The Surprising Winner in Merck's Patent War With Gilead Sciences

Image source: Gilead Sciences.

Merck & Co.'s recently launched Zepatier is challenging Gilead Sciences' dominance in the hepatitis C marketplace, but an equally important challenge by Merck is occurring in California courts.

This week, a California District Court jury determined Gilead Sciences' blockbuster hep C drugs Sovaldi and Harvoni infringe on two Merck patents, and that decision could lead to billions of dollars in payments to Merck.

However, Merck isn't the only company that would come out ahead if the courts tell Gilead Sciences to fork over a truckload of cash. Ionis Pharmaceuticals would land a windfall, too. That's because Ionis Pharmaceuticals, formerly Isis Pharmaceuticals, co-owns the patents Gilead Sciences is said to have violated.

How much are we talking about?According to Ionis Pharmaceuticals, its deal with Merck means it will receive 20% of whatever is awarded to Merck by the court, minus whatever legal expenses were incurred by Merck during the lawsuit.

Ionis Pharmaceuticals is also entitled to 20% of any future royalties Gilead Sciences must pay on future sales of Sovaldi and Harvoni.

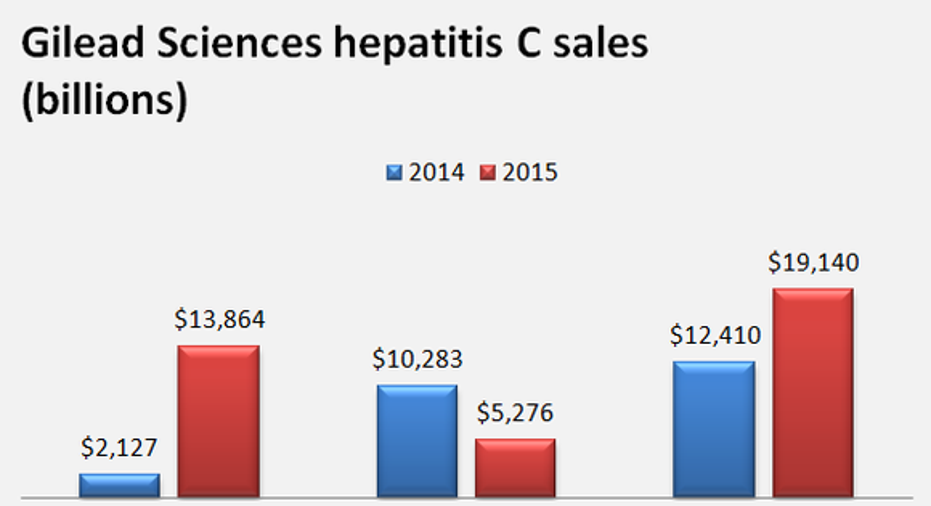

Since Sovaldi and Harvoni are multi-billion per year blockbusters, the amount of money that could be paid to Merck and Ionis Pharmaceuticals is substantial. Industry watchers estimate that royalties could amount to 10% of past and future sales.

Gilead Sciences brought in $12.4 billion in sales from its two hepatitis C drugs in 2014, and it hauled in another $19.1 billion in sales from them in 2015, so Gilead Sciences could end up paying Merck $3.16 billion for its sales so far. Legal fees in court cases like this can run into the millions of dollars, but even so, that still suggests Ionis Pharmaceuticals could end up getting a lump sum check for somewhere in the neighborhood of $600 million.

Importantly, Sovaldi and Harvoni's current sales pace suggests that Ionis Pharmaceuticals could also receive an ongoing royalty stream of about $380 million per year.

Moving the needleMultibillion-dollar payments to Merck would be great news for investors, but Merck's size means Gilead Sciences payments won't have nearly as big of an impact on it as they do on the much smaller Ionis Pharmaceuticals.

Despite researching therapies since the 1990s that exploit the body's gene messaging system, Ionis Pharmaceuticals' revenue still comes mostly from upfront licensing and clinical-stage milestone payments from drugmakers like Merck.

Image source: Ionis Pharmaceuticals.

Those upfront and milestone payments resulted in Ionis Pharmaceuticals reporting total revenue of $284 million last year and $203 million in 2014.

That's a solid amount of revenue, but Ionis Pharmaceuticals' research pipeline is packed with expensive mid- and late-stage studies that are causing expenses to soar and losses to mount. Last year, Ionis Pharmaceuticals spent $323 million on R&D, $37 million on general and administrative expenses, and lost a total of $88.3 million.

Since Gilead Sciences' royalty payments could conceivably more than cover Ionis Pharmaceuticls operating expenses, propelling the company into the black, this could be a game-changing win for the company's investors.

Looking aheadHowever, Gilead Sciences isn't going to just roll over and pay Merck royalties, and no one knows what the court may decide Gilead Sciences owes Merck and Ionis Pharmaceuticals.

Yes, there's a chance Gilead Sciences management settles with Merck, but a more likely scenario is for management to file an appeal in hopes of getting a different verdict.

Obviously, no one knows how all of this will shake out, but I think this week's news tilts the balance in Merck's favor, and if that's true, Ionis Pharmaceuticals shares are more attractive now than they were a week ago.

The article The Surprising Winner in Merck's Patent War With Gilead Sciences originally appeared on Fool.com.

Todd Campbell owns shares of Gilead Sciences. Todd owns E.B. Capital Markets, LLC. E.B. Capital's clients may have positions in the companies mentioned. The Motley Fool owns shares of and recommends Gilead Sciences and Ionis Pharmaceuticals. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.