Snapchat's Move Into Search Was Only a Matter of Time

As it continues to prepare for what figures to be the marquee tech IPO of 2017, vanishing-video service Snapchat recently acquired search start-up Vurb for a reported $110 million.

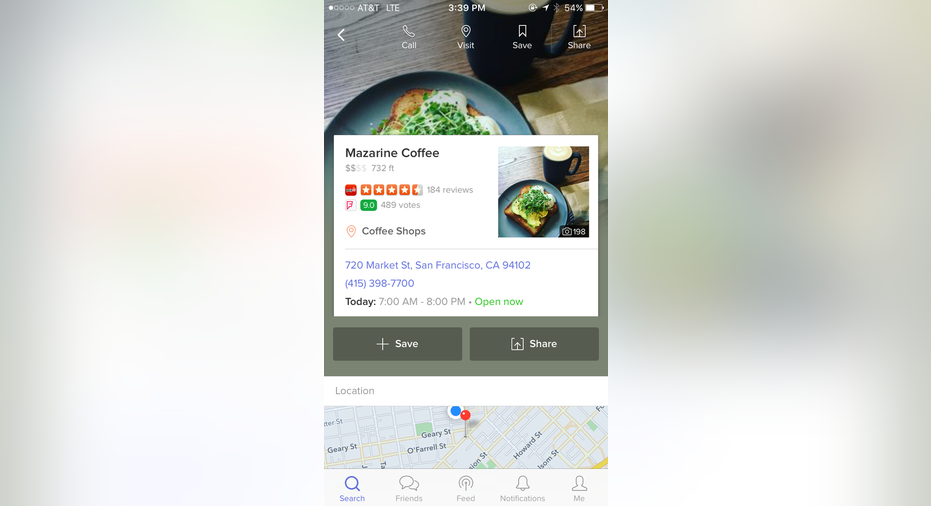

Image source: Vurb.

The move helps position Snapchat to continue to improve its service in several important respects. So, as it continues to challenge new-media powers Facebook (NASDAQ: FB), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and Pinterest, let's see why acquiring Vurb makes sense for Snapchat.

Snapchat purchases Vurb

For those unfamiliar, Vurb bills itself as a search app "that gives you suggestions and results tailored to what you love." To do so, the app combines self-reported information on your personal interests with third-party data on trending topics, your location, the weather, the time of day, and more to produce suggestions on things to do and places to go.

The Vurb app then provides these suggestions in easily viewed and searchable "Vurb cards," which integrate a host of relevant information including reviews, transportation information, reservation services, and the like. Said another way, the app attempts to narrow the gap between discovering useful information and actually engaging with an event, place, or service. Considering its myriad of potential uses, Snapchat could plan to leverage Vurb's underlying technology for a host of possible applications.

How Vurb helps Snapchat

From a product perspective, Vurb's search capabilities can improve Snapchat in several possible respects. As just one example, improved search could help Snapchat users better navigate the service's content-driven Discover feature.

Image source: Snapchat.

With Snapchat increasingly focusing on monetization ahead of an eventual IPO, the service could seek to expand the number of media partners involved with its revenue-generating Discover feature. Should it choose to do so, Snapchat may have to find new ways to present users with the content most relevant to them, though the company has yet to confirm such plans. Either way, it seems Vurb's preference-driven search capabilities nicely align with this potential strategic aim for Snapchat.

Beyond developing Discover, Snapchat could also use Vurb to power a more robust feature set within its chat application. Layering in third-party services into chat applications has become an increasingly popular business model among leading messaging services like Facebook Messenger and WhatsApp. To do so, the social media giant has leaned heavily on AI-powered "bots" -- programs that also rely on search technology like Vurb's.

Image source: Vurb.

These bots help power services as diverse as engaging with customer service teams, tracking orders, receiving flight status updates, hailing on-demand car services like Uber and Lyft, and much more. Though these are just a few ways that the search application could benefit the company, hopefully it's clear that Snapchat can likely benefit from incorporating Vurb's services into its own platform in some way, even if the direct application isn't certain at the moment.

In terms of its business impact, Snapchat's purchase of Vurb could help the company further its challenge to Facebook, Alphabet, and a number of other new-media names. At present, the primary revenue growth driver at Snapchat appears to be advertising, much like at its larger competitors. However, Snapchat's CEO, Evan Spiegel, has discussed his company's broader plans to turn each of its three core features -- chat, images, and Discover -- into independent, revenue-producing businesses over time. Doing so, and challenging Facebook and Alphabet in the process, will in all reality require Snapchat to deepen its search capabilities. Thankfully, that's exactly what Snapchat appears to have done by purchasing Vurb this month.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Andrew Tonner has no position in any stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), and Facebook. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.