Biden vs. Trump: Where do the candidates stand on Social Security?

Here's where the two candidates stand on Social Security benefits

Social Security provides a vital financial lifeline for tens of millions of Americans, and many more expect to rely on their monthly Social Security benefits when they retire.

With the program facing financial challenges, Social Security has become a key issue in the 2020 presidential campaign.

Both President Donald Trump and former Vice President Joe Biden have stated their support of Social Security, but the two candidates have very different ideas about what to do with the program.

MCCONNELL OPENS DOOR TO EXTENDING $600 UNEMPLOYMENT BOOST

In particular, Biden's overall plan includes some provisions that would boost Social Security benefits in many cases, but it would come at the cost of additional taxes.

Meanwhile, Trump hasn't taken Social Security head-on as an issue in 2020, but some of what he's done and proposed as president points to what he likely wants to do with the program.

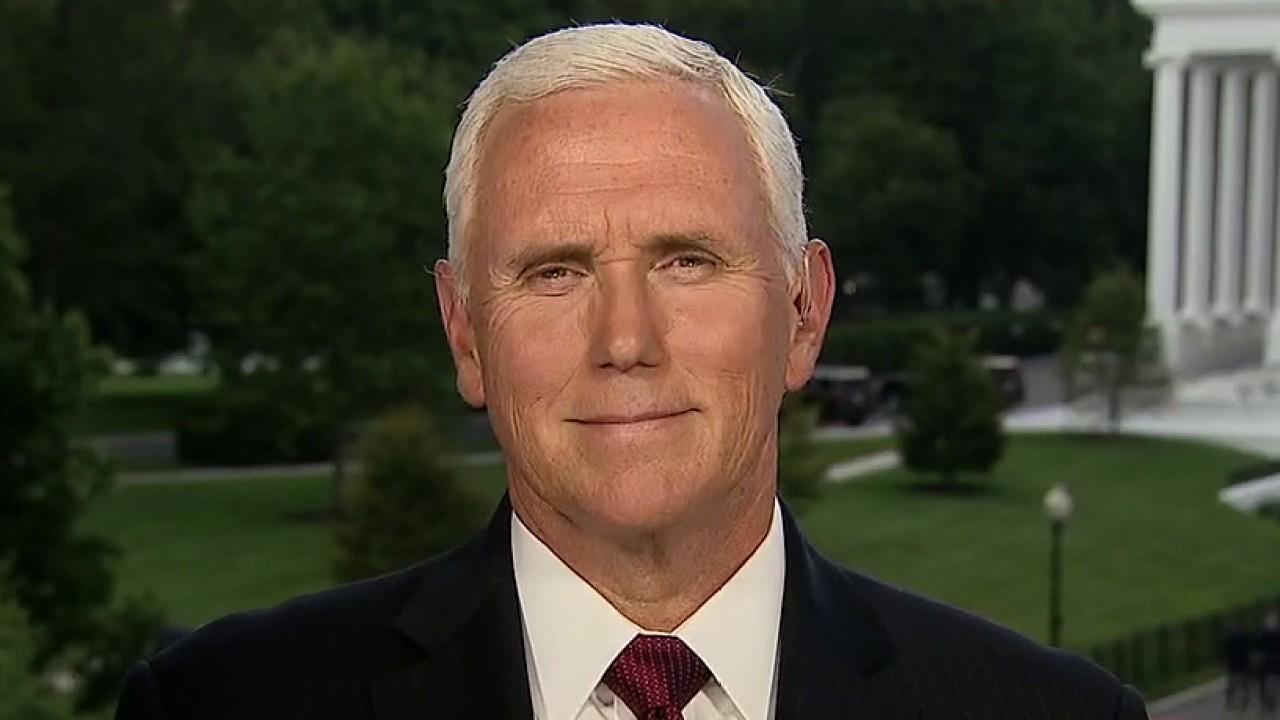

President Donald Trump smiles as he is about to sign four executive orders during a news conference at the Trump National Golf Club in Bedminster, N.J., Saturday, Aug. 8, 2020. (AP Photo/Susan Walsh)

Trump's Social Security platform: Filling in the gaps

For the most part, President Trump hasn't offered a specific platform about how he intends to handle Social Security and its financial challenges. As of now, his campaign website doesn't include issue briefs about Social Security.

However, actions speak louder than words, and Trump's moves from the Oval Office have drawn notice.

WASHINGTON IMPASSE ON CORONAVIRUS RELIEF THREATENS US ECONOMY

White House budget proposals have repeatedly aimed to reduce Social Security expenditures, citing "inefficiencies" in the program that could yield cost savings if addressed. One particularly controversial proposal earlier this year involves adding a disability review to the Social Security disability insurance program.

The new rule would have benefit recipients provide additional information supporting their ongoing claims for benefits on a biennial basis. Opponents have suggested the rule would result in millions of Americans losing their benefits despite being entitled to receive them.

In addition, Trump has repeatedly called for payroll tax cuts in response to the COVID-19 crisis. However, he hasn't been as vocal about ensuring that the general budget would reimburse the Social Security Trust Funds for the loss of revenue from a payroll tax holiday. Without that backstop, Social Security would find itself in financial straits even sooner.

FILE - In this June 25, 2020, file photo Democratic presidential candidate, former Vice President Joe Biden pauses while speaking during an event in Lancaster, Pa. Biden and his leading supporters are stepping up warnings to Democrats to avoid becomi

Biden's Social Security platform: Higher benefits, higher taxes

Former Vice President Biden would take a different approach toward Social Security.

WHAT A TRUMP PAYROLL TAX DEFERRAL WOULD MEAN FOR YOUR WALLET

Rather than addressing funding shortfalls by looking to reduce benefits, Biden would expand Social Security and impose significant taxes in order to pay for those additional benefits.

Americans pay Social Security payroll taxes on their first $137,700 in wages for 2020. However, higher-income taxpayers stop paying additional payroll taxes once their income goes above that threshold. That's because additional benefits no longer accrue above those income thresholds either.

The Biden plan would reimpose the 12.4% payroll tax funding Social Security on incomes above a certain level, with similar proposals having suggested $250,000 as a reasonable threshold. Opponents argue that the move would fundamentally change Social Security's purpose, turning what had been a retirement income generator into a wealth redistribution vehicle.

With this extra money, Biden would look to shore up Social Security benefits. In addition to dealing with the sustainability of current benefit payments, the tax boost would grant extra benefits to those who've been retired for 20 years or longer.

NEARLY HALF OF US JOBS LOST TO CORONAVIRUS COULD BE GONE PERMANENTLY, POLL FINDS

It would guarantee higher minimum benefits for low-income workers, and extend higher payments to surviving spouses after the death of their spouse.

Biden would also eliminate some provisions that reduce Social Security benefits for those families with a history of government earnings that weren't subject to payroll taxation.

A line in the sand

The differences in the stances that Trump and Biden have taken on Social Security are as wide as the divisions between their two parties.

With so much discord, most people with opinions about Social Security should find it easy to pick a favorite candidate.

Unfortunately, the huge gulf between the two positions also shows how unlikely it is that lawmakers on Capitol Hill will be able to craft legislation that will actually make it through Congress to arrive on the president's desk -- no matter who that president might be.

GET FOX BUSINESS ON THE GO BY CLICKING HERE