Is CarMax Inc.'s Growth Story Dead?

Image source: Getty Images.

CarMax is feeling a bit of pain now, since many investors believe the market for new and used vehicles in the U.S. is peaking. As such, any signal that suggests growth is slowing or that business is as good as it's going to get will lead to a sell-off -- which is just what happened Tuesday, when its shares took a 5% decline after the company's first-quarter results disappointed Wall Street. Let's take a look at some of the data, and at what could reignite the company's growth story.

Just the numbers

Starting with the top line, CarMax's revenue during the first quarter rose to $4.13 billion, up from $4.01 billion last year, but failed to reach analysts' average estimate of $4.21 billion. Also, Q1 net income checked in at $175.4 million, or $0.90 per share, which missed Wall Street's estimates of $182 million, or $0.92 per share.

While CarMax only fell two pennies a share shy of the bottom-line estimates, that weakness was felt over many aspects of the business. For instance, the company's 0.2% increase in same-store used unit sales was slightly below estimates of 0.3%, and the result failed to assuage investors' fears that the industry's growth is indeed slowing. CarMax's 4% growth in total used-vehicle unit sales was primarily driven by new stores opening.

Key takeaways

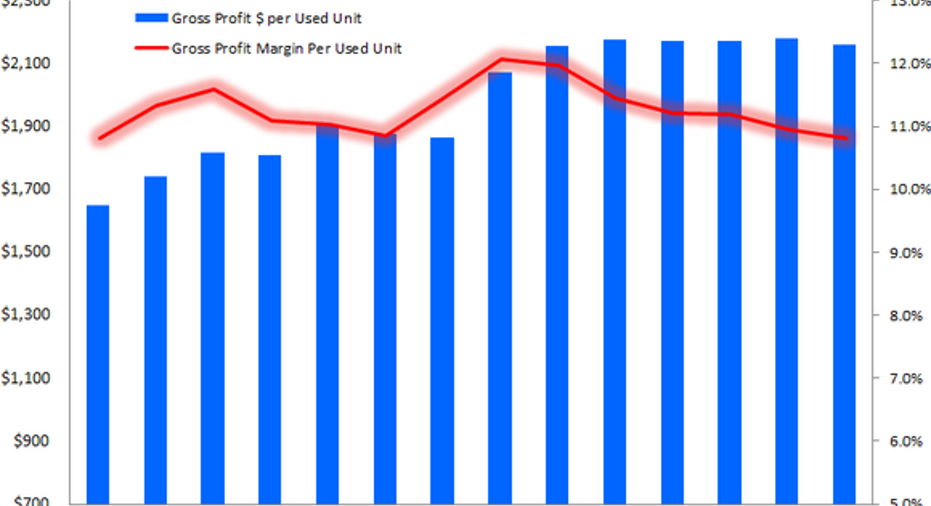

With comparable-store sales slowing, it's important for CarMax to generate as much gross profit per unit as possible. Total gross profit moved 5.3% higher compared to last year, to $572.6 million. Used-vehicle gross profit per unit was flat year over year at $2,202. That's a metric that investors have seen plateau in recent years.

Chart source: Author. Data source: CarMax.

Another factor to keep an eye on is CarMax's SG&A expenses, but not for the reason many people might expect. Investors might think that as the automotive market peaks, CarMax will have to spend more per sale on marketing and advertising its vehicles. While that's partially true, advertising is the smallest segment within its SG&A expenses.

The reason it'll be important to watch SG&A moving forward is that these new store openings mean additional overhead, and share-based compensationexpenses have increased as well. Total SG&A expenses moved 8.7% higher in the first quarter to $380.2 million, or $2,223 per used unit. Much of that increase is due to CarMax opening more stores; in fact, the company's store base increased 11%, or 16 stores, since the beginning of last year's Q1.

Another key factor investors should keep an eye on is the decline in foot traffic and credit applications from what CarMax calls tier 3 customers -- those in the lower portion of the credit-rating spectrum. During last year's Q1, tier 3 customers generated nearly 15% of CarMax's used-car unit sales. This quarter, those same consumers generated less than 12% of used unit volume.

The issue is that there doesn't appear to be a definitive reason for the decline in tier 3 customers, at least not yet. It could mean that those customers are putting off buying used vehicles, or perhaps they're taking advantage of cheap credit and buying new vehicles instead. Or it could be worse: It could be that more of those consumers are picking alternatives to CarMax for buying used vehicles.

What does it all mean?

No, this wasn't a great quarter for CarMax. But it wasn't as weak as the initial figures suggest, either. Consider that while a 0.2% increase in same-store sales was less than analysts expected, that figure would have been 3.6% if you excluded the mysterious decline in tier 3 consumers. That suggests that CarMax's business model isn't broken, but it does mean management needs to figure out what's going on with tier 3 consumers sooner rather than later.

CarMax plans to open 17 more stores within the next 12 months, eight of which will be within its fiscal 2017, and if it keeps its SG&A expenses under control while bringing back its tier 3 consumers to improve same-store sales, the company's growth story should resume.

The article Is CarMax Inc.'s Growth Story Dead? originally appeared on Fool.com.

Daniel Miller has no position in any stocks mentioned. The Motley Fool owns shares of and recommends CarMax. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.