Why U.S. Stocks Shrugged Off Result of Italy's Referendum

Unlike knee-jerk global market reactions following the 2016 Brexit vote in the U.K. and Donald Trump’s election to the White House in the U.S., a ‘no’ vote from the Italian people Sunday night on a constitutional reform referendum failed to kill Wall Street’s upward momentum.

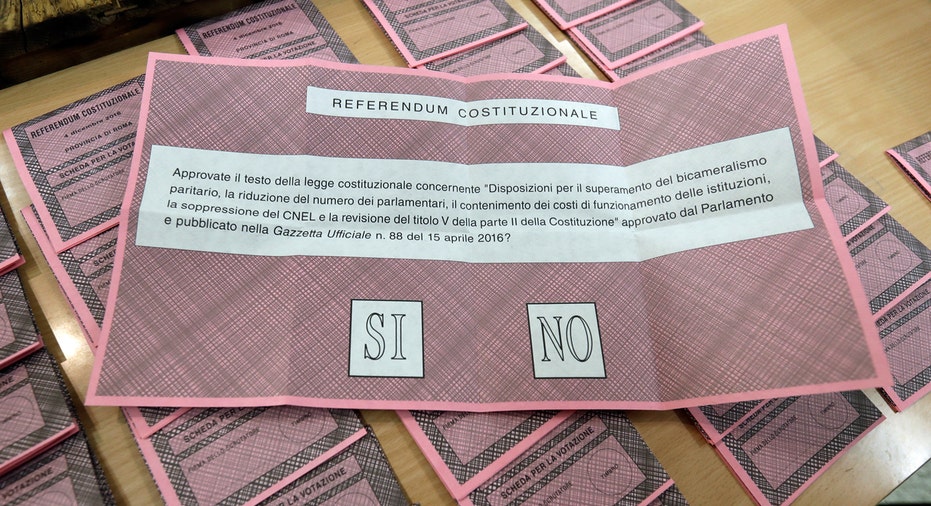

The proposed changes, introduced by Italian Prime Minister Matteo Renzi, would have reduced the amount of power the nation’s Senate wields and tipped power to the Chamber of Deputies, ending the government’s bicameral system, which includes two legislative bodies of equal power and influence. While both chambers voted for the changes earlier this year, the effort did not receive the required two-thirds majority, pushing the measure to a public vote. Following defeat Sunday, Renzi was set to resign from his post Monday.

As investors worried about the vote’s outcome on the nation’s embattled banking sector, the results sent Italy’s FTSE MIB equity index down as much as 2.1%, though it rebounded to end the session down about 0.4%. However, other global equity indexes including France’s CAC 40, Germany’s DAX, and the broader Euro Stoxx 50 ended Monday’s session in the green, while U.S. equities continued their trend higher as the Dow Jones Industrial Average notched a fresh record high.

The reason for the muted response to what some view as another victory for populism, is simply that markets had priced in the outcome before Sunday’s vote, explained David Lafferty, chief market strategist at Natixis Global Asset Management. Polls had the “no” vote leading by about 2% to 3% heading into the referendum, so the outcome didn’t arrive with nearly the shock value that both the Brexit and Trump victories carried after polls predicted opposite results.

“The structures supporting the EU and eurozone system are not collapsing, but today’s vote is another discernable crack in the foundation,” Lafferty said. “Italy’s growth has been failing, its deficits growing, and the solvency of its banks is in question…predicting European political paths is surely a fool’s game, but Renzi’s defeat is another headwind to keeping ‘the European experiment’ together.”

The Italian vote suddenly threw a brighter spotlight on the European Central Bank’s monetary policy meeting in Frankfurt on Thursday, and the debate around whether it should unleash more stimulus measures to its 1.7 trillion euro asset-buying program. In October, the central bank left policy unchanged as ECB President Mario Draghi left the door open to a more accommodative policy stance, remarking that higher inflation could rest on “very substantial” accommodation.

If anything, the ECB is likely to maintain its policy at this week’s meeting as opposed to tightening prematurely as markets had anticipated two months ago, said Peter Donisanu, global research analyst at Wells Fargo Investment Institute.

“While financial markets experienced a Taper Tantrum in October on expectations that the ECB would conclude its asset purchase program in March 2017, a “no” vote on Sunday could leave the door open for the Governing Council to invoke the ‘beyond, if necessary’ clause of its program – and potentially extend its purchase program if bond market conditions tighten,” he explained.