This High-Yield Dividend Growth Stock Remains a Standout in the Utility Industry

Image source: Brookfield Infrastructure Partners.

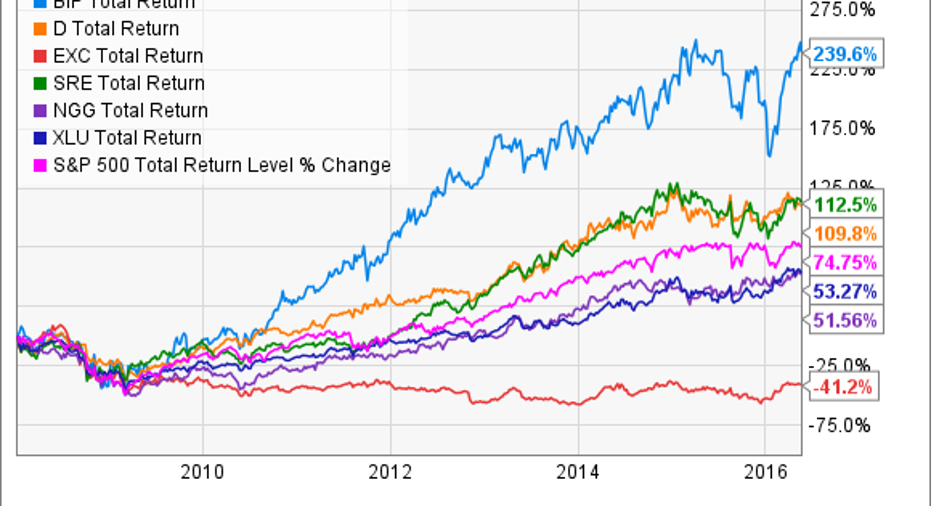

Finding under-the-radar dividend stocks is a passion of mine , because it can often result in phenomenal market- and industry-crushing total returns. Take, for example, Brookfield Infrastructure Partners , which has proved itself a standout among larger utilities such as Dominion Resources , Exelon Corp., Sempra Energy , and National Grid since its 2008 IPO.

BIP Total Return Price data by YCharts

Of course, past performance is no guarantee of future greatness, but there are three specific reasons for considering Brookfield Infrastructure Partners.

Solid earnings in face of global slowdown

| Metric | Q1 2016 | Q1 2015 | YoY Change |

|---|---|---|---|

| Revenue | $584 million | $537 million | 8.8% |

| Adjusted EBITDA | $322 million | $280 million | 15% |

| Adjusted funds from operations (AFFO) | $209 million | $163 million | 28.2% |

| Quarterly distribution | $0.57 | $0.53 | 7.5% |

| AFFO payout ratio | 62.8% | 79.1% | (20.6%) |

Sources: earnings presentations.

Brookfield Infrastructure had a very good year, despite concerns over slowing global economic growth. Better yet, while some of the growth was a result of newly acquired assets, Brookfield Infrastructure Partners saw strong organic growth as well as the first trickles of dividends from its recent Asiano purchase, which includes over 30 Australian ports that should provide large AFFO growth in its transportation segment.

Also note that while the distribution rose by 7.5%, comfortably within management's long-term target of 5% to 9% annually, the AFFO payout ratio declined substantially. That means Brookfield's 5.3% yield remains highly sustainable. It also means Brookfield Infrastructure is retaining substantial amounts of cash flow with which to fund its organic capital expenditure program, which grew almost 35% from $1.3 billion to $1.7 billion during Q1 of 2016.

Superior payout profile to its bigger utility peers

| Utility | Yield | Q1 2016 Payout Ratio | 7-Year Annual Dividend Growth Rate |

|---|---|---|---|

| Brookfield Infrastructure Partners | 5.3% | 62.8% | 13.7% |

| Dominion Resources | 4% | 79.5% | 7.7% |

| Exelon Corp. | 3.7% | 167.1% | (6.8%) |

| National Grid | 3.2% | 75.5% | 5.6% |

| Sempra Energy | 2.9% | 59.5% | 11.1% |

Sources: earnings releases, Morningstar, Yahoo! Finance.

Dividend investors need to look at the complete package when selecting long-term investments. That means checking not just the yield, but also the payout ratio and long-term payout growth potential.

On all fronts, Brookfield's profile stands head and shoulders above its larger utility peers. If management can deliver on its long-term distribution growth guidance, it should meet management's goal of generating total annual investor returns of 12% to 15%, far superior to the market's historic 9.1% return since 1871.

But as tempting as that guidance may be, don't ever simply take management's guidance -- of that of any analyst -- without a grain of salt. Ask yourself, "Does this company have a realistic path forward to the kind of growth that can make those kind of returns likely?"

When it comes to Brookfield Infrastructure Partners, that growth runway is not just in place -- it's also capable of providing potentially decades of superb, sustainable income growth and strong capital growth gains.

Superb asset portfolio with plenty of growth potential

Image source: Brookfield Infrastructure Partners.

Brookfield's cash flow comes from 38 assets located on five continents, providing it with broad diversification its peers can't match, as well as rich opportunities to invest in some of the globe's fastest-growing economies. The growth ability of traditional utilities, such as Exelon and Dominion Resources, is far more constrained by the fact that they operate in far more mature energy markets.

In addition, Brookfield Infrastructure Partners has a growth ace up its sleeve, in the form of Brookfield Asset Management , one of the oldest and most established asset managers on the planet. Brookfield Asset Management provides both management and a rich source of highly profitable, needle-moving acquisitions. It puts together consortiums to acquire multibillion-dollar global assets that are selling at low valuations and then includes Brookfield Infrastructure Partners as a minority partner, thus allowing Brookfield, which still lacks the scale or capital resources to pull of such deals solo, to grow much more quickly than other utilities.

However, while Brookfield Infrastructure is still relatively small, those capital resources are growing. For example, its existing liquidity to invest in new deals or asset expansion was up 27% from last quarter, to over $3 billion.

Risks to be aware ofInvestors interested in Brookfield Infrastructure need to be aware of the risk that its larger utility peers don't share.

The same global diversification that gives this utility such strong growth potential also exposes it to short-term currency risk. While management has hedged 75% of cash flows over the next 18 to 24 months, should U.S. interest rates rise, the dollar may once more strengthen and result in weaker results in the coming quarters.

In addition, Brookfield is considerably smaller than its peers and this fact, coupled with its fate being tied at the hip with global trade volumes, makes for occasionally volatile share price movements.

Bottom line

Whether searching for high, sustainable yield or vibrant dividend growth, Brookfield Infrastructure Partners offers an alluring option that deserves to be in your diversified income portfolio.

The article This High-Yield Dividend Growth Stock Remains a Standout in the Utility Industry originally appeared on Fool.com.

Adam Galas has no position in any stocks mentioned. The Motley Fool recommends Brookfield Infrastructure Partners, Dominion Resources, and National Grid. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.