Why Smith & Wesson, RetailMeNot, and Stillwater Mining Slumped Today

Monday started the week on a sour note on Wall Street, as investors apparently focused on the uncertainties surrounding the U.S. Presidential election. With just over six weeks left in the campaign, tonight's Presidential candidate debate could play a pivotal role in who takes over the White House in early 2017, and investors are trying to get a handle on the likely implications for their investments. Losses in the major market benchmarks were generally among 1%, with the SPDR S&P 500 (NYSEMKT: SPY) suffering a 0.8% decline and the iShares MSCI Emerging Markets (NYSEMKT: EEM) falling a more precipitous 1.5%. In addition to the general uncertainty, some individual companies faced particular challenges of their own. Among the worst performers were Smith & Wesson (NASDAQ: SWHC), RetailMeNot (NASDAQ: SALE), and Stillwater Mining (NYSE: SWC).

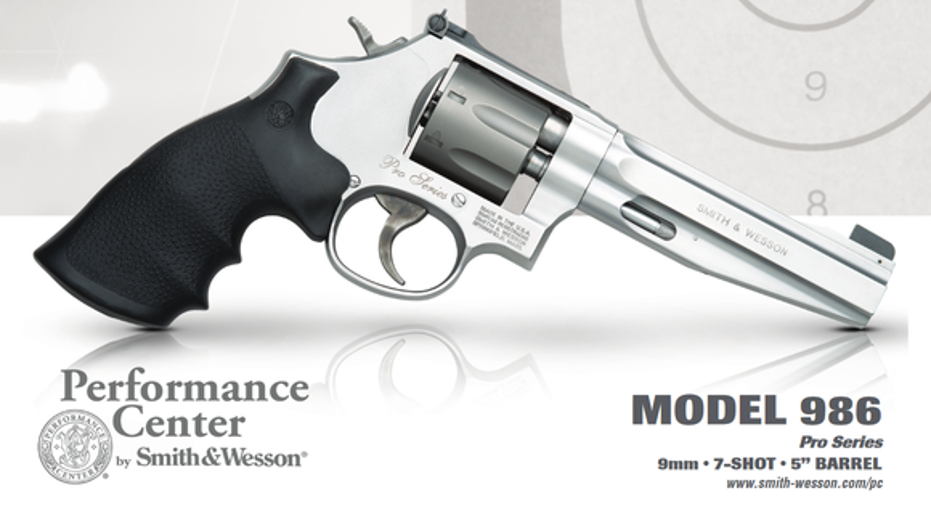

Image source: Smith & Wesson.

Smith & Wesson misses the target

Smith & Wesson dropped 7% after the gunmaker failed to win a contract from the U.S. Army for a weapon to replace the M9 semi-automatic pistol. The company worked with defense contract General Dynamics to propose an alternative to the 9-millimeter pistol, which critics say isn't as reliable or powerful as some military users would like to see. According to estimates, the opportunity from a win would have been somewhere between $300 million and $600 million for Smith & Wesson's share, but the gunmaker said that it had never build in expectations for a win into its overall financial projections. The news is unfortunate for Smith & Wesson but shouldn't make a major impact in its overall performance going forward.

RetailMeNot gets a bad grade

RetailMeNot fell more than 20% in the wake of receiving a rare sell rating from analysts at Stifel. The analyst company put a $9 per share price target on the stock, which is within 1% of where the shares closed the day on Monday. Concerns about possible declines in traffic for the online coupon provider's website could leave RetailMeNot unable to make good on its potential for long-term growth. That's in stark contrast to the positive outlook that many investors had following RetailMeNot's second-quarter financial report in early August, which sent the stock to its best levels in more than a year. It could take surprisingly strong results from RetailMeNot this quarter to reverse the tide and get the online website back on track.

Stillwater Mining looks less precious

Finally, Stillwater Mining declined by 7%. The company is directly exposed to platinum and palladium prices, both of which fell today. Platinum was down about 1.5% to $1,038 per ounce, while palladium dropped 1% to $692 per ounce. Both metals have seen better performance in recent months, and that had pushed Stillwater stock earlier in the summer to its best levels since 2014. With Stillwater's efforts to diversify into the gold mining business having largely proven to be inconsequential, the ups and downs of the platinum-group metals will continue to be the primary factor pushing Stillwater shares in either direction for the foreseeable future.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Dan Caplinger has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.