgage recasting allows you to make a large payment against the principal of your loan resulting in reduced monthly payments. The interest rate and loan term don’t change. If you’re considering a recast, you’re probably in good financial shape.

- Loan modification can help if you’re behind on mortgage payments or in danger of foreclosure. Your loan servicer may extend your loan term, lower the interest rate, or defer principal until you sell, refinance, or reach the end of your loan term to help you stay in your home if you’ve experienced a serious financial hardship and aren’t eligible to refinance.

Qualifying for a mortgage recast

Not all loan servicers will recast a mortgage, but if yours will, here’s what it may take to qualify:

- A conventional loan — You may not be able to recast an FHA, USDA, or VA loan.

- A qualifying lump-sum payment — Check with your loan servicer to make sure your payment meets its criteria. Many require a minimum amount of money for a recast.

- An existing home loan that’s in good standing — If you’ve recently made late payments, you may not qualify.

- A minimum of two consecutive timely payments at your current payment rate — Your loan servicer may not allow you to recast a loan you just closed on.

15 OF THE BEST MORTGAGE REFINANCE COMPANIES

Benefits of recasting your mortgage

If you recast your mortgage, these are some of the benefits:

- Lower monthly mortgage payments — Recasting your mortgage should result in a smaller loan balance with lower monthly payments.

- Interest savings — A smaller loan balance means less interest to pay on your loan.

- Same loan term — Recasting a mortgage doesn’t lengthen the term of your loan. And you can still pay your mortgage off early if you want to.

- Minimal fees — The fees you’ll pay to recast a mortgage are usually much lower than if you were to refinance — perhaps a few hundred dollars, depending on the loan servicer.

- No appraisal or credit check needed — With no appraisal or credit check needed, it’s often easier to recast a mortgage than to refinance one, especially if your home’s value has decreased or your credit score has gone down.

Drawbacks of recasting your mortgage

Of course, recasting a mortgage can also have drawbacks:

- Money tied up in your home — Using a windfall to reduce your mortgage principal means you won’t have that money available for other needs. Should you need money for an emergency, you’ll have less available.

- Unchanged interest rate — It’s possible you could save more money by refinancing your mortgage rather than recasting it.

- Same loan term — Making a lump-sum payment without recasting, or simply making an extra payment each month, could help you pay the loan off faster.

- Small reduction in payments — A substantial lump sum may only slightly reduce your monthly payments.

- Processing time — It may take several weeks to complete a mortgage recast. During that time, you must continue to make your regular payments to keep your mortgage in good standing.

Is a mortgage recast right for you?

Under the right circumstances, recasting your mortgage might make sense. If you have extra funds available and the interest rate on your existing home mortgage is low, it could be helpful to recast your mortgage to get a lower monthly payment and avoid the expense of refinancing.

Another situation where a recast might make sense is if you’ve purchased a new home with a mortgage before selling your old home. Once your old home sells, you might want to use the funds to pay down your new mortgage and recalculate your monthly payments, if your loan servicer allows it.

Still, there are times when other options might be more beneficial, such as refinancing your mortgage when interest rates drop.

WHEN IS THE RIGHT TIME TO REFINANCE MY MORTGAGE?

While Credible can’t help you recast your mortgage, you can compare prequalified rates on a refinance loan from multiple lenders. That information could help you decide whether recasting, refinancing, or staying the course with your existing mortgage is the right decision for you.