The Best-Case Scenario for Gilead Sciences, Inc.

Throw in the towel. Cry uncle. Give up. Gilead Sciences (NASDAQ: GILD) is toast. Really?

With revenue and earnings falling, the sentiment about Gilead is largely negative these days. However, the biotech's future might be brighter than some think. Here's a best-case scenario for Gilead.

Image source: Getty Images.

1. Hepatitis C franchise sales stabilize

Gilead Sciences surprised many observers with a dismal outlook for hepatitis C virus (HCV) drug sales in 2017. The company hasn't been able to answer an all-important question: When will HCV sales stabilize? I don't know the answer to that question, either.

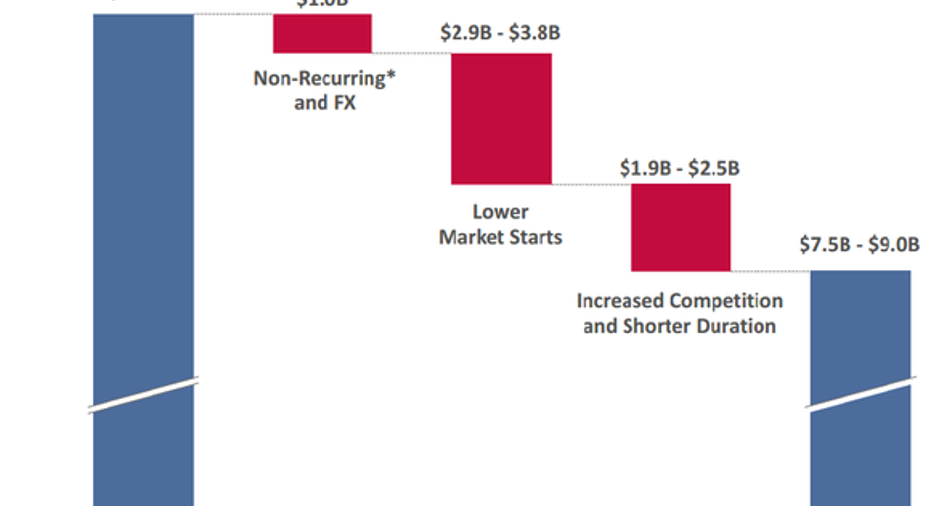

However, it's at least possible that we could see a bottoming out within the next couple of years.Here's how Gilead broke down its HCV sales guidance for 2017.

Image source: Gilead Sciences.

It's reasonable to conclude that Gilead won't see another reduction of up to $7.3 billion in 2018 like the company projects for this year. That would translate to total HCV sales of no more than $1.7 billion and as low as $200,000. I don't see that happening.

Let's suppose that Gilead will see annual HCVrevenue stabilize at $4 billion or so by 2019. If this is in the general ballpark of what actually happens, the company's revenue might fall another $3.5 billion to $5 billion per year. That's a big drop, but not insurmountable -- Gilead could make up that gap with other products.

2. HIV drug sales momentum grows

The most likely source for helping offset some of Gilead's HCV sales declines is its HIV franchise. Gilead has dubbed bictegravir as its future "Mount Everest." Wall Street projects the HIV drug could generate peak annual sales of between $5 billion and $6 billion.

Some think, however, that Gilead will have a hard time fending off rival drugs from Merck and GlaxoSmithKline'sViiv Healthcare. That could be the case, but Gilead CEO John Milligan believes that his company's approach has multiple advantages over the competition, resulting in a drug with a better safety profile and the ability to keep patients' resistance levels down.

We're looking at the best-case scenario, so let's assume Milligan is right. If so, Gilead appears likely to be able to return to solid growth for its HIV franchise with new products including bictegravir and Genvoya.

3. A few smart acquisitions are made

Even with an optimistic perspective, Gilead won't be able to achieve overall earnings growth with its HIV franchise alone. That's why acquisitions are a must for the company.

Incyte (NASDAQ: INCY) and Kite Pharma (NASDAQ: KITE) are two frequently mentioned potential buyout targets for Gilead. What if Gilead bought both of them? It's entirely possible, although it would require taking on additional debt.

The addition of Incyte would immediately add well over $1 billion in annual revenue. More important, though, is that Gilead would pick up Incyte's promising cancer drug epacadostat, which could become a multibillion-dollar winner if approved for all targeted indications.

An acquisition of Kite would bring experimental cancer drug KTE-C19 into Gilead's fold. Kite hopes to win regulatory approval for the drug in treating aggressive non-Hodgkin lymphoma later this year. Analysts think KTE-C19 could generate peak annual sales of up to $1.9 billion.

Gilead wouldn't have to stop with just Incyte and Kite. The biotech's cash flow should allow it to buy additional small biotechs if it wanted to.

4. The pipeline potential materializes

The late comedian Rodney Dangerfield's famous punchline was "I don't get no respect." That sentiment could also apply to Gilead's pipeline. However, there is a lot of potential for several of the biotech's pipeline candidates.

In particular, I like Gilead's nonalcoholic steatohepatitis (NASH) drugs. ASK1 inhibitor GS-4997, which reduces inflammation and tissue scarring in the liver, showed solid results in phase 2 studies. I also suspect thatACC inhibitor GS-0976, which prevents the formation of lipids in the liver, could be a bigger deal than some expect.

The NASH market could be enormous. Some have called it the "next hepatitis C." Gilead might not be the first to market in the indication, but don't count out the big biotech.

Adding it all up

If Gilead's HCV sales stabilize in the next few years, the bleeding on the top and bottom lines would finally end. If John Milligan's optimism about bictegravir proves correct, Gilead's HIV sales will grow, helping offset some of the HCV losses. A few strategic acquisitions, if Gilead chooses to go that route, would pad the company's revenue and earnings further. All of this should allow Gilead to be in pretty good shape when its pipeline begins to pay off, particularly its NASH drugs, in a few years.

Is this vision far-fetched? I don't think so. Although the road ahead might not turn out to be quite as smooth as laid out above, my prediction is that Gilead's reality will resemble this best-case scenario rather than the bleak future that some expect. If I'm even close to being right, Gilead's stock should perform very well in the years to come.

Find out why Gilead Sciences is one of the 10 best stocks to buy now

Motley Fool co-founders Tom and David Gardner have spent more than a decade beating the market. (In fact, the newsletter they run, Motley Fool Stock Advisor, has tripled the market!*)

Tom and David just revealed their ten top stock picks for investors to buy right now. Gilead Sciences is on the list -- but there are nine others you may be overlooking.

Click here to get access to the full list!

*Stock Advisor returns as of February 6, 2017

Keith Speights owns shares of Gilead Sciences. The Motley Fool owns shares of and recommends Gilead Sciences. The Motley Fool has the following options: long June 2017 $70 calls on Gilead Sciences. The Motley Fool has a disclosure policy.