Stocks to Buy in Home Automation

Home automation is a growing trend with its roots in decades old wired technology. It is quickly becoming a child of the artificial intelligence (AI) revolution. While many of its components still host wired connections like their ancestors, much of the recent innovation is linked viaAI-based virtual assistants. Here's a look at some of the ways you can invest in this nascent technology.

Professional installation

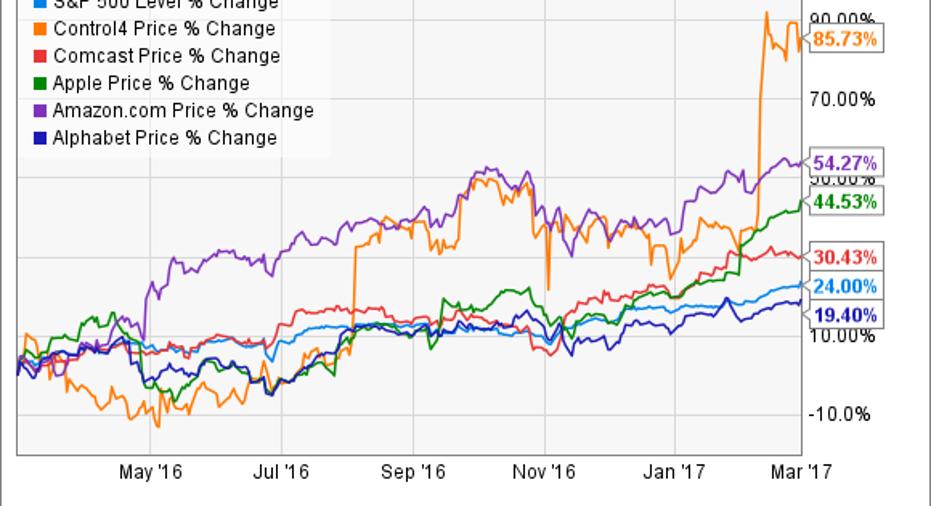

Investors looking for a pure-play in the growing trend of home automation need look no further than Control4 Corporation (NASDAQ: CTRL), the industry-leading provider of automation and control solutions for the connected home or business. This is an extremely small company, with a market capitalization of about $365 million, so investors should expect some share price volatility that is often associated with small market cap companies. Its professional systems are installed during the initial homebuilding or can be part of a retrofit. It provides homeowners with a growing number of options for automation including communication, entertainment, security, lighting, and temperature control. Products can be connected via a central network and the system can integrate over 10,000 third-party product choices.

The home automation segment is forecast to grow. Image source: Getty Images.

Control4 has been exhibiting massive growth. In its most recent quarter the company produced revenue of $57.4 million, up 34% over the prior year quarter, and earnings of $0.16 per share compared to a loss of ($0.03) year over year. The company has been increasing its sales and marketing efforts, which appears to be paying off. Control4 continues to expand its base of dealers in both its domestic and international markets. Early last year, it acquired Pakedge Networking and is continuing to roll this product out among its dealer base. The inclusion of an organic networking solution will drive revenue and increase customer satisfaction, by more quickly identifying issues in customer networks. The company is also expanding its addressable market by providing lower priced options for middle income homeowners.

Managed services

Investors looking for a more diversified offering have numerous options. Comcast Corporation (NASDAQ: CMCSA) is a top choice in the managed services segment of the market. While nested in the company's security service, it also provides lighting and environment controls. Investors will no doubt be familiar with Comcast's cable and broadband services, which provides the company with the advantage of controlling the network. Comcast has grown both revenue and earnings consistently over the last five years, and the stock has increased 156% to the S&P's 75% over the same time.

Do-it-yourself

The home automation Do-It-Yourself (DIY) Market offers a multitude of options. The list of products in the segment is extensive and range from lighting, thermostats, cleaning products, and many more. Some of the biggest names in technology provide artificial intelligence-based virtual assistants that can act as the controller for your DIY system and a gateway investment in the category. Amazon's (NASDAQ: AMZN) Alexa, Alphabet'sGoogle Assistant and Apple's Siri virtual assistants will integrate with a plethora of devices.

The development of the smart-speaker system controlled by these virtual assistants will likely prove to be the tipping point in the DIY segment. Amazon's Echo, powered by Alexa, currently boasts more 7,000 third party skills. While not all these skills are related to home automation, it does provide an indication of just how much of a lead Amazon possesses in the area. Google Assistant, which is integrated into most Google hardware, is the smarts behind its Home smart speaker.

These companies are major players in big tech, with any income from home automation barely making a dent in their overall revenue. Each is making a play for the control of your in-home ecosystem. By becoming a one-stop shop, and having an assistant become a virtual presence in your home, each company hopes that this will lead to a greater share of your consumer dollars.

Investor takeaway

Each of these companies represents a solid way to invest in the home automation segment, offering pure play, or diversified options. This is an emerging technology that bears watching, as investments will evolve over time. Now how can I automate making my bed?

10 stocks we like better than ComcastWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Comcast wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of February 6, 2017

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Danny Vena owns shares of Alphabet (A shares), Amazon, and Apple. Danny Vena has the following options: long January 2018 $85 calls on Apple, short January 2018 $90 calls on Apple, long January 2018 $640 calls on Alphabet (C shares), and short January 2018 $650 calls on Alphabet (C shares). The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Amazon, and Apple. The Motley Fool has the following options: long January 2018 $90 calls on Apple and short January 2018 $95 calls on Apple. The Motley Fool has a disclosure policy.