Wonderful Worlds (That Never Existed)

"Nostalgia is a seductive liar," George Ball once said.

The easiest way to rationalize today's problems is to recall a time when they didn't exist. It gives the impression that our frustrations are temporary and fixable, rather than an ongoing reality of life.

But a lot of the "good old days" we look back on never actually happened. Here are three worlds we nostalgically remember that only occurred in our heads.

1. A time when most workers had a pension

The median retirement account balance for workers age 55-64 is $76,381, according to Vanguard. This is perhaps a third of what a typical couple will need for medical expenses alone during retirement.

The first response to something this serious is indignation. The second is nostalgia. "People haven't gotten worse at preparing. Workers used to have pensions," a commenter on a retirement forum recently said. One article remembers a time when pensions were "universally accepted and expected." Another says sharply, "Twenty-five years ago, everyone had a pension."

Well, no.

Pension coverage peaked in 1979, when 38% of private workers participated in a defined-benefit plan, according to the Employee Benefits Retirement Institute. Which is to say, 62% did not.

Compare that to 401(k) participation today: "Nearly 80 percent of full-time workers have access to employer-sponsored retirement plans, and more than 80 percent of these workers participate in a plan," writes the American Benefits Council. The percentage of all workers (full and part-time) participating in some form of retirement plan has been pretty stable over the last 40 years, at around 45%.

There was a time when pensions were standard at large, deep-pocketed companies. But there was never a time when large, deep-pocketed companies employed most Americans. A big share of employment comes from the Eddie's Car Repairs and Sue's Bakeries of the world, which were as unlikely to offer a pension 40 years ago as they are today.

And even as pension coverage has plunged, what remains are so much more generous that total pension income has gone up over time. Nevin Adams of EBRI writes: "Pension income ... represented 20 percent of all the income received by those 65 and older in 2010. In 1975, it was less than 15 percent."

It can't be repeated enough that the only reason we have a retirement crisis today is because, for the first time in history, everyone expects to retire rather than working until they die.

2. A time when the government lived within its means

A vocal group of voters and politicians are pushing for a balanced-budget amendment that prevents the federal government from running a deficit. It's based on logic that "American families live within their means. It's time for the American government to follow suit" as one supporter put it.

This idea that deficits must be stopped harkens back to a time when the government spent less than it took in.

Which is a world that has never existed.

The government has run a deficit in 84 of the last 115 years, according to the Office of Management and Budget. That's 73% of the time. The few periods of surplus came during times we now call bubbles: the 1920s and the late 1990s. The only non-bubble period in which the government ran multiple surpluses were the three years after World War II, as military spending fell but war-time taxes remained. It was accompanied by a deep recession. Government debt has increased in 49 of the last 50 years. I suspect the next 50 years will be similar.

People intuitively think the government must have lived within its means in the past because no person could spend more than they make forever and remain viable. But governments aren't people. Governments have indefinite lifespans, with no final date when all debt needs to be repaid. Rather than paying debt off, old debt is replaced with new debt, and life carries on as normal. As long as debt-to-GDP has some level of stability over time, a government can run a deficit every year, forever. Our government will spend $600 billion more than it takes in from taxes this year. But with a growing $18 trillion economy, the debt-to-GDP ratio shoulddecline.In that context, a half-trillion-dollar deficit is rather conservative.

A government does have to live within its means. It's just hard to wrap your head around the idea of a perpetual deficit being well within its means.

3. A time when the market was calmer and more orderly

There more than 34,000 references to "today's volatile market" on Google.

You hear it all the time. An example from this week: "Intoday's volatile marketenvironment, managing risk and building the 'right' portfolio is harder than ever."

"Today's volatile market" implies that yesterday's market was less volatile -- which is a testable assumption. And it's mostly wrong.

Yesterday's market was, by and large, just as volatile as today's.

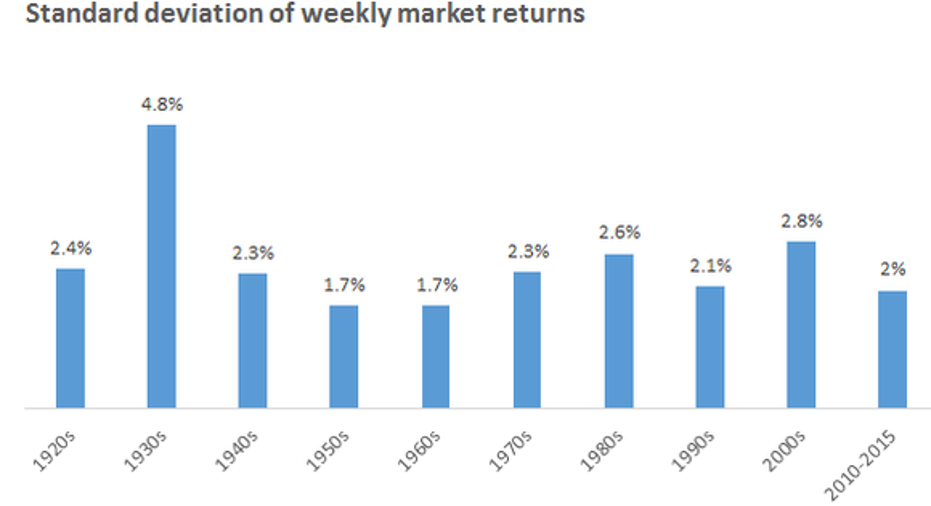

I recently calculatedmarket volatility for daily, weekly, monthly, and annual market periods over the last 90 years. At every length of time, recently volatility is nearly equal, if not below, its long-term average.

Take weekly volatility of the S&P 500. Recent years are hardly an outlier:

And monthly volatility:

And annual:

I suspect people think today's market must be more volatile than the past because it's been really volatile lately, and they assume no society in its right mind could put up with chaos for ninety years straight.

But we have. The idea that markets used to be a calmer and more orderly is a world that has never existed.

Falsely imagining today as more volatile than yesterday also explains why so many investors are prone to sell, fidget, rotate, and worry when the market dips. Not understanding the historical context of volatility make declines appear abnormal, like something is broke and needs to be avoided. In reality, volatility is exactly why markets have generated good returns over time. If markets were calm, there would be no risk. And if there's no risk, there's no reason for returns above bonds. Why would there be? It has always been that way, and it always will be.

Same as it ever was.

For more:

Why does pessimism sound so smart?

Hard truths for investors to wrap their heads around

How the investing industry could change

The article Wonderful Worlds (That Never Existed) originally appeared on Fool.com.

Contact Morgan Housel at mhousel@fool.com. The Motley Fool has a disclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.