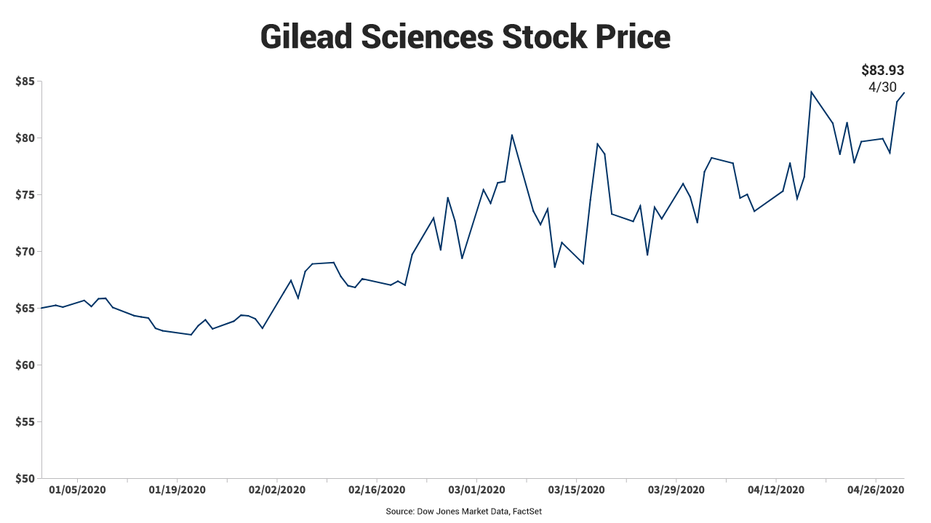

Remdesivir's potential against coronavirus drives Gilead stock surge

Gilead Sciences is the fifth-best performing S&P 500 stock this year

Gilead Sciences Inc. investors betting on the antiviral drug remdesivir as a potential COVID-19 treatment have yet to see how much the wager will pay off.

Shares of the Foster City, California-based biopharmaceutical company rose 28 percent year-to-date through Wednesday, making them the fifth-best performing stock in the S&P 500, according to Dow Jones Market Data.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GILD | GILEAD SCIENCES INC. | 152.50 | +3.13 | +2.10% |

The question is whether they can maintain that level.

“We are still unsure about the ultimate commercial value of remdesivir, given multiple other potential therapeutics (including antivirals from other companies) and vaccines,” wrote UBS analyst Navin Jacob, whose $80 price target on the shares is accompanied by a “neutral” rating. He said that the “scarcity value” of Gilead, which can respond to pandemics quickly, “should not be underappreciated.”

The COVID-19 pandemic, which broke out in Wuhan, China, in December has since infected at least 3.2 million people worldwide and killed nearly 229,000, according to Johns Hopkins University & Medicine. Over 993,000 infected people have recovered.

Two studies out Wednesday, including one by the National Institute of Allergy and Infectious Diseases, which is headed by Dr. Anthony Fauci, an adviser to President Trump on the pandemic, found remdesivir displayed positive results as a COVID-19 treatment.

The review showed "clear-cut" evidence that the drug diminishes the time required to heal from the virus, Fauci said at a White House press briefing on Wednesday. Thirty-one percent of patients showed an improvement in recovery time and the mortality rate improved to 8 percent from nearly 12 percent.

Gilead’s management has already said it could supply 1 million cumulative courses by yearend 2020, and Morgan Stanley analyst Matthew Harrison projects that could “potentially be improved” to 1.5 million courses.

CLICK HERE TO READ MORE ON FOX BUSINESS

Harrison warned, however, that remdesivir has a six-month manufacturing process and said it doesn't appear “the amount of available drug can be dramatically increased in the near-term.” He has an “equal-weight” rating on the shares, along with a $75 price target.

Gilead is set to report its quarterly results after Thursday's closing bell. Wall Street analysts surveyed by Refinitiv are expecting adjusted earnings of $1.57 a share on revenue of $5.45 billion.