The First CAR-T Drugs Have Left the Gate

For all the talk about biotechs being nimble, it's a big pharma that looks like it'll be the first company to launch a chimeric antigen receptor T-cell (CAR-T) product.

Novartis (NYSE: NVS) announced last week that the Food and Drug Administration accepted its application to market tisagenlecleucel-T, which used to be called CTL019, in patients with B-cell acute lymphoblastic leukemia (ALL) who are relapsed and refractory to other therapies. The application was given a priority review, meaning an approval decision should be made within six months.

A few days later, Kite Pharma (NASDAQ: KITE) completed its application for axicabtagene ciloleucel, which previously went by the code name KTE-C19. The FDA could take the full two months it has to accept Kite's application, but since the biotech went with a rolling submission, which the FDA allows for promising new drugs, Kite's application could be accepted early, putting it less than two months behind Novartis.

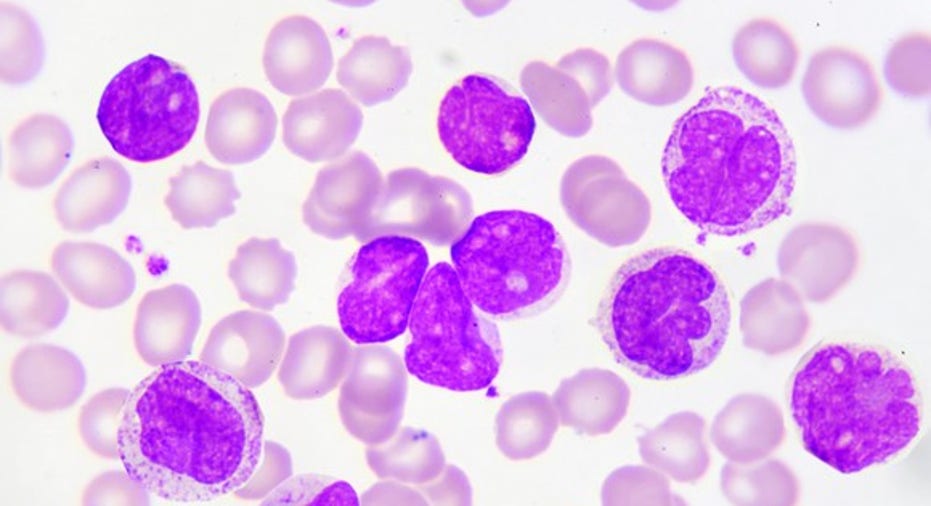

Image source: Getty Images.

Alphabet soup

CAR-T treatments take T cells out of a patient, genetically modify the cells so they're programmed to attack tumor cells expressing a specific protein, and then infuse them back into the patients to attack the cancerous cells. Both Novartis' and Kite Pharma's CAR-T therapies target cells expressing CD19 (a protein expressed on certain white blood cells and present in some types of blood cancer), but since Kite is asking for approval to treat patients with non-Hodgkin lymphoma (NHL), the two treatments won't compete directly.

At least not yet.

NHL is actually a category of lymphomas that includes diffuse large B-cell lymphoma (DLBCL), transformed follicular lymphoma (TFL), and primary mediastinal B-cell lymphoma (PMBCL). Novartis has also studied tisagenlecleucel-T in patients with DLBCL, but it hasn't released the data from that trial yet. The pharma plans to file an application to treat patients with DLBCL in the fourth quarter, setting up a potential head-to-head fight sometime next year.

Winner sets the price

Since CAR-T therapies are personalized treatments that have to be made individually for each patient, they're likely to be expensive to produce and therefore require a premium price. The first company to get a CAR-T therapy approved will set the price, which later companies may have to match unless they can justify a higher price with higher efficacy.

With prices that will probably exceed those of current cancer treatments, investors should expect some pushback from insurers. One way Novarits and Kite can get around the cost issue is by offering money-back guarantees. Kite's axicabtagene ciloleucel, for instance, brought about a complete remission in about half of the patients tested in clinical trials, so Kite may be able to get insurers to pay a premium price if they're only charged for patients who go into remission.

More to come

Kite's and Novartis' CAR-T therapies are just the tip of the iceberg for this new way to treat cancer.

Juno Therapeutics (NASDAQ: JUNO) isn't too far behind, although development of its lead CAR-T therapy, JCAR015, was recently halted due to issues with potential side effects. Fortunately, Juno Theraputics has a deep pipeline with nine product candidates in clinical trials.

bluebird bio's (NASDAQ: BLUE) bb2121 looks promising, but the biotech has reported only phase 1 data. Bluebird plans to present more data at the American Society of Clinical Oncology meeting in June.

Bellicum Pharmaceuticals(NASDAQ: BLCM) is developing a CAR-T therapy with an interesting twist, called GoCAR-T, which adds an activation switch that can control expansion and stimulation of the cells, potentially avoiding side effects. Bellicum's lead treatment using its GoCAR-T technology, BPX-601, is in phase 1 development.

Investors without the stomach for the roller-coaster ride that new therapies often end up on can get a piece of the action by buying Celgene (NASDAQ: CELG), which has a major deal with Juno Therapeutics and a smaller one with Bluebird.

10 stocks we like better than Kite PharmaWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Kite Pharma wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of April 3, 2017

Brian Orelli has no position in any stocks mentioned. The Motley Fool owns shares of and recommends bluebird bio and Celgene. The Motley Fool recommends Juno Therapeutics. The Motley Fool has a disclosure policy.