The 5 health crises of the 21st century that have roiled markets

The coronavirus is just the latest health scare to stir up fears in global markets

Just as U.S. stock markets prepared to close, the State Department issued a travel advisory that asked Americans to "reconsider travel to China due to novel coronavirus first identified in Wuhan, China." This came on the heels of a volatile session over fears of a potential pandemic -- marking the fifth time in the last two decades that U.S. markets have been roiled by scenarios that were once Hollywood storylines for movies like "Outbreak" and "Contagion."

Following the outbreak of the deadly flu-like illness in Wuhan, China, and its subsequent spread to other countries including the United States, Australia, Canada and the United Kingdom, some investors are pointing to ripple effects. All three major indexes were down Monday as news of the virus, which has claimed the lives of more 80 people and sickened over 2,000 worldwide, gained more traction.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50135.87 | +20.20 | +0.04% |

| SP500 | S&P 500 | 6964.82 | +32.52 | +0.47% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23238.66991 | +207.46 | +0.90% |

The Dow Jones Industrial Average was down over 453 points, or 1.57 percent, at market close Monday. The S&P 500 slid 1.57 percent and the Nasdaq Composite dropped 1.89 percent.

The stock market, however, generally tends to overreact after these types of incidents unless it’s something that becomes prolonged, Jeffrey A. Hirsch, chief executive officer of Hirsch Holding Inc. and editor in chief of Stock Trader’s Almanac, recently told FOX Business.

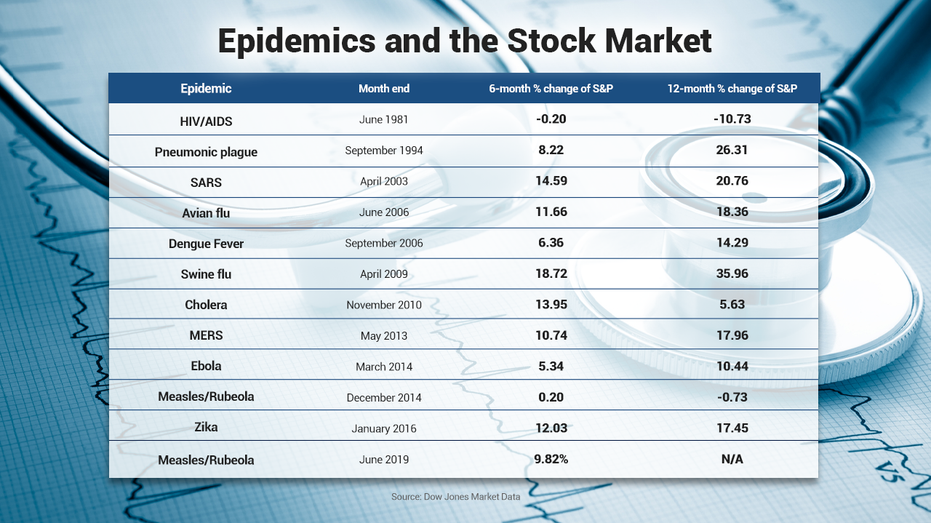

Here's how the markets have reacted to similar incidents that have occurred in the 21st century, in part tracked by the Dow Jones Market Data Group.

SARS

When the "severe acute respiratory syndrome" or SARS virus, hit in 2003, it killed nearly 800 people and sickened 8,000. Markets briefly halted at the onset of the deadly pneumonia. A 2004 analysis determined that the SARS crisis cost the world economy a total of about $40 billion, but stocks ultimately ticked back up. The Dow Jones Market Data Group, citing historical market data, showed the S&P posted a gain of 14.59 percent following the first report of SARS. After 12 months as fear died down the benchmark was up 20.76 percent.

Avian flu virus

The arrival in 2016 saw the destruction of more than 200 million birds worldwide that resulting in economic losses of over $20 billion. Still, the S&P rose more almost 12 percent six months after first reports and the market gained 18.36 percent in the 12-months after initial reports of the outbreak.

Another smaller outbreak occurred in seven years hitting China and one iconic American brand hard. Its KFC outlets were virtually empty following nine deaths with sales dropping as much as 20 percent at one point

MERS

More recently, when the "Middle East Respiratory Syndrome" or MERS virus, claimed the lives of more than 850 people and sickened 2,500 starting in May of 2013, the S&P shot up more than 10 percent in the first six months and nearly 18 percent after a full year. However, the market tremored again in 2015 when South Korea was hit with an outbreak. Some 200 people were infected with the illness and 38 died. The country ordered the closing of 3,000 schools and the South Korean tourism industry was severely damaged when more than 100,000 trips to the country were canceled.

Ebola

In 2014, the outbreak of the Ebola virus in West Africa was the “largest, most severe and most complex Ebola epidemic” in history, according to the World Health Organization. What made this outbreak more urgent in the USA than before while 28,000 people were infected, and 11,000 people died -- nine of the people who contracted the disease outside the US brought the disease to the U.S. mainland traveling as airline passengers or as medical evacuees. Of those nine, two died. In addition, two nurses contracted the disease but recovered.

As a result, many airline stocks were down double digits and The S&P 500 fell more than nine percent from its September 19 high to its October 15 low with Ebola hitting the U.S. in the middle of that period. After watching intently, the markets inched back up and after six months the S&P was up five percent; a year later up 10 percent.

Zika

In 2016, when the mosquito-borne Zika virus hit tourism and travel-related stocks were hit hard. Most of the major cruise lines such as Carnival and Norweigian sail from South Flordia and in 2016 more than 1,000 cases were reported and 226 were contracted locally prompting many vacation cancelations and airlines, cruise ships and hotel altering cancellation policies.

The leisure companies eventually rebounded as Zika fears died down as seasons changed and mosquitos were chased by the cold. The S&P was up 12 percent six months after the crisis first struck and increased 17 percent after a year.

CORONAVIRUS WHACKS DOW BUT LIFTS DISEASE FIGHTING STOCKS

While “epidemics and pandemics do have market consequences and raise risk” and “external shocks can derail economic trends and abruptly alter market sentiment,” David Kotok, chairman and chief information officer at Cumberland Advisors research note last week, the severity and length of the outbreak will ultimately determine the market’s reaction.

CONFLICTS HAVEN'T HURT MARKETS BEFORE AND IRAN CRISIS NO DIFFERENT

Chinese officials have placed a quarantine on Wuhan, impacting the movement of more than 56 million people, as they grapple with how to contain the virus from spreading.

CLICK HERE TO GET FOX BUSINESS ON THE GO

Analysts have historically preached caution: “We cannot draw any fixed conclusions about the effects of pandemics,” a 2006 report from Fidelity Investments read. “Equity markets react unpredictably to the unknown; nevertheless, such events should not be examined in isolation, but viewed in common with other prevailing market conditions.”