How to Sign Up for an E*TRADE Brokerage Account: A Step-by-Step Guide

Image source: Getty Images.

Getting started in investing online can seem overwhelming. There are more than a few online brokerages to choose from, and each has its own online application to navigate. But setting up an account doesn't have to be hard, and The Motley Fool has put together a handful of how-to guides for exactly that purpose.

This article will walk your through all the steps for setting up an individual E*TRADE (NASDAQ: ETFC) brokerage account, which should only take about five to 10 minutes to complete. If you want to compare offers from other brokers, or view their features, check out ourbroker comparison page.

Now let's get started!

What you'll need to get started

To set up your E*TRADE account, you'll need:

- Your residential address

- Your date of birth

- Your Social Security number or Employment Identification Number

- The contact information of your current employer (if applicable)

- The information on the bank account you'll use to fund your E*TRADE account (you can always set this up later)

E*TRADE requires you to deposit a minimum of $500into your individual brokerage account within 60 days of your account creation in order to keep the account active. The company charges $9.99 per trade if you makes fewer than 150 trades per quarter, and $7.99 per trade if you make more than 150 (you can find out more about E*TRADE's pricing here).

If you have any problems filling out the application, the company lists its phone number and offers an online chat feature. Both the number and the link to the chat feature are located at the upper right-hand corner of the page.

Step 1: Start the application

To start the application process, go to this page andselect an individual account. You'll also need to specify whether or not you're a new E*TRADE customer. If you're not a current customer, you'll enter your first and last name and email address at the bottom of the page. If you're already a customer, just enter your user ID and password for the site.

Once you've filled out these questions, click "continue" and head on to the next page.

Image source: Author screenshot from E*TRADE site.

Step 2: Enter your personal information

This page has two main sections that you'll need to fill out. The first section asks for the address of the primary account holder on the account, your phone number, your Social Security number, and the country you reside in.

The company also asks for your marital status and the number of dependents you have. E*TRADE says it needs all of this information in order to verify the identity of people opening the account.

You'll also have to answer whether or not you've been notified by the IRS that you're subject to backup withholding and fill out your current employer information (if you're currently working).

Image source: Author screenshot of E*TRADE site.

E*TRADE will also ask if you're employed by a registered broker-dealer, a securities exchange, or the Financial Industry Regulatory Authority (FINRA). It will also ask if you're a director or policymaker of a publicly owned company, or a 10% shareholder of a publicly owned company. All brokerages are required to ask these questions, and you'll likely keep these boxes unchecked.

The last section on this page includes a few questions about your investment profile. The questions include your annual income, your liquid net worth, your total net worth, and how you'll be funding the account (e.g., personal funds, pension, gift, etc.).

Image source: Author screenshot of E*TRADE site.

You'll also be asked how you plan to use the E*TRADE brokerage account (long-term investing, savings for retirement, etc.), what your objectives are for the account, how often you'll trade, and your experience level.

There's a a drop-down list of answers for all of the investment profile questions, so don't be overwhelmed if you haven't thought out all of this beforehand.

You can also set up an additional person to have Power of Attorney over your brokerage account (so they can make trades, too) by downloading the form at the bottom of the page and sending it back to E*TRADE. If this isn't applicable, just skip this question.

Once you've finished this section, click continue to move on to the next step.

Step 3: Set up the account

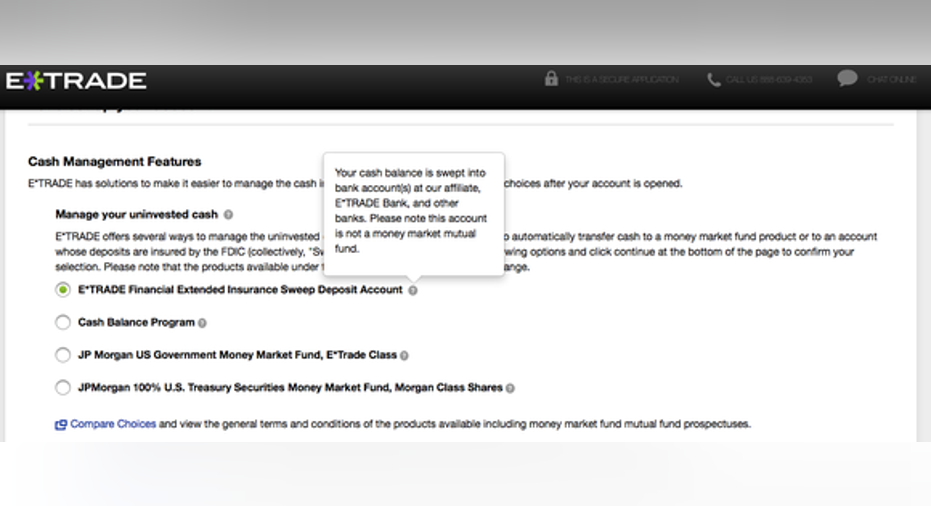

You'll select how you want to manage your uninvested cash on this page. Any time you have money in your E*TRADE account that hasn't been invested yet, or when you've sold shares and haven't reinvested the proceeds, the money goes into a money market fund, which is often called a sweep account.

You'll be given four options on this page as to what to do with your uninvested cash. The default is E*TRADE's Financial Extended Insurance Sweep Deposit Account. Hover over the question marks listed next to each option to see a description of each. There's also a link under this section that allows you to compare the choices in greater detail.

Image source: Author screenshot of E*TRADE site.

Keep in mind that any decisions you make here can be changed later, after the account is set up. So don't panic if you're unsure which cash management account is the best option for you.

You'll also be given the option to access money in your E*TRADE account with a debit card and/or an E*TRADE checkbook. You'll need at least $1,000 in the account to do do either of these. For this how-to, we're leaving both of these options unchecked.

On this page you'll also be given the choice to sign up for margin and options trading.These two investing techniques are risky, and new investors typically shouldn't use them. If you're reading this how-to, you probably don't want these two services right now. But you can find out more about margin trading and optionshereandhereif you're interested.

Lastly, you can opt to have all of your E*TRADE documents (statements, trade conformations, tax documents, etc.)sent to you via mail at the bottom of this page. The default is to get these online, which is the cheaper option (E*TRADE charges a handling fee for each paper statement sent to you via mail, unless there's an exemption).

You're almost finished! Just head on to the next section to review your application.

Step 4: Confirm and submit

On this page you'll simply review all of your information to make sure it's correct. At the bottom of the page you'll also create a username and password to access the account.Once you do that, click "submit," and you'll be taken to a page with your account number. Keep this handy for your own reference.

Image source: Author screenshot of E*TRADE site.

From here, you'll see links for depositing funds into the account from the E*TRADE Customer Welcome Center. Remember, you have to do this within 60 days to keep the account active.There's also a form on this page that will allow you deposit funds from your bank account. But you can go to the Welcome Center and take a look around first before you do all of this.

And that's it! Your E*TRADE online brokerage account is all set up. Remember to check outspecial broker offers hereif you're shopping around for a broker.And if you need some tips on how to get started investing, check out these articles:

10 stocks we like better than E*TRADE Financial Corporation When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and E*TRADE Financial Corporation wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of Nov. 7, 2016

Chris Neiger has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.