These 2 Stocks Just Raised Their Dividends

Bye-bye, Q2 earnings season. It was nice to know you. For many investors, it was particularly nice because a raft of dividend raises was declared (dividends are often announced within or concurrent to quarterly results).

IMAGE SOURCE: GETTY IMAGES.

So, now we're in the slog, a fairly inactive period as far as payout lifts are concerned. We saw very few hikes last week, and that's sure to repeat at least once before Q3 earnings season starts to heat up. Meanwhile, here's the promised pair of raisers from the last few days:

Altria

The tobacco industry might have its detractors, but it's a longtime favorite of income investors. It has a strong customer base, to put it mildly. It's also usually very profitable and tends to throw off a great deal of cash.

Case in point, Altria Group (NYSE: MO), which in one corporate form or another has been booking a tidy profit and paying out chunks of it to shareholders for a very long time. The upcoming quarterly will be a little chunkier than its predecessor, by 8% at $0.61 per share.

In this increasingly health-conscious world we live in, the cigarette business has become tougher for the companies involved in it. Despite that, Altria has done a fine job of boosting profitability lately -- its bottom line rose a sturdy 14% on a year-over-year basis in its most recently reported quarter, although revenue saw a 1% drop.

MO Free Cash Flow (Annual) data by YCharts.

The good performance has boosted annual operating and free cash flow, both of which have increased notably over the past few years. The most recent FCF figure was more than enough to cover Altria's payout. This is a successful company that loves its dividend, and I think it'll continue to raise it well into the future.

Altria's new distribution will be handed out on Oct. 11 to stockholders of record as of Sept. 15. At the current share price, it would yield 3.7%, well above the current 2.1% average of dividend-paying stocks on the S&P 500.

Aceto

Like Altria, pharmaceuticals and performance chemicals concernAceto (NASDAQ: ACET) has lifted its quarterly dividend by 8% -- its first raise since 2013. Going forward, the company will pay almost $0.07 per share.

Yet despite a fiscal 2016 that saw gains in revenue and profitability, the company'sQ4 had some worrying minus signs. The quarter's net sales fell by 8% (to $135 million), while bottom line saw a queasy drop of 50% to almost $14 million.

Aceto attributed the quarterly declines to increased competition in its generics business, Rising Pharmaceuticals. This is particularly impactful as the unit is part of the company's top division by revenue, Human Health.

According to the company, a burst of new product launches next year should boost sales and earnings in the mid-single-digit percentage range. The market, though, doesn't seem to agree as it traded Aceto stock down by over 21% after the news release hit the wire.

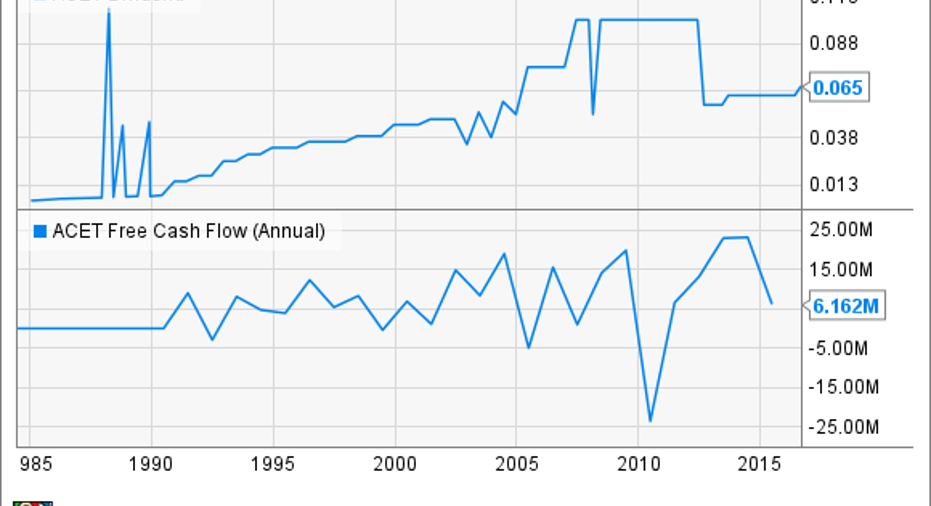

Meanwhile, over the years, the company's cash flow figure has been a real seesaw, with many peaks and valleys. Although the dividend has been more or less stabilized of late, it's also had its erratic, up-and-down trajectory at times.

ACET Dividend data by YCharts.

Considering all that, I'm not sure I'd depend on the company to maintain or grow the payout in the coming years.

Aceto's upcoming dividend will be dispensed on Sept. 20 to shareholders of record as of Sept. 9. At the stock's most recent closing price, the new amount would yield 1.3%.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Eric Volkman has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.