PayPal Holdings Inc.'s Best Category in 2015

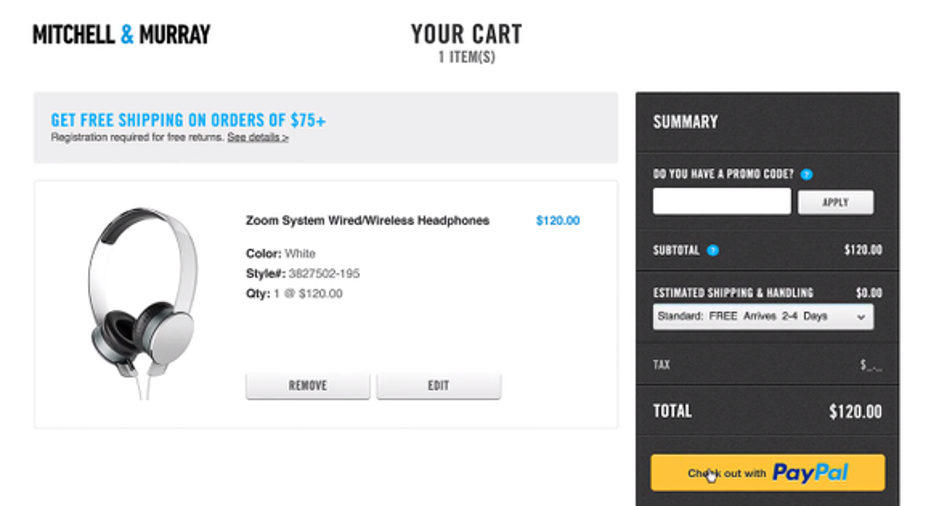

Image source: Paypal.com.

In the five months since payments processing pioneerPayPal Holdings completed its spinoff from parenteBay, shareholders have scoured the company's stand-alone financial statements to understand its native strengths and weaknesses. As a business exercise, if we honed in on strengths to choose the revenue category in 2015 that represented the most future value to PayPal, which category would rise to prominence?

That prize would undoubtedly be handed to mobile payments, a measure of transaction volume that PayPal facilitates through mobile devices. "Mobile" as a revenue stream grew at the phenomenal rate of 42% last quarter (PayPal's second quarter as an independent company). As the first bullet point in the chart below indicates, mobile payments represented nearly one-quarter of PayPal's Total Payment Volume, or TPV. TPV is a measure of the total transaction volume that PayPal facilitates through its "Payments Platform."The 24% of TPV achieved by mobile volume equals roughly $16.5 billion.

The company is reaping benefits from an investment in mobile payments technology through its $800 million, all-cash purchase of online payments facilitatorBraintreein 2013. Braintree, which counts companies such asAirbnbandPinterestas customers, offers a payment gateway designed specifically for mobile transactions, with robust functionality for international currency transactions.

In buying Braintree, PayPal also acquired a fledgling but vital asset: peer-to-peer payments app Venmo. Venmo is a social app popular with millennials that enables friends to make payments to each other and share payments at restaurants and other types of retailers. During the company's third-quarter earnings conference call, management announced a new feature called "Pay With Venmo," which will allow Venmo users to pay within the app at any PayPal merchant. This should boost the amount of net revenue associated with Venmo's growing TPV, which, as you can see from the second bullet point in the chart, is relatively small, but scaling up quite rapidly.

The strategic importance of mobile to PayPalIt would be easy to view mobile transactions simply as a pillar of revenue for PayPal, as it sheds its old identity of being the payments arm of eBay. But PayPal management doesn't think of mobile as a revenue source unto itself so much as a bridge to a much more significant growth opportunity.

That opportunity lies in providing an enhanced in-store purchasing experience, using a combination of a retailer's customer data and PayPal's payment and analytics tools. PayPal wants to be the payment method of choice when customers walk into stores such as Macy's and REI. The company is testing technology that allows the data that retailers already have on customers' purchasing habits to integrate with PayPal's checkout tools.

As an example, PayPal's software, through APIs integrated with a retailer's back-end software, would recognize rewards points a customer has accumulated in the retailer's loyalty program. This would allow the customer to use his or her mobile device to split payment at the register between reward points and a PayPal account (or debit / credit card transaction facilitated by PayPal). The company also foresees allowing retailers to send targeted offers to customers once they've entered a store, again by tapping preexisting data residing in loyalty program and purchase databases.

Given these intriguing possibilities, it's interesting to consider what PayPal's business would look like today had it not undertaken its heavy investments in mobile payments. If the company hadn't pushed to evolve beyond its roots as a "payment button" on merchant websites, it's questionable that it would have shown the projected financial returns to justify its spinoff from eBay in July of this year.

On the other hand, delving into mobile payments isn't without trade-offs. As Braintree plays a greater role in PayPal's TPV due to its unabated growth, we can expect some erosion in PayPal's overall "take rate," or total revenue divided by total payment volume. Since Braintree processes a higher number of credit card transactions than the overall business, it has a higher transaction cost, and thus a lower take rate, than other PayPal payment avenues. Some of the impact is visible already -- in the last six business quarters, PayPal's take rate has declined roughly 25 basis points, from 3.49% in Q2 2014, to 3.24% in Q3 2015. But within PayPal's overall game plan, a modest decline of one quarter of one percent in take rate is a fair exchange for the additional billions in TPV that mobile payments are capturing.

The article PayPal Holdings Inc.'s Best Category in 2015 originally appeared on Fool.com.

Asit Sharma has no position in any stocks mentioned. The Motley Fool owns shares of and recommends eBay and PayPal Holdings. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2015 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.