Why Line Corp. Stock Dipped Today

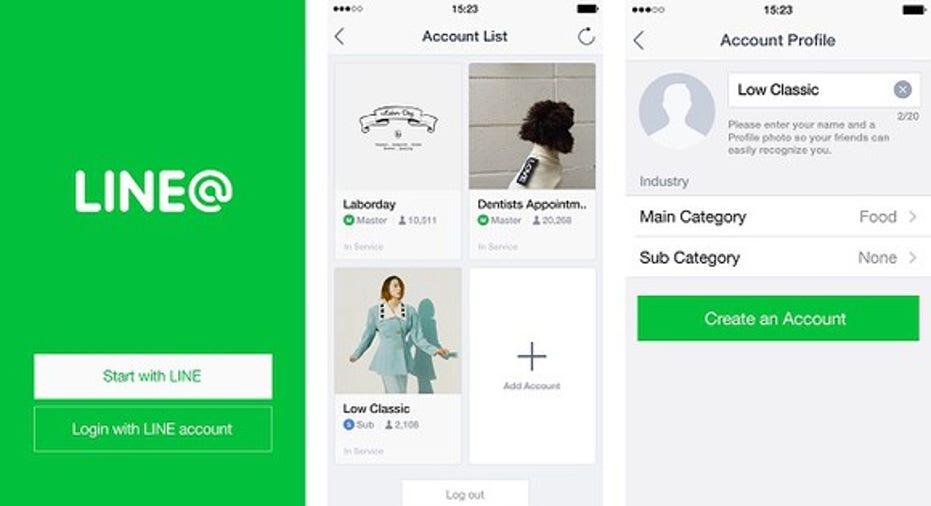

Image source: Line Corp.

What happened

Line Corp.(NYSE: LN), the messaging service that has been public for less than a year, saw its stock drop 11% today, after the company reported record profit but missed analyst expectations.

So what

For the full year 2016, Line posted revenue of $1.24 billion, up 17% year over year, and profit of $66.5 million, compared with a net loss of$66.8 million for the prior year.Still, even though a young tech company posting such a huge earnings swing so soon after going public is impressive, it was still less than analysts were expecting due to higher operating costs-- which is why the stock dropped today.

Now what

Line Corp. just went public last July and was the biggest U.S. IPO of the year, raising over $1 billion. The company had impressed investors with its customer growth, but Line's total number of users only grew 1% for the year. The reason for the slow growth seems to be because the company is focusing on better operations in its home country and near by, before expanding more aggressively globally.

Line's most important segment is advertising, which makes up about 40% of the company's revenue. Line has continued to develop new kinds of services, such as the recently introduced mobile payments and media streaming, but so far advertising still seems be the way forward in terms of profit growth -- something that an increased global footprint could really help.

10 stocks we like better than Abercrombie and Fitch When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Abercrombie and Fitch wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of January 4, 2017

Seth McNew has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.