Why Efficiency Is Now King in Rooftop Solar Energy

Image source: Getty Images.

When SolarCity (NASDAQ: SCTY) and Tesla Motors (NASDAQ: TSLA) announce their new product on Oct. 28, I would be shocked if it didn't have something to do with the efficiency of their residential rooftop solar panels. SolarCity's Silevo plant, currently under construction in Buffalo, New York, is less about SolarCity internally sourcing panels than it is about increasing the efficiency of each solar panel. Silevo's website says it can produce solar modules with efficiency of up to 18.4%, which is on the higher end of today's commodity modules. And SolarCity's pilot scale tests have produced panels that exceed 21% efficiency. Better efficiency is key today in solar.

What makes the residential solar market unique, and sets it apart from very large-scale solar projects in particular, is that it's more sensitive to differences in solar-panel efficiency. The costs associated with installing solar on a roof are mostly outside of the panel itself, so each bit of energy a panel can squeeze out will make the project more cost-effective. And customers are starting to realize the value of efficiency in rooftop solar, something investors need to keep an eye on.

The shift in solar preferences

One of the strange takeaways from the first half of the year in solar was that SolarCity posted relatively disappointing residential solar numbers and guidance, while SunPower (NASDAQ: SPWR) was becoming more bullish on the segment. The reason can be partly attributed to efficiency.

SunPower has long been the efficiency leader in solar, but it's been up against rapidly falling prices for commodity solar panels, which are what SolarCity installs. As panel prices fell, SunPower had to either lower its own costs or increase efficiency to keep up -- or do both.

But the decline in panel costs won't make a big difference forever, at least not in the residential solar market. That's because as solar panel prices fall, a larger percentage of the cost of a residential solar system is in sales, labor, inverters, wiring, racking, and other costs. These costs don't change just because a panel is less expensive, but they can be offset by higher efficiency. Here's a look at how this works.

Let's start with SolarCity's stated costs per watt in the second quarter (in the second column below). Assuming the average solar system is 6 kW and modules cost $0.50 per watt, the overall cost of the system is $18,300. (This includes the cost of the module, as well as the installation, sales, and general and administrative costs -- outlined in the third column.) A 20% reduction in module costs, to $0.40 per watt -- a decline we've seen in the last few months -- lowers the total cost by about $600, to $2.95 per watt.

Calculations by the author based on SolarCity's Q2 2016 earnings report.

Reducing the module cost, which accounts for 16% of the system's cost, by 20% has a small effect on the overall system cost. But when efficiency increases, the impact is far greater because it can be spread over the entire system.

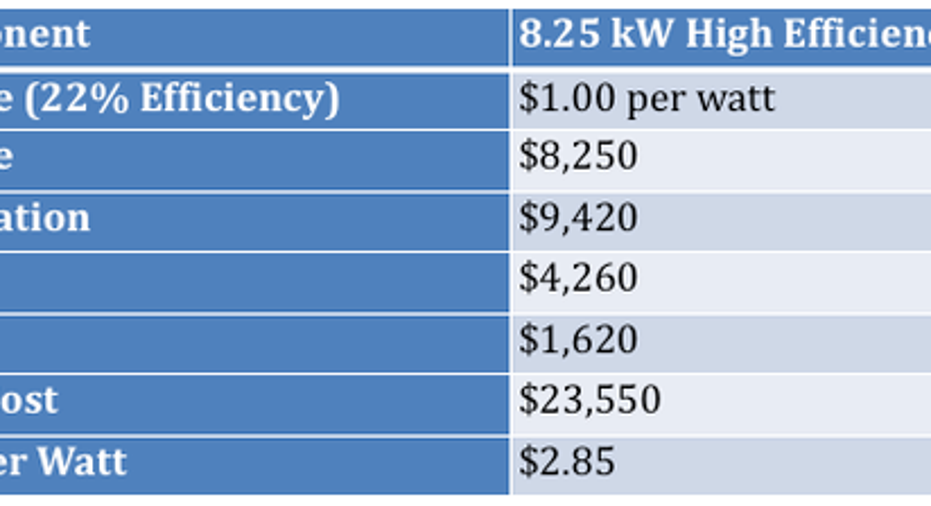

Below, I've calculated the system cost for a solar system with 22% efficient panels, in line with SunPower's X-Series product, and scaled the system's size to have the same physical footprint but provide a much-larger amount of energy, 8.25 kW. On the same roof, a more efficient system would have significantly more output.

The non-panel costs weren't changed, because most wouldn't be significantly different when only efficiency changes. But I did double the cost per watt of a more efficient module to show how a more efficient panel can cost more and still lead to lower-cost energy.

Calculations by the author based on SolarCity's Q2 2016 earnings report.

You can see that despite having double the cost per watt of the solar panel, the higher-efficiency system actually costs lower overall on a per-watt basis. This is because efficiency leverages all of the non-panel costs on a rooftop system.

Financial results show that efficiency matters

It's this efficiency dynamic that's driving companies like SolarCity to seek differentiation with more efficient panels. And Silevo is central to that strategy.

It's worth noting that while commodity solar manufacturers were struggling with margins in the mid-teens in early 2016, SunPower's residential segment generated gross margin of 22%. That's the strongest of its segments right now and is driven by the efficiency advantages in residential solar.

Efficiency provides a competitive advantage and a shield from competition

You can see above that efficiency gives a competitive advantage and can shield a company like SunPower, and potentially SolarCity, from competing on costs alone. If you have a differentiated product, cost is only a small part of the equation.

When SolarCity and Tesla Motors announce a new product later this month, keep an eye on whether it makes solar systems more efficient, not just less costly. Because the residential solar industry is starting to prove that cost isn't the only component that will drive adoption, differentiation with efficiency will be key to generating value for investors in the long term.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Travis Hoium owns shares of SunPower. The Motley Fool owns shares of and recommends SolarCity and Tesla Motors. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.