Retailers May Be Facing an Impossible Battle Against the Internet

There's no question that the world of retail is changing, with growth in online shopping dominated by Amazon (NASDAQ: AMZN) at the moment. But for everyday life, the move to online retail feels more like a trickle than a revolution.

For example, I still shop at the grocery store multiple times a week and Target (NYSE: TGT) on a regular basis, augmenting with orders on Amazon for random items. And for me, the shift to online shopping has been slowly taking place over the course of over 10 years.

Every once in a while, you get a new perspective on retail that shows who's building out the right strategy for the future, and who isn't. In my case, my wife and I are soon expecting a child, and it's led to a mind-numbing number of store visits, online searches, and calls with customer service at suppliers across the country. Who knew having a baby would show everything that's wrong with retail today?

Image source: Getty Images.

The inventory problem

One of the biggest challenges retailers face is inventory. The goal is to buy enough product so that shelves are stocked and move quickly, but not so much that a retailer has to carry inventory for a long time, or even resorts to discounting.

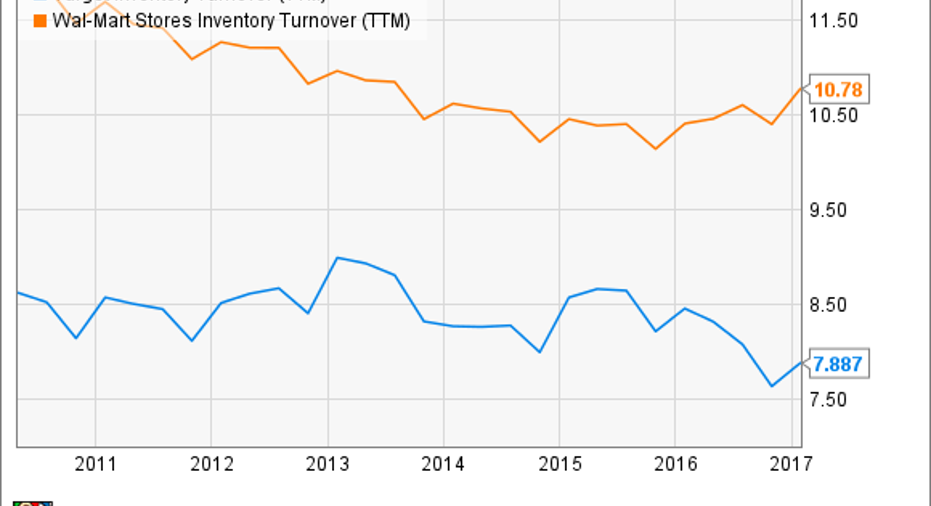

Walmart (NYSE: WMT) has always been a master of inventory management, which has been one of the keys to its long-term success. But over the last seven years, the number of times its inventory has turned over each year -- sales divided by average inventory -- has fallen 9%. The same percentage decline has happened at Target, which had slower turns in the first place.

TGT Inventory Turnover (TTM) data by YCharts.

What can retailers do to solve this? They could hold less inventory, and risk not having the items customers need when they come to the store, which could push shoppers online where there's more inventory at their fingertips. They could also carry fewer items, but more inventory of each item. This may result in a higher likelihood of having the right-colored item that a buyer wants, but risks not having the item at all. Again, if a retailer doesn't have the item, it's likely pushing customers online.

The supplier problem

This challenge extends to suppliers, as well, and can be easily seen in the challenges of product companies like Fitbit (NYSE: FIT) and GoPro (NASDAQ: GPRO). They've been plagued by lagging sales, which leads to inventory writedowns, which leads to less investment in new products and a downward cycle for their businesses.

The challenge is that product companies have inventory at the company level, at distributors, and at retailers, which is a supply-chain problem for everyone involved. If there's not enough inventory in the channel, you have product shortages and missed sales (see GoPro's Q4 2016). If there's too much, a company can risk discounting, or returns and writedowns (see GoPro's Q4 2015). The perfect balance is almost impossible to attain.

This is why I recently advocated for companies like GoPro and Fitbit to move away from the retail model altogether and sell online, where there's inherently less inventory in the supply chain, and therefore less inventory risk at the supplier level. But that would cut retailers out of the model altogether.

The supply-chain problem

Finally, the problems I highlighted above show what's wrong with the entire supply chain and why retailers may be destined to fail. When my wife and I go shopping for a car seat or stroller, we're trying items and seeing how we like the look and feel. But invariably, when we make a decision on what we want to buy, it's never in stock at the retailer. I don't even know how many times I've heard, "We can order that and it'll be here in a few weeks." My other option is that I could order it on Amazon and I'll have it in two days.

This is why the supply chain is a problem for retail. As sales have shrunk and inventory turns have trended lower, companies are trying to hold less inventory -- which is understandable. But as they hold less inventory, they're less likely to have what I want when I want it, meaning they become a showroom for a purchase I eventually make online.

The entire model needs to be blown up and rethought by everyone, or Amazon is destined to take over the world -- which may already be happening.

Rethinking retail

I think there's still a lot of value in the showroom for customers, especially when you're buying an item for a baby, or furniture, or clothing. Getting an idea how these items feel or look in person simply can't be replaced by an online shopping experience.

But retailers should appreciate that they're now a showroom, and should use that to their advantage. I'd be willing to buy a big-ticket item from a local retailer and let them handle logistics if I knew it would be delivered to my home in a few days. But if their sales and delivery process is more complicated than buying online, then I'll take my business elsewhere.

With inventory becoming a problem for retailers, a move to a showroom model may help both retailers and product companies, who could ship items direct to customers via the retailer. Of course, this would be rethinking retail as we know it.

What's clear is that something has to change for retailers. They're in a death spiral of falling inventory turns leading to less inventory, and losing more sales online. Unless the whole retail industry is upended, this could be a spiral that will be hard to escape.

10 stocks we like better thanWal-MartWhen investing geniuses David and TomGardner have a stock tip, it can pay to listen. After all, the newsletter theyhave run for over a decade, the Motley Fool Stock Advisor, has tripled the market.*

David and Tomjust revealed what they believe are theten best stocksfor investors to buy right now... and Wal-Mart wasn't one of them! That's right -- theythink these 10 stocks are even better buys.

Click hereto learn about these picks!

*StockAdvisor returns as of March 6, 2017The author(s) may have a position in any stocks mentioned.

Travis Hoium owns shares of GoPro. The Motley Fool owns shares of and recommends Amazon, Fitbit, and GoPro. The Motley Fool has the following options: short January 2019 $12 calls on GoPro and long January 2019 $12 puts on GoPro. The Motley Fool has a disclosure policy.