Trump eyes crackdown of NYSE-listed Chinese companies

White House wants to penalize Beijing for its handling of the COVID-19 pandemic

The Trump administration is considering whether to impose stricter requirements on Chinese companies listing on U.S. stock exchanges in order to penalize Beijing for its handling of the COVID-19 pandemic.

Chinese companies currently aren’t required to follow U.S. accounting standards, which has led to fraudulent corporations using America’s capital markets and caused investor losses.

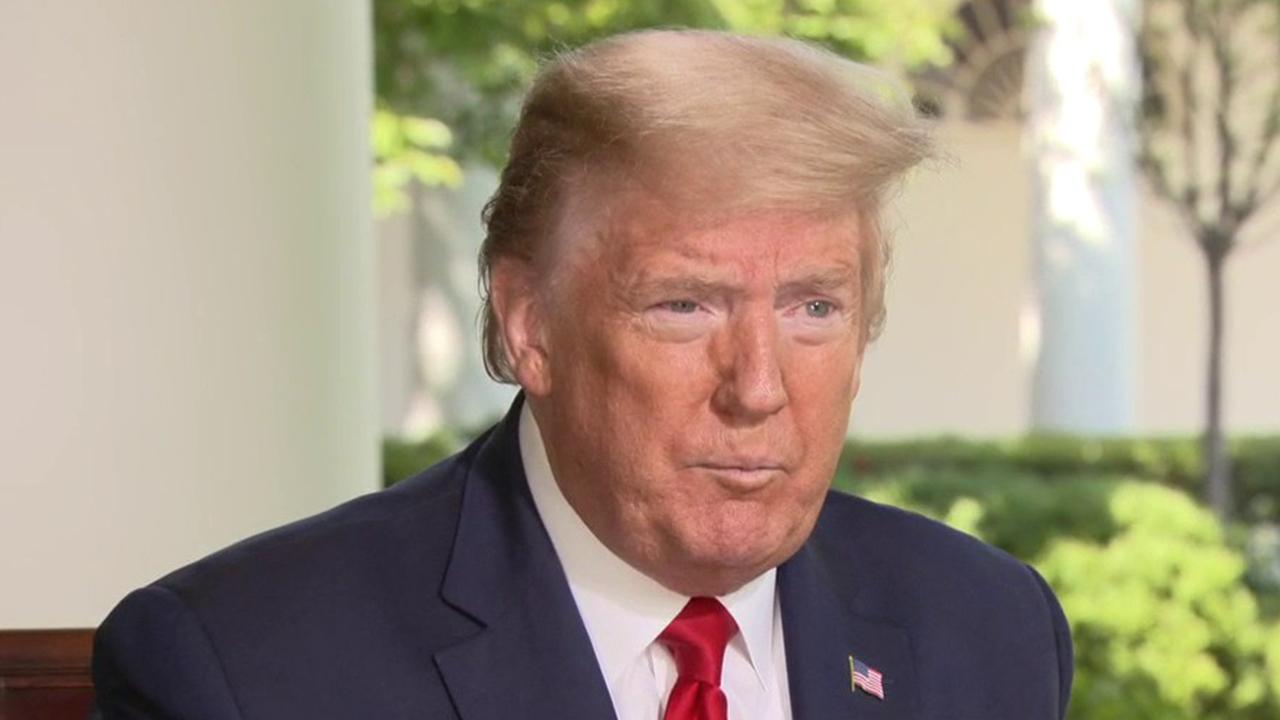

President Trump told FOX Business’ Maria Bartiromo that his administration is looking "very strongly” at requiring Chinese companies to follow U.S. accounting standards. If it does, he noted, the companies will say, “’OK, we’ll move to London or we’ll go to Hong Kong.’”

There were 156 Chinese companies listed on U.S. Exchanges worth $1.2 trillion as of February 25, 2019, according to the U.S.-China Economic and Security Review Commission.

The White House on Monday ordered the Federal Retirement Thrift Investment Board, a government retirement fund, to divest $4 billion of equity stakes in Chinese companies. The administration and Congress are looking into additional measures against Beijing as well.

CLICK HERE TO READ MORE ON FOX BUSINESS

Among the ideas are giving Americans the right to sue China for the damage COVID-19 has caused to the economy and human life, imposing sanctions and travel bans and restricting loans to Chinese businesses by U.S. firms.

“I’m very disappointed in China,” Trump said.