Markel Makes an Acqusition

Markel (NYSE: MKL) has announced the latest in a string of acquisitions. The insurance holding company, often considered a smaller version ofBerkshire Hathaway,announced that it has agreed to purchase privately held surety company SureTec. The price is roughly $250 million, inclusive of a three-year earn-out. Let's see if we can tease out whether this is a good deal for the buyer.

A sure bet?

The acquisition is entirely in character for Markel. The company grew its business on a foundation of specialty insurance products, and surety certainly qualifies as a specialty.

For the many people who might not be familiar, surety bonds are essentially agreements that bind a third party to the obligations of the counter-party in a contract. If the latter does not meet those obligations, the third party compensates the contracting entity at an agreed amount. A bail bond is a prominent example of a surety.

IMAGE SOURCE: GETTY IMAGES.

SureTec says it's one of the top 20 surety providers in the U.S. It's active in all 50 states and has a foundation of over $200 million in assets.

As a privately held company, it doesn't release financials, so it's tough to gauge what kind of impact it might have on its parent-to-be. Markel's press release on the deal doesn't offer up any specifics; the closest it gets is a bland "we look forward to exploring opportunities to profitably grow" SureTec's results.

Looking at Markel's historic performance, though, strongly indicates a company interested only in productive assets. The company's combined ratio -- i.e., the profitability of its insurance underwriting -- is consistently under 100%. For reference, a number under 100% indicates profitability, while anything above is a loss.

Markel's total combined ratio was 92% in its fiscal 2016, and 89% the previous year. In both instances, all three of the company's insurance lines (U.S., international, and reinsurance) were in positive territory. In fact, it's tipped over the 100% line only once since 2007. This is a conservative insurer, not one that would take a flyer on a business that lands in the red.

It's also rather unlikely to do so if that business is folded into the U.S. insurance segment, as is the case with SureTec. The segment is a powerful driver of results, as it's more than twice the size of the next-largest segment (international insurance) in terms of both gross written and earned premiums. In 2016, U.S. insurance was responsible for a full 55% of the company's total gross written premiums.

As with the much larger Berkshire Hathaway, Markel uses a chunk of the float from its insurance underwriting to fund its investments. Also hewing to the Berkshire Hathaway model, those investments have been guided for years by a sharp investor -- Tom Gayner, who can be considered Markel's Warren Buffett.

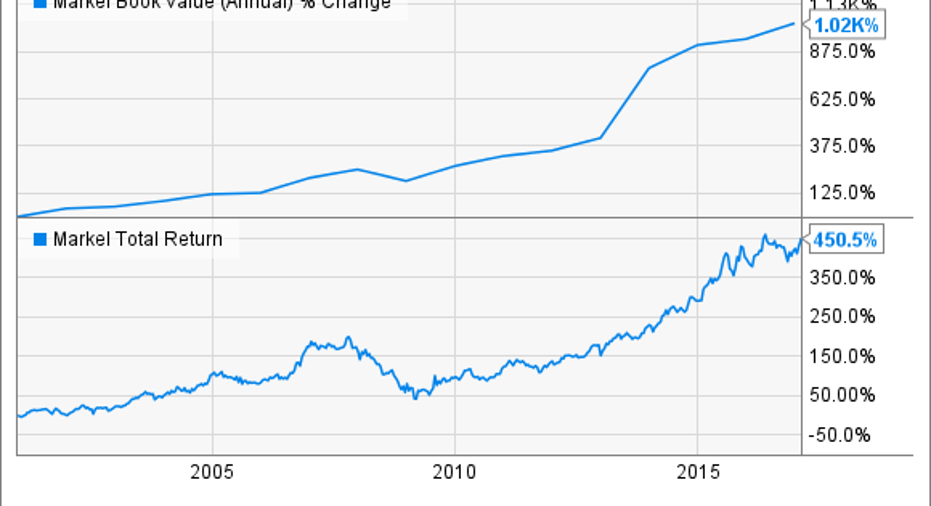

The solid one-two punch of the company's profitable insurance operations and its well-chosen investments have juiced growth. Book value -- Markel's yardstick for success -- has grown by over 1,000% since 2000. Investors clearly like what they see; across that span of time, the company's stock price has risen by nearly 550%. Those are Berkshire Hathaway-like numbers.

MKL Book Value (Annual) data by YCharts.

Similarly to Berkshire Hathaway, Markel doesn't spend its money casually or recklessly. In the end, I would say SureTec is surely a solid investment for the company.

The details

The SureTec Financial transaction is subject to approval from the relevant insurance industry regulators. Markel expects it to close in the first half of this year. SureTec Financial will be rebranded Markel Surety and operate as a separate business unit; its products will be grouped with Markel's other specialty offerings.

10 stocks we like better than MarkelWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now...and Markel wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of February 6, 2017.

Eric Volkman has no position in any stocks mentioned. The Motley Fool owns shares of and recommends Berkshire Hathaway (B shares) and Markel. The Motley Fool has a disclosure policy.