The Sky's the Limit for Facebook Inc.'s Instagram

As recently as the middle of last year, investors were champing at the bit to know when Facebook would take the monetization wraps off its fast-growing Instagram site. With the early success of video ads on Facebook and its primary digital advertising competitor, Alphabet, photo-sharing Instagram seemed like a natural.

Instagram has since been "unleashed" and has hit the monetization ground running. Facebook CEO Mark Zuckerberg hasn't shared Instagram revenue specifics -- and that isn't likely to change when Q1 earnings are shared April 20 -- but early indications are that Instagram is quickly becoming everything investors hoped it would. In fact, based on some new data, it appears those pie-in-the-sky forecasts leading up to monetizing Instagram could prove conservative.

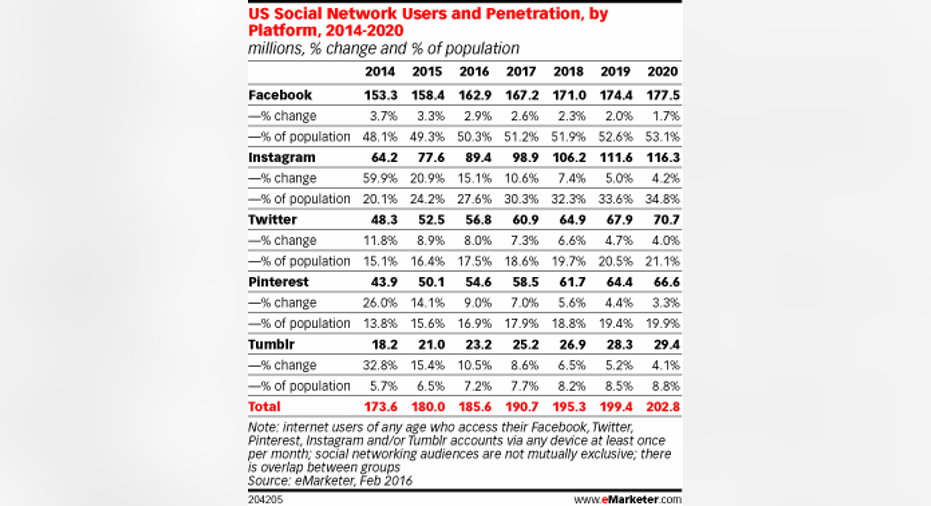

Source: eMarketer.

Just the factsThe world has gone mobile, and Zuckerberg's insistence on making Facebook mobile-ready has paid off handsomely. As investors saw last quarter, Facebook has hit the mobile jackpot. A whopping 1.44 billion of Facebook's total of 1.59 billion monthly active users (MAUs) last quarter were on-the-go, and "approximately 80%" of total ad revenue in Q4 was derived from mobile.

Nearly 1 billion "friends" access Facebook via their mobile device every day. Facebook has successfully managed its internal efforts to become mobile-ready, which has made the integration of Instagram -- which already enjoyed a strong following among users on the go -- a snap.

Just shy of 90 million folks in the U.S. will access Instagram at least monthly this year, according to estimates from eMarketer, 34.1% of which will use their mobile device. By next year, over half the expected 98.9 million U.S. Instagram MAUs in the states will share photos with friends and family on-the-go. By comparison, Twitter is expected to garner 56.8 million total U.S. monthly users in 2016.

Part of the disparity between Twitter's and Instagram's domestic success comes from sheer size. Instagram boasts over 400 million MAUs, despite its relatively late arrival on the social-media scene. That compares with Twitter's 305 million MAUs as of last quarter, a decline of 2 million users from the year-ago period. And there's a lot at stake for both mobile and desktop digital advertisers in the United States.

Does it matter?Globally, digital ad spend is expected to top $180 billion this year and surpass TV as the leading outlet for the world's marketers by the end of 2017. As the largest buyer of digital ads, the U.S. is prime territory, and Facebook's existing dominance stateside, combined with the rise of Instagram, will leave folks like Twitter in the dust.

Digital video ad spend alone will generate nearly $10 billion in the U.S. this year and climb to $14.77 billion by 2019. Online ads viewed on a desktop still account for the majority of video spots sold in the U.S., but the gap with mobile is narrowing in a hurry, and Instagram is poised to garner more than its fair share.

The rise of Instagram isn't a surprise: It was a matter of when, not if, it began adding appreciably to Facebook's top and bottom lines. One conservative estimate -- others are considerably higher -- suggests Instagram will generate $5.8 billion in annual revenue in four years. To put that into perspective, Twitter reported $2.2 billion in sales last year.

Social-media watchers are well aware of Twitter's MAU problems, but it's not just the tweet master getting left in Instagram's dust. Even upstarts including Pinterest and Tumblr can't match Instagram's growth rate, and given its ideal format for digital ads in general, and video spots in particular, it will be surprising if Instagram "only" adds $5.8 billion in revenue by 2020.

Thanks to Instagram's more than 200,000 advertising partners -- most of which also spend marketing dollars on Facebook -- video-friendly ad format and rapid MAU growth on both desktop and among the world's mobile population, Facebook is sitting on an absolute goldmine.

The article The Sky's the Limit for Facebook Inc.'s Instagram originally appeared on Fool.com.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Tim Brugger has no position in any stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (C shares), Facebook, and Twitter. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.