Tesla Reportedly Makes Another Game-Changing Manufacturing Hire

Tesla (NASDAQ: TSLA) wants to be the best manufacturer in the world. But it's going to take some serious talent. Fortunately, some key executives are stepping up to the challenge.

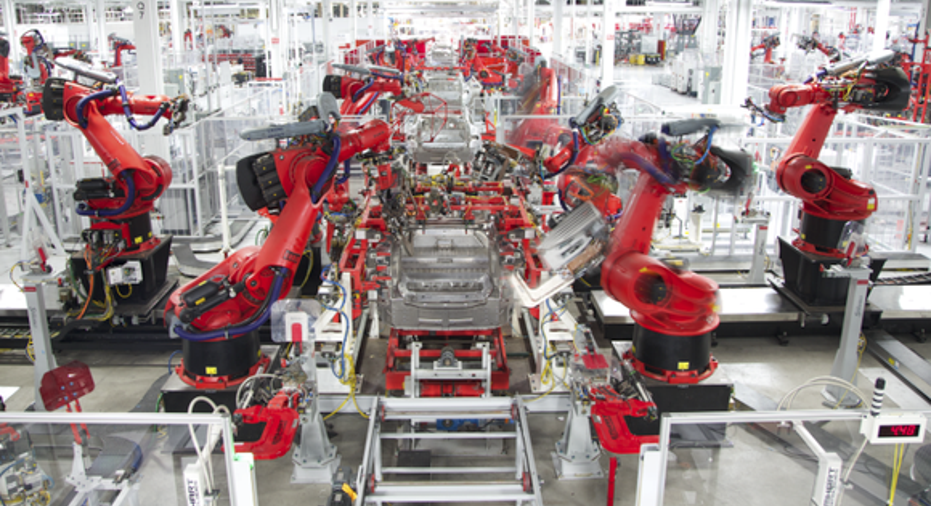

Tesla factory in Fremont, California. Image source: Tesla Motors.

Manufacturing is now Tesla's primary focus

"Tesla is going to be hell-bent on becoming the best manufacturer on earth," Tesla CEO Elon Musk said during the company's first-quarter earnings call in May. He went on to explain that the company has, so far, "done a good job on design and technology of our products," but the key focus needed for success in the future is to "be the leader in manufacturing," he explained.

Whether or not Tesla really can become the world's best manufacturer, it's certainly a good time for management to turn their attention this direction. Not only has Tesla's Model X production ramp-up been slower than expected as the company faced headwinds with production challenges and quality issues, but the automaker also recently doubled down on its longer-term unit volume goals. Tesla now wants to build 500,000 vehicles per year by 2018 -- up from about 50,000 vehicles last year and an expected 79,000 this year. This revised target for achieving a 500,000 annual build rate is two years earlier than its initial plan.

In light of the company's recent problems with production and its ambitious vision for the future, Tesla's shifting focus toward manufacturing makes perfect sense. Of course, it's easier said than done -- and it's going to require some serious talent.

Highlighting the company's urgency to improve manufacturing, Musk took advantage of Tesla's first-quarter conference call, using it as a recruiting opportunity: "I really want to send the message out there to the best manufacturing people in the world. We want you to come join our company."

Tesla's all-star recruits

Shortly after Musk's rant during the company's first-quarter call about Tesla's determination to become the world's best manufacturer, Tesla landed a critical hire. The company announced the recruitment of one of the world's most talented auto manufacturing executives: former Senior Director of Production for the A4, A5, and Q5 Audi vehicles. Tesla told The Motley Fool that Hocholdinger would oversee essentially all of Tesla's production, with a particular focus on improving Model S and X production, as well as helping ramp-up production of Model 3.

Model 3. Image source: Tesla Motors.

Now Tesla has made another important hire aimed to beef up its manufacturing prowess, according to Electrek. The company has hired Apple's (NASDAQ: AAPL) Director of Reliability Engineering, David Erhart, Electrek said, citing unnamed sources. At Tesla, Erhart will take on the role of Senior Director of Reliability.

With over 20 years of experience in reliability engineering, Erhart is undoubtedly an important hire for Tesla. And his three years of experience at Apple specifically speaks to his expertise; while Apple outsources the majority of its manufacturing, the company works closely with its manufacturers to ensure the quality of its devices set the ultimate standard -- and Apple pulls this off at an incredible unit volume.

Notably, Electrek also asserts this hire only touches the surface of the company's increased efforts in quality and reliability of manufacturing.

As Tesla steps up its manufacturing game with highly qualified talent, it's putting substance behind its focus on manufacturing. Indeed, hires like this are even beginning to make Musk's bold vision for becoming the world's best manufacturer look more realistic.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Daniel Sparks owns shares of Apple and Tesla Motors. The Motley Fool owns shares of and recommends Apple and Tesla Motors. The Motley Fool has the following options: long January 2018 $90 calls on Apple and short January 2018 $95 calls on Apple. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.