Stock investors celebrate big decade as commodities trail

Winners and Losers of the past 10 years

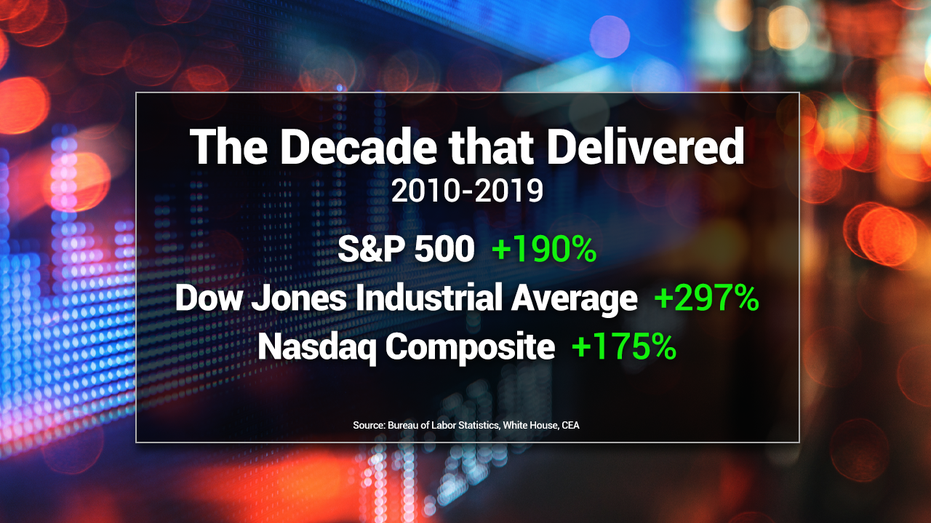

A celebration is in order with the stock market on the verge of wrapping up its best decade since the 1990s.

Ten years ago, U.S. markets began the decade in the ashes of the worst financial crisis since the Great Depression and ended it amidst what some are calling the strongest economy in modern history.

“The past decade generated excellent returns across financial sectors, amid unprecedented monetary stimulus,” wrote Mark Haefele, chief investment officer at UBS Global Wealth Management, in the company’s 2020 outlook.

DEFENSE STOCKS PRIMED FOR 2020 TRIUMPH

The benchmark S&P 500 gained 190 percent during the 2010s while the Dow Jones Industrial Average and Nasdaq Composite climbed 297 percent and 175 percent, respectively, according to Dow Jones Market Data Group.

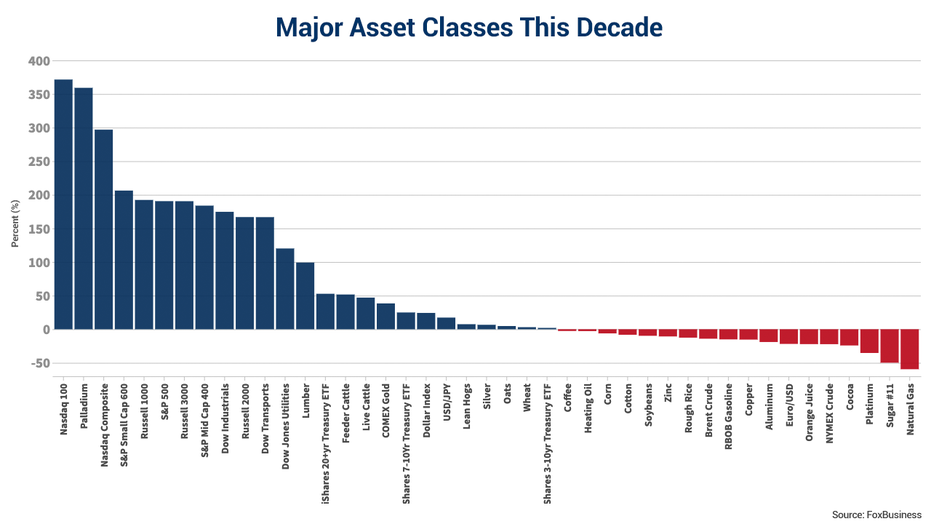

Within the S&P 500, information technology (+336 percent) and consumer discretionary (+322 percent) and health care (+229 percent) outperformed the index. Streaming giant Netflix (+4,081 percent) was the top performer within the S&P 500 with the institutional brokerage service provider MarketAxess (+2,598 percent) and the developer and manufacturer of cardiovascular products Abiomed (+1,839 percent) rounding out the top three.

Looking at the Dow, UnitedHealth Group (+871 percent) was the top-performing member over the decade while Apple (+862 percent) ran a close second. In total, 12 member companies outperformed the average. On the flip side, International Business Machine (+3.3 percent) and Exxon Mobil (+2.5 percent) lagged significantly.

While the 2010s were a banner decade for stocks, commodities were a mixed bag. Palladium (+259 percent) was the top performer while lumber (+99 percent) and gold (+38 percent) recorded notable gains.

The poor performers included natural gas (-59 percent) and sugar (-50 percent), which saw the biggest declines, while crude oil (-22 percent) and copper (-15 percent) also declined.

Looking ahead, UBS says the 2020s, which the firm refers to as the “Decade of Transformation,” will “generate lower returns and spur higher volatility for most financial assets than in the past decade.”

CLICK HERE TO READ MORE ON FOX BUSINESS

The firm expects equities to “return more than most other asset classes,” saying it sees annual nominal returns of 4 percent to 6 percent per year in developed markets and a 9 percent annual return in emerging markets.